If I offered you 275 shares of Exxonmobil (XOM), worth $24,900.00, would you take it? I bet you would!

If I offered you 275 shares of Exxonmobil (XOM), worth $24,900.00, would you take it? I bet you would!

I want to show you how I just saved the dividend equivalent of 275 shares of Exxonmobil, worth $804.00 of Exxon’s annual dividend payments in one short phone call and an Amazon order. And, you can do the same!

Do You Rent Your Cable Modem?

I live in Atlanta where Comcast rules the cable and high speed internet world. Sure, there is AT&T (T) that offers DSL (cheaper but, way too slow) and U-Verse that isn’t available in my area (very limited fiber footprint), but the best speed/service for the buck is still Comcast Xfinity.

I received my bill from Comcast last week expecting the $104.00 bill and to my surprise, my bill had shot up to $121.00.

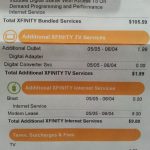

I put on my funny looking Sherlock Holmes hat and looked at the bill (see below). Sure enough, my “latest deal” had with Comcast had expired, which is not uncommon. I generally have to call them every six months and tell them I’m going to leave if they don’t lower my bill. They always do.

I realize there is nothing special about wanting to lower your cable bill. Who doesn’t want cheaper cable right? The real discovery and the important part of this post, is that I was paying $9.00 a month to LEASE A CABLE MODEM from my cable provider, and I bet you are too.

For those slower at math (which includes me) that’s $9.00 a month x 12 months = $108.00 a year to RENT a cable modem every year!

Being that I’m not an idiot (or maybe I am as I’ve been RENTING a cable modem from Comcast for years and never paid attention), I went to Amazon for the solution. The cable modem that I need for Comcast (also works for Charter & Cox) is only $65.00 delivered. (Here is the cable modem I bought)

I have been paying $108 a year for a device that I can buy ONCE for $65.00. Thats a 40% margin Comcast is making of the cable modem the first year and 100% margin every consecutive year. That’s great for Comcast, but terrible for us!

Now, if you want to be a little more extreme (I want to retire in 10 years), you can go the route I did.

I bought the $65 cable modem from Amazon. I also called comcast and downgraded my service to a new deal. I picked the internet plus (50Mbps down), internet only package for $49.95 a month, and I canceled our cable TV service (we don’t watch much TV as we have Netflix & Amazon Prime). And, with this “new deal”, Comcast included HBO GO for 12 months for free!

How Does Trimming a Service & a Cable Modem Equal $23,900?

To see the real gravity of the buying choices we make, I think it’s important to equate spending (or in this case, savings) to dividend payments.

So how does this savings math equate to $23,900 in ExxonMobil stock? Well, it would take almost $24,000 (or 275 shares) in ExxonMobil stock to produce $804.00 in dividend income. Thats HUGE! (see the dividend equivalent calculator below)

In other words, if I were to continue to pay my old cable bill ($121.00 a month) through retirement, I would need to have $24,000 invested in ExxonMobil to cover just my new savings from that one expense.

I know the equivalent of ExxonMobil stock is not actually having the asset you could sell to go buy yourself a new TV (or the cash flow), but it certainly is the one year equivalent of dividend payment for having $24,000 investing in ExxonMobil that you now have to invest in dividend stocks.

So, the moral of the story, if you’re renting a modem from your cable company, then you’re PAYING WAY TOO MUCH! Save yourself $108 dollars a year or the equivalent of $3,290, 37 shares of ExxonMobil in yearly dividend payments and buy your own modem. Or, trim the cable as I did and save yourself $800 a year!

Do you equate your bills to yearly dividend payments? Have you discovered any bills you’ve been paying WAY TOO MUCH on because you hadn’t been paying attention?

Comments are closed.