This month has been full of ups and downs outside of my dividend income and net worth… which by the way are great this month! With health problems and some huge bills we still managed to squeak out a positive month. Let’s get to it!

Dividend Income

I am super excited to report we’ve set yet another monthly record! February has been a light month in terms of payments for the last two years, but that seems to be changing.

This month I received $150.51 from 18 different companies. That averages out to a little over $8.41 a paycheck per company for not doing a single minute of work for them! Gotta love it!

The big news is that’s a 290.93% increase from February 2015 (I received $38.50 in Feb 2015)! The income is growing like crazy this year. Granted, I have invested (what I consider to be) a lot of money this year and am starting to reap those rewards this month. I just calculated and discovered I’ve put almost $11,000 to work this year so far.

February 2016 Dividend Income

*I own some companies in several different accounts. That is why you see OHI & O listed more than once.

The dividend portfolio has been updated.

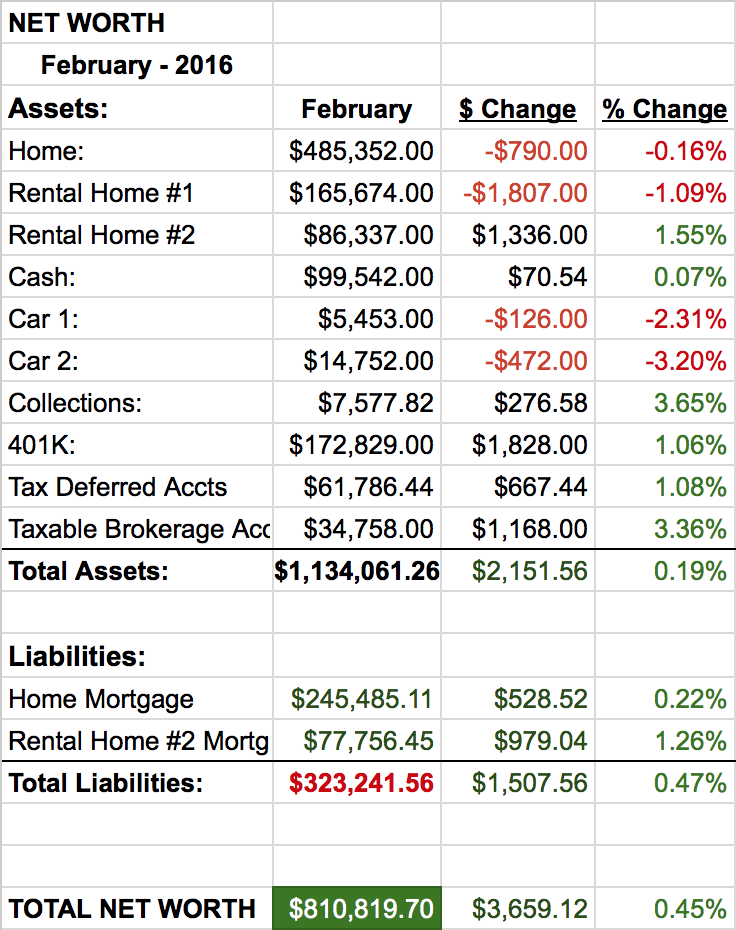

Net Worth

February has been an extremely stressful month and I must say, I’m happy it’s over! My wife had her somewhat of an emergency surgery this month and the surgery portion went EXTREMELY well! The initial biopsies didn’t show any signs of cancer, which was obviously a huge relief! The recovery from the surgery has been somewhat challenging. We’ve run into some rather unfortunate complications that has made the recovery very uncomfortable.

On the other hand, financially, February was an alright month and we are starting to move back in the right direction.

Let’s do the numbers…

As you can see, we’re positive again! Hopefully the net worth downward trend has stopped for awhile and we can get a few consecutive up months recorded. Even with the rather large surgery bill we were able to go positive.

Cash

We’ve managed to stop our cash bleed temporarily and pull it up by .07%. That really was quite an accomplishment with the quantity of doctor & hospital bills we’ve paid. Sadly, there are plenty more bills to come.

Fortunately we have health insurance to cover us during these times. And thank God we do! The hospital gave us the bill for my wife’s surgery and my jaw nearly hit the floor. The total was for a bit over $70,000! YIKES! The hospital bill also showed the insurance company’s negotiated rate which was slightly over $12,000. And our portion for this big bill was just over $2,300… which is much more manageable. The health care industry has some pretty ridiculous pricing.

I’m comfortable saying that I over estimated our out of pocket expense for her surgery in last month’s report. It now looks like we’ll have to pay roughly $5,000 for her surgery and doctor visits which is a huge financial relief.

Real Estate

Looks like the greater Atlanta home values took a pretty healthy dip again this month. According to Zillow, our primary home value fell considerably again, down 1.09% this month. While real estate isn’t as volitile as the stock market, it is coming in a close second place. I had no idea values jumped around this much… or maybe that’s just Zillow.

Zeroing out rental property #2 mortgage is our current objective. We are chipping almost $1,000 off the mortgage monthly and are making great progress. We’d like to have it paid off in under 4 years.

Cars

And the proper trajectory, down, for our car values has resurfaced. This month we seem to be making up for the last two months of strange increases by dropping 3.2% on one car and 2.3% on the other.

Wrap-up

So there you have it, not a bad month financially and some GREAT NEWS on the family health front. I certainly got a big bump by investing that almost $11,000 over the last two months into depressed dividend growth stocks. We’ll see if that actually turns out to have been a wise choice as the months go on. I do feel like we are still in a troubling spot. Prices have corrected a bit, but this could very well just be a bear market rally with lots of lower prices to come. It does look like the S&P wants to hold at 1,810. It will be interesting if we retest and fall through if the FED decides to keep up their projected interest rate raising pace.

How did you do this month? Did your net worth also recover this month?

10 Comments

Hi, I’m starting to get interested on div stocks. Is it advisable to start with one company (let’s say 5k worth) then save for another one until i have enough 5k (frm savings n div from company 1)? Thanks

Regards,

Abc

Hi ABC,

While I can’t speak to what’s best for everyone, I can tell you what I’ve done.

For me, it made sense to spread out my money across many sectors and not just invest a lump sum in one company (as you can see in my Dividend Portfolio ). Building (in essence) my own mutual fund of dividend growth stocks was the most practical way of investing once again, for me. I have been able to make small purchases ($200 – $400) per buy because I only pay 1 buck per trade. Here is the link to my Interactive Brokers review for more information on them. This has enabled me to buy the exact companies that I like and stay away from the companies I don’t. Which isn’t the case when you buy into an existing dividend growth mutual fund or ETF like a VDIGX, SPHD, VYM… However, one of those might be the best option for you if you don’t have the desire or time to build your own portfolio.

Thank you for the question! Let me know what you decide to do.

Congrats on an amazing YoY increase in monthly dividend income. Almost a 300% increase is insane.

Hi Investment Hunting,

Thank you! Its exciting to see those large percentages. I hope it can continue. We just need the market to give us some more values so we can keep putting money to work.

Thank you for the stopping by and commenting!

Congrats on that huge year over year increase in your dividend income. Lots of different companies/funds paying you and a nice way to diversify your income stream with stocks and real estate. Hope your wife is continuing her recovery. Thanks for sharing.

Hi DivHut,

I’m very happy with the progress I’ve made so far. But as you know, its a long road.

Thank you for the well wishes for my wife. She is doing MUCH better. I think in another week or so I won’t have to do the dishes anymore 😉

As always, thank you for stopping by and saying hi!

You have “collections” listed. What types of items are in that category?

Hi Hank,

Good point, I guess I should clear that up.

My collections include pretty much anything we own that could be sold quickly, has some value and is insured. Musical instruments, stamps & coins, weapons, jewelry…

Musical instruments & guns make up the largest percentage of the collection value. I live in the South where we like to play the fiddle while shooting our guns 😉

Thank you for the comment!

I think you can take the Zillow pricing and throw it in the trash. We have sold two properties since that has been around and it really is just plain crap IMHO at predicting the final sale price.

Nice job on increasing dividends by almost 300% YoY!!!

Hi Derek,

I also have my doubts about Zillow pricing. Did you find their estimates to be high or low when you sold your two properties? I suspect they overestimate values.

The dividend income is really starting to grow. I just hope I can keep finding values so I can continue growing dividend income at these rates!

As always, thanks for stopping by!