I can’t believe it’s time to wrap up the year with another dividend income and net worth report. It’s been a whirlwind of a month and a year. We had a fantastic Christmas holiday with more family time than one guy could ask for. I have a gigantic list of New Year goals, financial/personal, and I’m excited to see what the new year brings. But that’s for another post, let’s get to the good stuff.

Dividend Income

Now to my favorite part, the dividend income report. This month, as expected, has been another for the record books! I can’t believe the progress I’ve made in such a short time. I can forecast, make projections and chart my expected dividend income for the next couple of years pretty accurately to put a smile on my face. However, there is nothing like the excitement of actually getting the dividend payment in the account to get the blood flowing!

December has been a gigantic month both in terms of total dividend income received and the total amount of dividend paychecks. Every time I set these personal records I’m reinvigorated and anxious to set new highs.

This month I received $281.12 in dividend payments. That’s a 18.9% increase from September (the last big pay month)! I’ll happily take an almost 19% raise every quarter, thank you very much! To put this growth into further perspective, last December I only received $68.08. That’s a 312.92% increase over last December!

Even more exciting, all of this dividend income was spread out across 23 different paychecks! I still can’t get over being paid for doing nothing. I averaged an $11.95 paycheck this month from 23 of the best companies in the world for doing nothing. I must say, being a dividend investor is the best job i’ve ever had!

Below is a breakdown of dividends received for the month. You can see my complete dividend income progress here.

[table id=8 /]

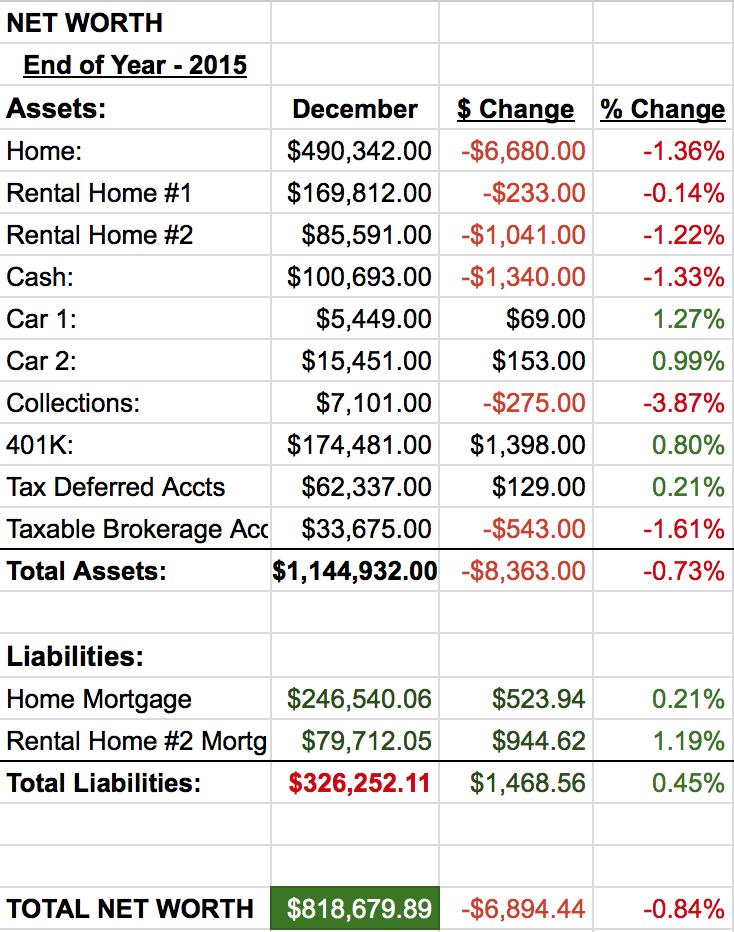

Net worth

The Christmas celebration was great! Sadly the Christmas bills are now starting to roll in. We had a fantastic time with the family, eating, drinking and being merry and now I have to pay for it 🙁 However, I don’t lament spending money on the presents, food and drink for the family. I can’t imagine spending money on a anything more worthy of hard earned cash. Remember, wealth can be fleeting, take time to enjoy your moments with your family when you can.

Let’s do the numbers…

I said this in last month’s report but I’ll say it again. I have always thought of myself good with cash… Really, I am. However, it’s certainly not obvious from this month’s report. Way to end the year, right?

Cash

This month my cash position has dropped again, a little over 1.3%. While I don’t make any excuses, I do have some excuses. The holidays presents for the little piglet and gifts for everybody else did take a chunk. Also, food and drink from having all the family over (completely worth it) also ate up a bit of cash.

Sadly, the big expense this month was our dog. She is getting older and starting to have some problems with her health. She had a UTI along with some other stuff and the multiple vet visits added up to a bit over $600! Fortunately, she seems to be feeling better and isn’t peeing all over the place anymore… so that’s good news.

Real Estate

According to our friends at Zillow, our house got hit hard this month . We are now back to where we were in October and down 1.36%. Oh well.

Rental property #2 is now finally squared away with the mortgage company (no more of them trying to rip us off) and we are excited to get this one paid of in the next 3.5 years. We are very, very anxious to get this one paid off!

Cars

The cars are appreciating again this month! Funny how that works. Perhaps vehicles have an inverse relationship with real estate? Anyway, it does make tracking vehicle value more interesting.

So there you have it, the last month of 2015 ended with a crescendo for dividend income and a diminuendo for overall net worth. Dividend income is by far more important and I couldn’t be more pleased with the progress for the month! My dividend portfolio is really starting to kick into high gear.

It looks like this year is starting off pretty rocky. I’ve set up a few limit orders for some new buys a bit lower then where we are now with hopes of getting some good deals during the next down move. I still think we might have seen a top for awhile and I will continue to buy cautiously.

4 Comments

Blake,

Nice job in December on those dividends! It always feels nice to set a new record for yourself.

That’s crazy how the car values went up for the month :-). I don’t really count our vehicles as assets because they are both old and hardly worth that much :-).

Hi Derek,

Thanks! It felt great to hit the new monthly dividend record. With the market moving like it is now, this year should be a great boost to the dividend cause (as long as we don’t get any cuts). It was a weird month for our vehicles. It seems including cars on net worth reports is pretty much 50/50. I figure cars are pretty liquid so we might as well count them.

Thank you for stopping by and commenting!

Hi Blake,

Great site! Maybe you could help me with a fundamental question since I’m new to dividend investing. Stock prices drop by the dividend amount when it’s paid out, right? So how do you come out ahead? Thanks and good luck with your goals!

Hi JP,

That is true, on the ex-date stock prices should drop by the amount of the dividend (but often stock prices inflate leading up to ex-dates so thats often a wash). But stock price appreciation is not the goal (don’t get me wrong, its nice, and something I do track), dividend growth and income are the ultimate targets. I’m hoping to achieve (on a larger scale) exactly what I have been achieving, a safe, constant and growing income stream from my portfolio. Here is a link that goes into a bit more detail: Dividend growth stocks the cornerstone of my early retirement plan

Thank you for the comment, please let me know if that helps.