With all the travel this month & a looming surgery for my wife, I’ve slacked off on my dividend growth investing. I’ve made only two trades so far this month and none of my existing limit orders are anywhere close to hitting. So, needless to say, its been a slow month.

However, not all is lost. I still have another few days… and a lot can change.

You’ll notice that I picked up a little HSEB – HSBC HOLDINGS PLC 8.00% preferred. It’s a bit of a gamble. But, I thought I would do a small, real world test to see how it works out. HSEB has been callable since December 2015. Meaning HSBC could redeem this preferred stock at its $25 price. If this were to happen tomorrow, I would loose $2 ([$27 buy price – $25 call price = $2 loss] or a total of $60 with my 30 shares). That would stink and would probably be a good lesson to learn… as risking real money on tests isn’t very bright.

However on the flip side, until they do call, they will pay $.50 every quarter. So, if they don’t call until the end of next year, I will receive 5 dividends payments of .50 each (.5 dividend x 5 quarters = $2.5). That would be alright. We’ll see how this shakes out.

New Buys - September 2017

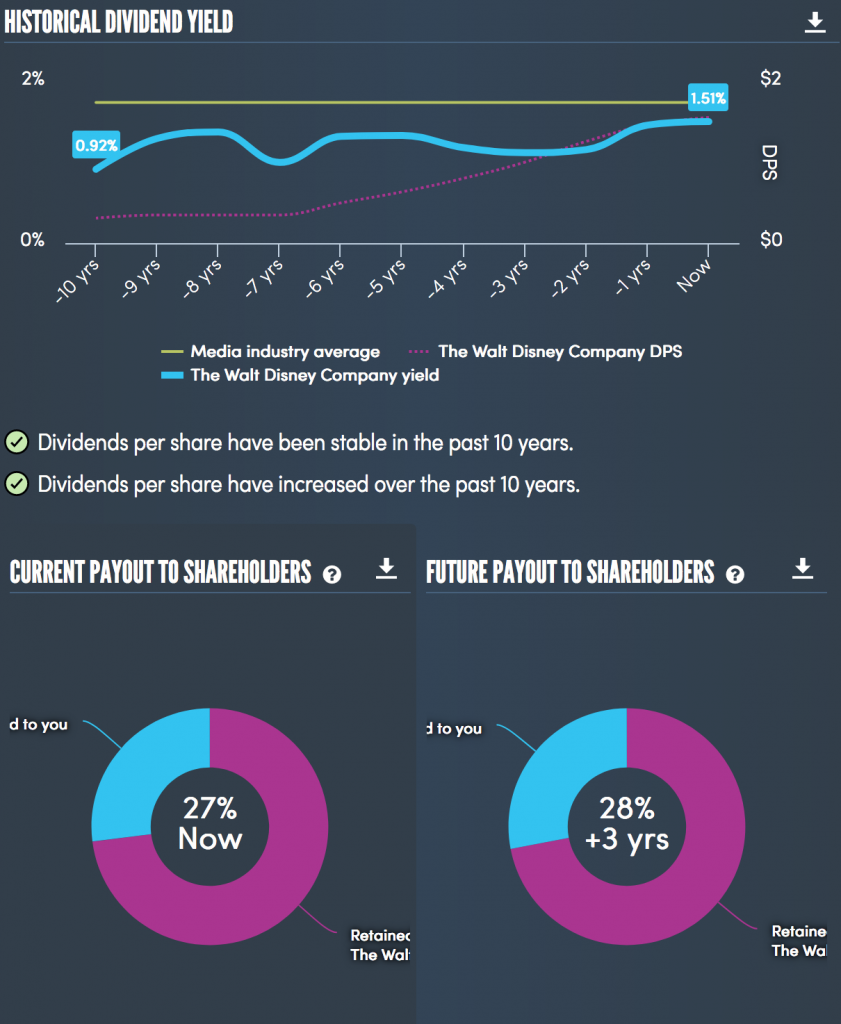

Below is a graphic chart from Simply Wall St that shows the dividend yield range for the stock purchased above.

My dividend portfolio has been updated with these buys. I will keep this page updated with additional purchases made this month.

5 Comments

DIS is one stock that I wish I bought when it was $30!

I hope your wife has an uneventful surgery and speedy recovery! 🙂

Hi GYM,

HA, yeah me too! DIS at $30 seems like a great value now doesn’t it? I wish I would have bought a lot of different companies in 2010!

Also, thank you for the well wishes!

Just wanted to drop in and say I saw your blog while searching around Google for ideas on where to invest.

I’ve been investing in stocks and real estate for a few years now and this dividend-investing approach was something I never thought about, thanks for the idea, would love to see a complete guide on how to approach this.

The best to your wife!

Hi Jimmy,

Dividend investing is a fantastic strategy to use. It’s fairly conservative and provides cash whether markets are up or down. I’ll work on a comprehensive walk-though on the steps I used to get started.

I appreciate the well-wishes for my wife!

ok, I will keep my eye out for such a guide, thanks for considering my request, I’ll subscribe to the blog and will be waiting to see it, thanks 🙂