Dividend income and net worth have both increased substantially this month. Well, maybe not substantially, but real estate has once again proven to be the driving force behind a nice sized increase in net worth. Dividend income is moving in the right direction, just not fast enough.

Dividend Income

My favorite section (and clearly the most important part) of this post – the monthly dividend income report. I’ll never be able to retire at 45 without building my long term portfolio of dividend growth stocks that will pay (hopefully) forever.

So, lets get to it.

This month I received $158.84 from some of the most financially sound corporations in the world. I was paid on average, $8.82 from each of the 18 companies below to do nothing other than click a button and tie up some cash. I’m happy to oblige! The big news is we are back to our big year over year dividend income increases. This month’s dividend income is a 109.57% increase over May 2015. That’s the kind of growth that I need to sustain in order to retire early in just 9 short years.

May - 2016 Dividend Income

After using some impressive math skills I learned in the 4th grade, I realized it was impossible for me to reach my yearly goal of making $3,000 in dividend income this year – going at my current pace. So, in April, I set a public goal to invest at least $6,000 last month (of the roughly $20,000 I needed to reach my goal) in dividend growth stocks. I failed. I failed big. Frankly, I missed my minimum goal by almost $2,000 (investing only a little over $4,000). I could make all sorts of excuses, but I won’t. There were values to be had, and I missed them. Now, I really need to redouble my efforts in order to get close to my yearly goal. Cash is in the accounts, the hard part for me is pulling the trigger on values that are just decent.

The dividend portfolio has been updated.

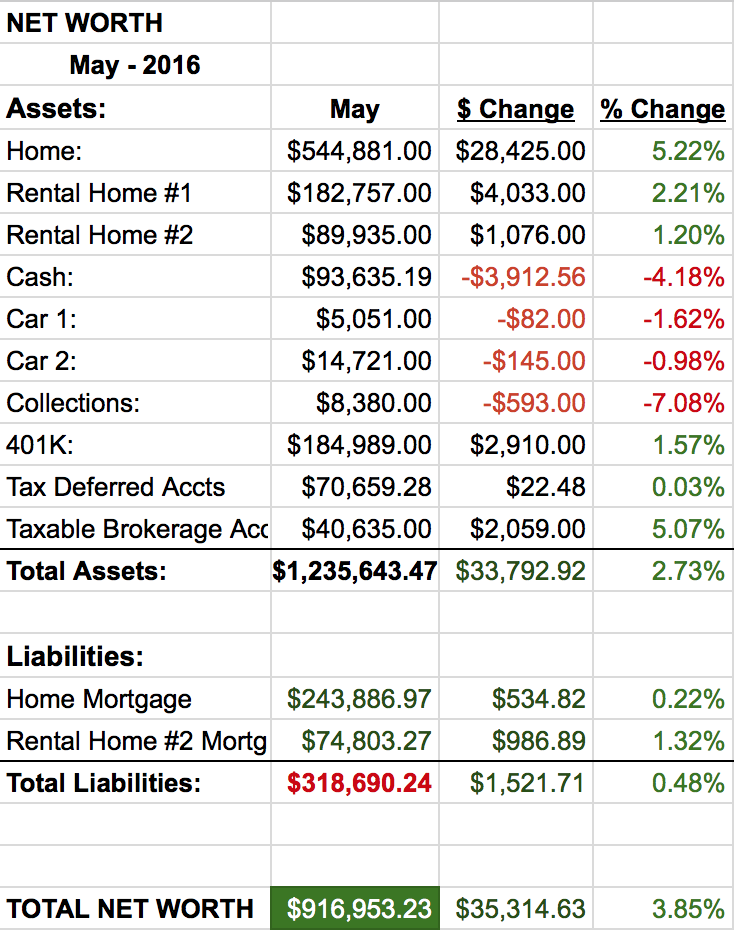

Net Worth

Wow! Real estate is has been on a rampage the last couple of months. This has propelled my net worth to levels I wasn’t expecting to reach until 2018. Whether Zillow’s numbers are accurate or not is another question.

Let’s do the numbers…

Cash

It’s bad and it’s only going to get worse. I’ve been spending money like the US gooberment recently. This month, we noticed our 3 year old dishwasher was leaking in two different spots – from the door and the water intake. This caused damage to the sub floor, and we had to buy a new dishwasher (it was going to cost $300 to get a new door – no way). So there goes 500 bucks. We have also FINALLY begun our home improvement projects. Money is going to start flying out the door. We have some big plans, that are also expensive. However, I’m certain that these improvements will pay us in spades and get our house in line with the value shown above.

Real Estate

Boom! Another massive move up on real estate. Once again, these numbers come from our friends at Zillow, who I can only assume, are taking the trend of recent sales in my area to determine my house is now worth almost $30,000 more than it was last month. Which, for the record, means my primary home, according to Zillow, has gained $60,000 (a little over 12%) in value over the last two months! Sounds a little suspicious to me.

The rental properties are still kicking along well. Oddly we had plumbing issues with all three properties this month. I guess that’s the fun of being a landlord and home owner. We are still working to have rental #2 paid off in under three years.

Cars

The car values have been declining like normal. On average we loose about 1% a month. Not much more to say other than don’t waste money on expensive cars until you can afford to burn cash.

Wrap-up

Progress is okay. I’m investing in dividend growth stock values (that I see pop-up) and my net worth says I’m almost a millionaire. I have absolutely no reason to feel bad about this month, but I do. I have this awesome chance to double my annual dividend income this year and I’m messing it up. I’m hesitating on making purchases that I know are “okay” values today and hoarding cash for good values that may never come. This is something I struggle with. I’m not looking to time any bottoms, but I just can’t push myself make purchases in the top ranges of most of the stocks that I’m watching.

Perhaps the FED will raise interest rates in June (though that looks unlikely now) and we’ll see markets correct again. Or perhaps the FED will raise interest rates in June and the market will sore higher. Only time will tell how the market feels and how it will respond to the news. I’ll have cash in hand and be ready to pounce when the time is right.

How did you do this month? Are you finding your real estate soaring in value as well?

10 Comments

Quite a few nice companies paying money for almost doing nothing from our end.We have few common companies like aapl,T etc.Just curious with amount of you accounts in brokerage,this seems low,unless they pay in other months quite a bit.

Hi Desi,

Glad to be invested in similar companies! The taxable brokerage account has quite a few different holdings now, as you can see from the dividend portfolio and only a very small percentage paid in May. Perhaps that’s what you noticed?

Thanks for stopping by and commenting!

Wow – Nice month! I have seen the Zillow estimates increasing on our side as well. I only “officially” look at my net worth on a quarterly basis but from looking at Personal Capital, it looks like we had a decent May as well. Your new capital investment goals are pretty aggressive. If you are able to start hitting them going forward, you are going to kill it!

Hi Thias,

That makes me feel better about our zillow pricing. The valuations they have been providing just seem unreal. Glad to hear you had a good month as well! This year I have to be super aggressive in-order to hit my doubling goal. I won’t be able to sustain adding this kind of cash in the future (I don’t think).

Thank you for stopping by and saying hello!

Fantastic month. You’re doing a great job. Your monthly dividend totals are getting to the point where the snowball effect will kick in. Nice work.

Thanks IH!

I’m hoping that mystical snowball starts soon. I have a lot of work to do yet before its moving without me breaking my back to push it.

Thanks for stopping by and commenting!

Really nice job, net worth is bumping up right against that “millionaire” title 🙂

Hi MrSLM,

Thanks! While it is exciting to get close, its a number thats driven mostly by real estate at the moment. I need to work much harder to build up a larger liquid (cash & stocks) hoard. Don’t get me wrong, I’m excited to be where I am… I just still have a long way to go!

Thanks for commenting!

Your dividend income is moving right along. It’s nice to see many similar companies paying us in the month of May. I know it’s never fast enough seeing that passive income roll in but as long as you can put up good year over year increases you are headed in the right direction.

Hi DH,

Definitely not moving fast enough, but just like you, I’m in it for the long hull and will be patient. Its not easy.

Glad to be in such good company with regards to our holdings.

Thanks for stopping in and saying hello!