Company Overview

Chevron (CVX) is an integrated energy company with exploration, production, and refining operations worldwide. Like most oil companies, the business is split into Upstream and Downstream, though Chevron also has Chemical, Retail, and Mining operations.

Chevron (CVX) is an integrated energy company with exploration, production, and refining operations worldwide. Like most oil companies, the business is split into Upstream and Downstream, though Chevron also has Chemical, Retail, and Mining operations.

Sales, Earnings, Free Cash Flow

Chevron is the second integrated oil company I’ve analyzed, and though I’ve touched on it before, I reiterate – this business is highly dependent on the prevailing price of oil to determine it’s financial success. Of all products to be dependent on, oil has to be one of the worst. There are so many factors that go into oil price, it’s dizzying – supply and demand, taxes, natural disasters, government intervention, etc. In my last analysis, I took an excerpt from the 10-K of ExxonMobil about the uncertainty of the oil business. To not leave Chevron out, here is one from their 10-K

The petroleum industry operations and profitability are influenced by many factors, and individual petroleum companies have little control over some of them.

| Years | Revenue (in millions) |

|---|---|

| 2006 | $210,118 |

| 2007 | $220,904 |

| 2008 | $273,005 |

| 2009 | $171,636 |

| 2010 | $204,928 |

Revenues have shown irregular growth, which is expected, though 2009 took a very heavy dive, when sales dropped 37%! A nice recovery happened in 2010, with sales rising to 204.9 billion, bringing the 10 year average growth rate to 7.5%.

Because of how cyclical this industry can be, I don’t feel like 10 year average revenue growth is a reliable indicator of anything – if, for example, you calculated a 10 year growth rate with 2009’s earnings of 171.6 billion, it would be pretty terrible. It seems to me it’s more important to analyze this company in cycles. And at the moment, we are on an upswing – 2010’s rising oil prices increased numbers across the board, and I think 2011 will see the same. Q1 sales are already up 11 billion from Q1 2010, and unless gas prices drop into summer (doubtful), this should hold through the end of the year.

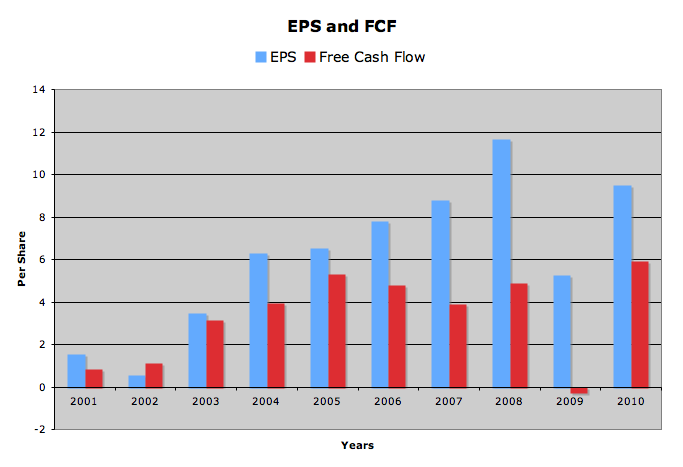

The cyclical nature of this business is evident in the graph. EPS has not quite recovered from its 2009 high of $11.67, but last years EPS grew over 80% from $5.24 to $9.48. The 10 year average growth rate is 22%, but again, this number is not a very useful gauge. For this year, analysts expect CVX to make $12.54, followed by $13.16 in 2012, for increases of 32% and 5%, respectively.

In Q1 2011 CVX earned $3.09 a share, up from $2.27 a share in Q1 2010. CVX cites higher oil prices and increased margins as the reasons.

Free cash flow has been more erratic than earnings, and actually went negative in 2009, when cash from operations of 19.4 billion could not cover Cap ex of 19.8 billion. Normally a major red flag, but CVX really dove into Cap ex in the second half of 2009, gearing up for increased production and prices through the recovery.

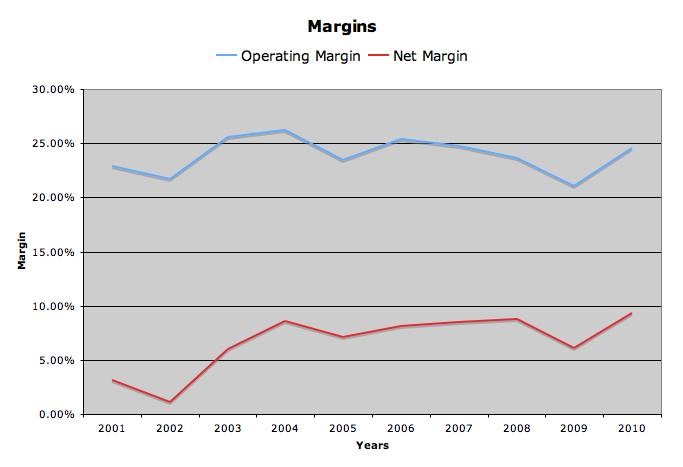

Margins have bounced around, but in a good way, since both operating and net margins were at, or near, their highest in 2010. The 10 year average operating margin is 23.9%, and in 2010 it was 24.5%. The 10 year average net margin is 6.7%, and in 2010 it was 9.3%. Maintaining margins, and even increasing them, is of great importance in such a cyclical business. Keeping those margins up when prices go down is not easy, but can help soften the blow of oil price declines or over supply.

However, if looking at their historical net margin, CVX has not been able to accomplish this. In the better years, when prices were rising, like 2003-2004, and 2007-2008, margin peaks. But during the bad years, 2001-2002, 2009, margins sink like a stone – 3%, 1%, 6%. When oil prices drop, it seems everything goes with them.

Chevron also has a stock buyback program, which has aided in earnings and fcf per share. The original program began in 2007 with 15 billion, and after purchasing 119 million shares, ended in July 2010. The board of directors instituted a new program, with no cap or time limit. The company expects to repurchase between $500 million and $1 billion of its shares per quarter.

Dividends

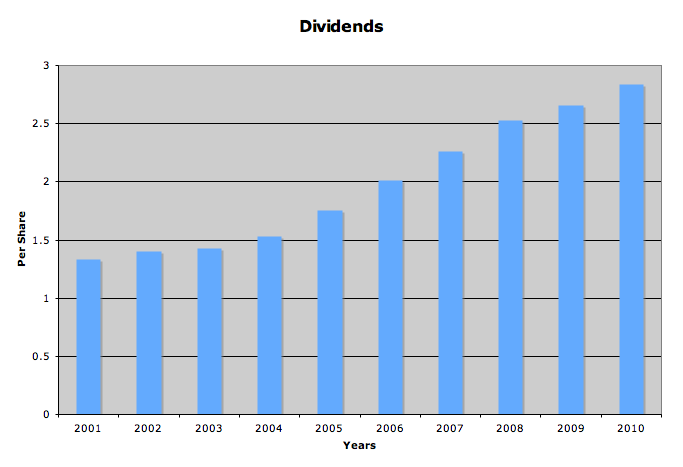

Chevron has paid an increasing dividend every year for 24 years. The current quarterly rate of $0.78 is equal to an annual dividend of $3.12, giving the stock a yield of 3%.

In the past decade, the dividend has grown by an average of 8.7%. This growth has slowed, but this is slightly attributable to the size of the dividend – a 10% increase on a $3 dividend is $0.30 a share, as opposed to the same increase on a $0.10 dividend, which is only $0.01. Still, other metrics show slowing growth, including the 5 year rolling rate, which has dropped from a high of 13.4% in 2007 to 9% in 2010.

But this year it seems CVX is excited and confident about its growth, and the most recent annual increase from $2.84 to $3.12 represents 9.9% growth. CVX must be betting that oil prices will remain elevated for the time being.

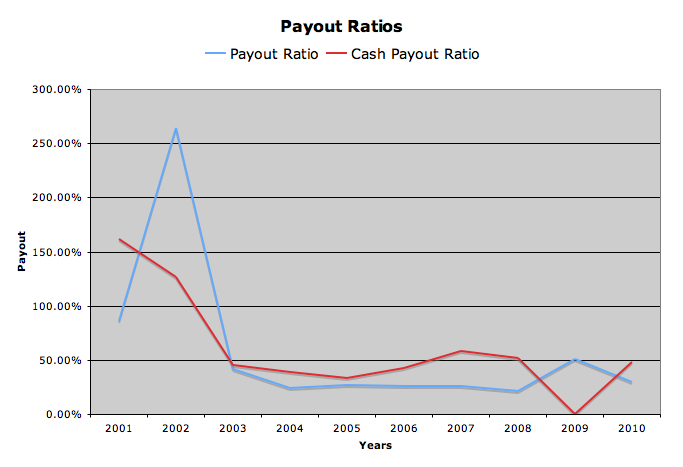

The early part of the decade saw some payout ratio issues for CVX, when both cash and earnings based skyrocket to well over 100%. They have since come back down to reasonable levels, and both now sit below 50% as of 2010. This is something to watch however, with such variable cash flow and earnings, this number can at any time cross the 100% threshold. This will not be a problem for any one year, since CVX has a good debt rating and plenty of credit, but if you see multiple years with 100% + payout ratios, I would be wary.

Balance Sheet

The balance sheet for CVX is very clean, and debt is only 9.5% of total capital. The company has paid down a good amount over the past decade – in 2001 debt was 33.5% of capital. But the current level is very sustainable, and the interest expense was only 50 million in 2010, so that will not be a problem.

The current ratio is a healthy 1.7, well above the generally accepted “safe” level of 1.

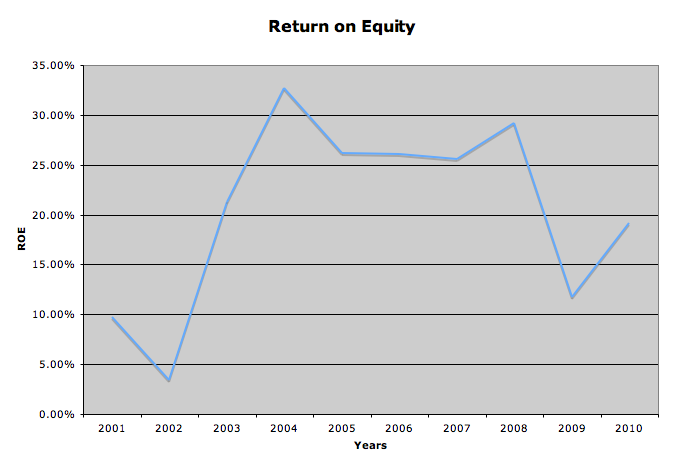

Return on Equity has bounced around a bit, which is to be expected. It was terrible in the early 2000’s, even with higher leverage CVX had. The middle of the decade was strong, but it took a big dive in 2009, and then somewhat recovered in 2010. I expect ROE to be inconsistent in this business, but I hate to see such big dips in the bad years.

Stock Price Valuations

current price – 102.86

5 year low p/e – 8.1

p/e (ttm) – 10.9

p/e (forward) – 8.2

peg – 0.9

5 year high dividend yield – 4.2%

dividend yield – 3.1%

Conclusion

As I dig deeper and deeper into these oil companies, I am getting more and more hesitant to invest. Not only is energy getting harder and harder to find, and costing more and more to extract, but countries are fighting vigorously to keep their resources – or at least profit and regulate them. Companies have to spend more money to extract less energy, and are left to deal with greedy governments, strict regulators, and fickle weather.

In addition, we are seeing a shift in many industrialized nations to energy conservation – a far cry from the gas guzzling, energy-is-cheap-so-lets-use-it-all mentality that our parents and grandparents had (at least here in the states). And while there is no doubt the world is using more energy as a whole, how well this translates into shareholder profits is yet to be seen.

What I think is most eye-catching about CVX, or most other oil companies, is their low p/e’s. But don’t be fooled by single digit or low double digits p/e ratios. Most oil companies are selling at this price, and based on my research of the past 10 years, this is average. ExxonMobil is trading at 11.6x earnings, ConocoPhillips at 8x, Royal Dutch at 9x. At best, CVX may hit a p/e of 12-15, but even 15x earnings is hopeful.

The time to buy these types of cyclical companies is at the bottom of a bad cycle, and should you have gotten in at $56 with an almost 5% yield, that’s a great buy. But right now, I don’t see a lot of capital appreciation potential, and though a 3% yield and 9% dividend growth are good for a 10 p/e stock, if your planning on buying now you missed the boat.

To get all my updates, please subscribe to my rss feed

Full Disclosure: I am long XOM, I have no stake in CVX. My Current Portfolio Holdings can be seen here

11 Comments

Pig,

Thanks for the great analysis here on Chevron. Your comments at the end remind me of an article I recently read from WSJ:

http://online.wsj.com/article/SB10001424052748704281504576329371097519268.html?mod=googlenews_wsj

Basically, they feel Exxon Mobil is a sunset business, one that will not fall off the cliff, but will slowly and surely fade into the sunset as oil becomes harder and more expensive to find and refine while national oil companies keep their hands tight on national reserves.

I agree with you. The question is really how much oil is out there and when will we reach peak oil? Have we already? Will we in 50 years? Of course, nobody knows the answers to these questions, but eventually we will run out. The key will be which companies invest properly and timely enough into the next “big thing” in energy.

Good stuff!

That’s the hard thing with a lot of the high dividend industries, energy and tobacco especially; you really have to evaluate them as if they are an annuity, but without knowing how long they’ll go, it’s hard to say whether or not they’re worth the money.

At any rate, I think oil is fairly valued here, and I think it could very easily fall back to the $50-70 range should we see another global recession (which is pretty much certain.) Buy on the dips!

From the data here, I think Chevron is good enough to invest. Also that, Oil is still the number one power resource in the world.

Ya I agree that oil has a bit to fall and if it goes up we could see more slow economic growth. A bit risky no matter how you cut it. But if you are a longer term investor, I would think you could get away with a bit of flucuation.

Good analysis on CVX. I am a long timer reader and have been long CVX for many years. It’s such a stable and consistent dividend grower. I actually just wrote an analysis on CVX. If you want, you can read it. It’s my 2nd article that I’ve published. Please check it out at http://seekingalpha.com/article/1532612-why-chevron-is-undervalued-right-now

Thanks!

Excellent analysis. For CVX, my concern is the FCF, which makes me concerned for the dividends, though I don’t expect them to cut. Maybe just to slow it down quite a bit.

Anyway, an excellent analysis. I agree with you on the questions of future oil. As the stuff gets harder to find, we also get more efficient finding it. So, it’s a hard to know when the business dies. In the next 10 years, no problem. In the timeframe of 20-30 years, I think we are okay, maybe. If you talk about 50-100 years then yes, we have a problem.

Thanks d4s