The beloved and loathed dividend income and net worth tracking report has arrived. It’s officially time to kick this off with a resounding… ping.

The beloved and loathed dividend income and net worth tracking report has arrived. It’s officially time to kick this off with a resounding… ping.

As the intent of this blog is to be my dividend growth investing journey towards early retirement (AKA: Financial Independence) in only 10 years, I guess I should address my dividend income and finances as a whole.

Dividend Income

Let me preface this by saying, I just started down the dividend growth investing path 9 months ago. The dividend income numbers aren’t all that impressive as of yet, but you’ve got to start somewhere right?

In the last 6 months of this year (2015) , I’ve received $441.48 in dividend income from my dividend portfolio. The total portfolio yield is currently at 3.67%.

While $441.48 in dividend income certainly isn’t a lot, and nowhere close to a point where I could retire, it is money that I received for doing NOTHING! And to me, it doesn’t get any better than free money. I’m on track to break the $1,000 dividend income milestone this year! I was hoping to keep my portfolio yield much closer to 4%, but I haven’t found the type of values in the stocks that I wanted to purchase.

My Net Worth

I thought long and hard about whether I really wanted to do this and finally came to the conclusion, why not! I think part of the problem with many people’s financial position is that money is often kept secret and not discussed. Without sharing numbers, it’s harder to learn how to become financially independent.

Measuring net worth is quite easy and recommended by many as an overall personal financial barometer. The goal, obviously, is to have a positive and growing net worth. This takes time, patience, and discipline.

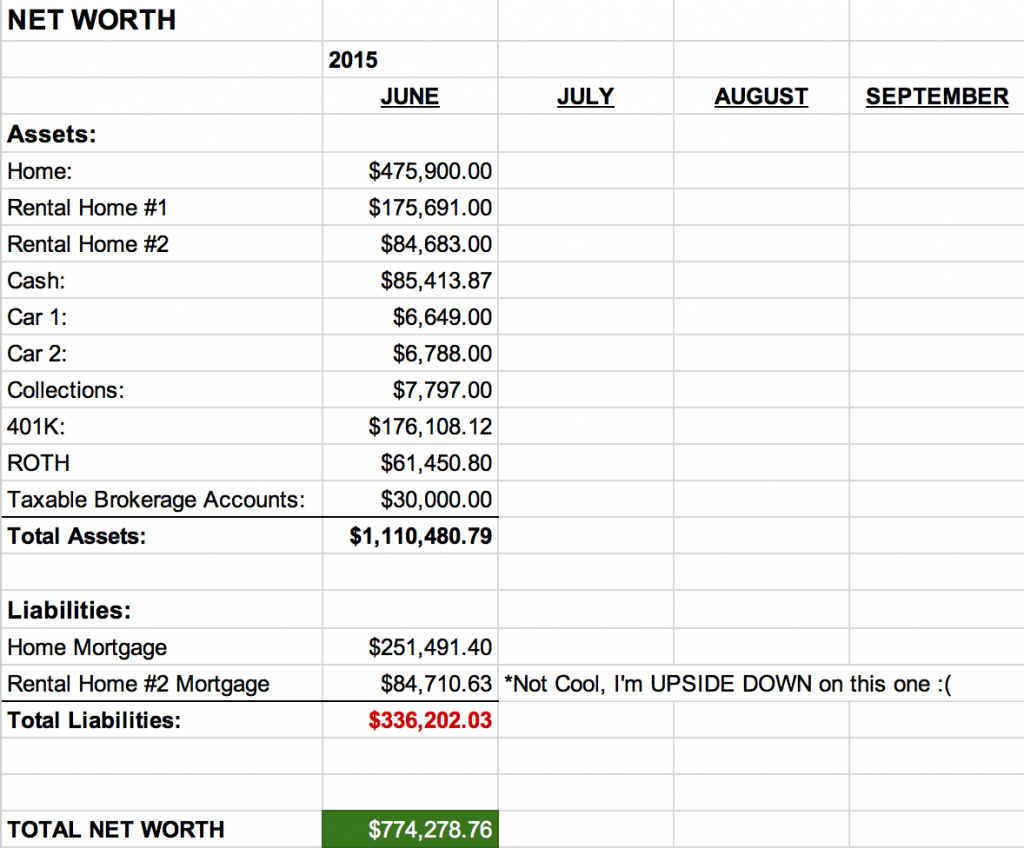

My net worth information is below. I included my hard and valuable assets here.

As I’m not a real estate professional, I used Zillow (which some say shows unrealistic prices) for home values. However, I live in Atlanta where there is plenty of data for Zillow to pull from. So I suspect the home values are somewhat accurate.

So, here it is:

While I have no consumer or school debt, I do have A LOT of real estate debt. Yikes, I need to get working on this. My goal is to have my house paid off in 10 years before retirement, not an easy task!

I’ve never tracked my net worth on a monthly basis. So it will be interesting for me to see the ups and downs (I hope there are more ups!) throughout the next few months and years. I will be updating my dividend income and net worth every month here on The Dividend Pig.

You may notice I have quite a bit of extra cash at the moment. I will use this as seed money for dividend paying stocks as values pop up. You can see my current dividend portfolio here.

So there it is, my six month dividend income and net worth. I’ll continue to keep you posted each month.

Do you track your dividend income monthly? Do you include your cars and other valuables like jewelry when you calculate your net worth? Why or why not? Maybe a more important question is… do you regularly calculate your net worth?

7 Comments

Blake,

I love the look of the new site. Really glad to see the Dividend Pig has a new life. 🙂

Cheers

Avrom

Hi Avrom,

Thank you for the compliment on the site design! It’s a work in progress but its getting there. Thanks for dropping by!

Hi Blake – looks like you are in great shape! Especially with two rental properties. I know you are down slightly on one of them but are they producing positive monthly cash flow? Are they both in Atlanta as well? I heard that is a pretty hot area to invest in.

I also have a lot of real estate debt but I’m not too worried about it. I have great rates on the loans and the home values have gone up quite a bit (knock on wood).

I track my monthly dividend income and my net worth regularly. I use Merrill Edge for net worth and budgeting – by far my favorite financial tracking tool. I currently don’t include my collections, jewelry, etc because I never intend to sell them. But perhaps I should.

You have a TON of cash to work with – congrats on that! Put some of it to work and you will absolutely crush your $1k dividend goal.

Ken

Hi Ken! The rental properties are making money (in Atlanta & a smaller city close by)… but that cash goes into additional mortgage principle payments to pay them down quicker. I’ve been using Mint for a long time since its automatic, but I’ve never manually tracked net worth. I think there is a difference doing it manually… for example, I had no clue I had a little over a million in assets:) You also might be pleasantly surprised by what you find!

I like the idea of putting that cash to work, but I will do it slowly. While I know we are in a big bull market, I can’t help but think it will be a quick, hard fall when the time comes. I want to have some cash available when that happens.

Oh, and good news! I got another buy limit order filled today. I’ll try to get that post up tonight.

As always, thanks for stopping by!

Hey Dividend Pig! Glad to see youre on the rockstar net worth page now.

What is your plan on that mortgage you have that is upside down? You just going to try and ride it out? Well I guess if youre making good cash flow off it then you’re good to just keep it. I love rentals!

Hi CFD,

Good news… the upside down property is now officially not upside down. I’m in the positive by a couple hundred bucks as of this last payment 🙂 But to answer your question, I don’t have any crazy plans for it. I’ll leave it as is and continue plinking away at the debt. It pays for its self and the extra cash flow it generates goes straight to its mortgage to pay it down quicker.

Thanks for commenting and stopping by!