Company Overview

The Hershey Company (NYSE: HSY) is a manufacturer of chocolate and sugar confectionery products. The Company’s principal product groups include chocolate and confectionery products; snack products; gum and mint refreshment products; and pantry items, such as baking ingredients, toppings and beverages. Hershey’s has more than 80 brand names selling in over 50 countries.

The Hershey Company (NYSE: HSY) is a manufacturer of chocolate and sugar confectionery products. The Company’s principal product groups include chocolate and confectionery products; snack products; gum and mint refreshment products; and pantry items, such as baking ingredients, toppings and beverages. Hershey’s has more than 80 brand names selling in over 50 countries.

*Note: Hershey just released it’s 2010 income statement and balance sheet. It has not yet released it’s cash flow statement, so all cash flow analysis are based off of 2009 numbers.

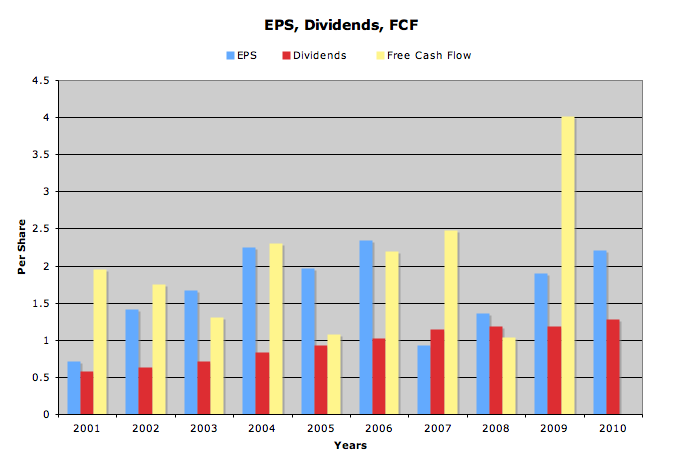

EPS, Dividends, FCF

| Annual Growth Rates | Earnings Per Share | Dividends Per Share | FCF Per Share |

|---|---|---|---|

| 10 year | 13.13% | 9.1% | N/A |

| 5 year | (1.42%)% | 5.58% | 38.98% |

| 1 year | 16.32%% | 7.56% | 288.48% |

Hershey’s recently raised dividends by 8% to .345 a quarter. Though 9% average dividend growth rate is admirable, 5 year rolling dividend growth rates have been declining.

Expected Earnings

- FY 2011 – 2.78

- FY 2012 – 3.01

Analysts expect HSY to grow earnings at an average rate of 7.5% for the next 5 years, in line with the industry average of 7.5%.

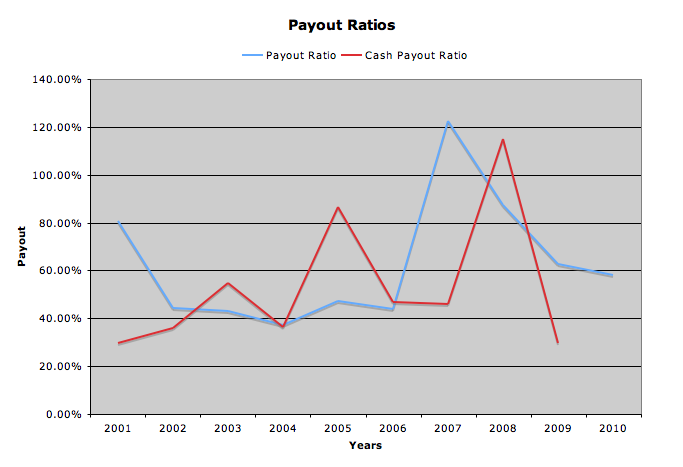

Payout ratios leave some room for dividend growth, being 58% of earnings. As of 2009 (last year with available numbers), the fcf payout ratio was 30%. 2007 was the only year that payout ratios exceeded 100%.

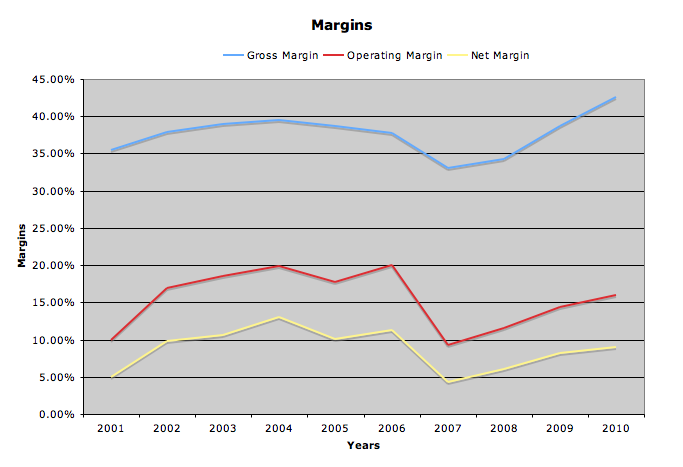

Revenue and Margins

| Years | Revenue (in thousands) |

|---|---|

| 2001 | 4,137,213 |

| 2002 | 4,120,317 |

| 2003 | 4,172,551 |

| 2004 | 4,429,248 |

| 2005 | 4,819,827 |

| 2006 | 4,944,230 |

| 2007 | 4,946,716 |

| 2008 | 5,132,786 |

| 2009 | 5,298,668 |

| 2010 | 5,671,009 |

Revenue growth has been sluggish, averaging just 3.5% for the past 10 years. This is within Herhsey’s long term growth rate target of 3-5% annually.

Margins have been unstable over the past decade. A sharp dive in 2007 rebounded strongly in the past few years.

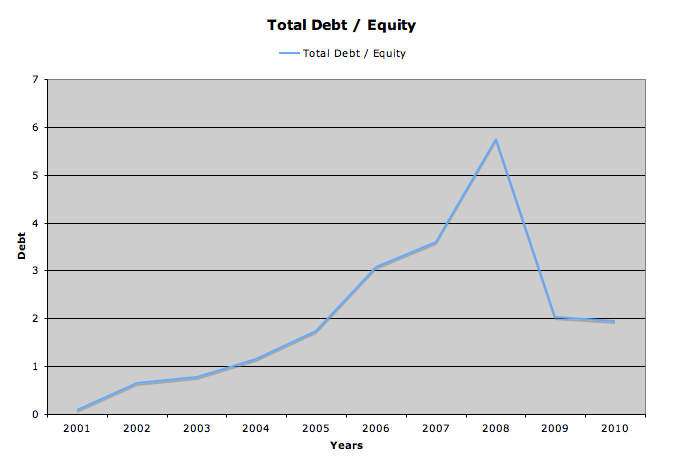

Balance Sheet

Hershey has a good deal of debt. Total Debt to equity climbed to 5.74 in 2008, and though HSY has paid off some of that, they still have a total debt to equity ratio of 1.95. As of 2010, debt is 66% of HSY’s capital structure.

The interest coverage ratio is 9.39, though this has dipped as low as 3.9 in 2007. The current ratio is 1.74.

It is also important to note that HSY has a lot of intangibles and goodwill on it’s balance sheet. The two combined accounted for 647 million dollars, or 18% of total assets. This is from a combination of trademarks and acquisitions made in the past few years.

In 2009, HSY acquired Van Houten Singapore, which gives them that brand in Asia and the Middle East. In 2008 Hershey’s Brazil entered into a cooperative agreement with Bauducco, giving them 49% of Hershey do Brasil. And in 2007 they made a deal with Godrej Beverages and Foods to manufacture and distribute confectionary products in India, as well as with Lotte Confectionary for access to the China market.

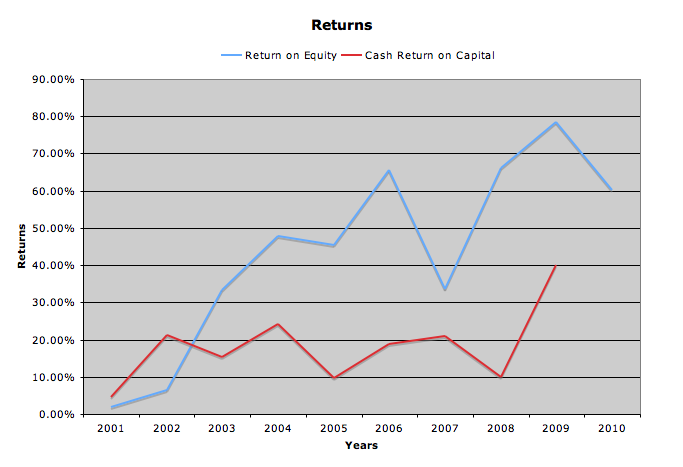

Returns

Return on equity is not a fair value for HSY, since they are so highly leveraged and equity has decreased from a high of 1.3 billion to 937 million. With that said, the past years return on equity was 60%, above HSY’s 10 year average of 48%.

Cash Return on Total Capital for 2009 was 39.97%, above the 9 year average of 18.6%.

Stock Price Valuations

current price – 50.49

5 year low p/e – 23.46

p/e (ttm) – 22.85

p/e (forward) – 18.16

peg – 3.05

5 year high dividend yield – 3.27%

dividend yield – 2.73%

Conclusion

Hershey’s is the largest producer of chocolate in North America, and a worldwide leader in chocolate and sugar confectionary. Their products can be found in 50 countries worldwide, and every North American is familiar with their iconic brands, such as Hershey’s and Reese’s.

I have some hesitations to buying into Hershey. Their margins are erratic, and I’m concerned as to how they will hold up as food prices rise. Cocoa is the most signifcant crop for them, and 2009 saw prices near 30 year highs. I’ve read numerous articles lately on increasing food prices around the world, and I wonder how much of that they can pass onto consumers before they have to lose margin. Hershey guards against this with futures contracts, hedging, and discounts, but sooner or later increasing raw material prices need to be made up somewhere else.

Also, the large debt load they carry is worrying. A total debt to equity of 1.94 is rather high, as is a capital structure that is 66% debt. Although interest coverage is acceptable, I’d still prefer to see less debt from such an old, mature company.

Though I love their products, I have no plans to enter into a position with HSY.

Full Disclosure: I do not own any HSY. My Current Portfolio Holdings can be seen here

To get all my updates, please subscribe to my rss feed

8 Comments

I like the fact that they are making in roads in emerging markets (India with billion + population itself is huge). But I’d wait before buying to HSY.

Very thorough analysis DP!