Company Overview

Darden Restaurants Inc. (NYSE: DRI) is the world’s largest company owned and operated full service restaurant company. The company’s brands include The Olive Garden, Red Lobster, Longhorn Steakhouse, The Capital Grille, Bahama Breeze, and Seasons 52. As of May 30, 2010, DRI operated 1,824 restaurants in the US and Canada. They also have franchised 5 restaurants in Puerto Rico and 25 Red Lobsters in Japan.

Darden Restaurants Inc. (NYSE: DRI) is the world’s largest company owned and operated full service restaurant company. The company’s brands include The Olive Garden, Red Lobster, Longhorn Steakhouse, The Capital Grille, Bahama Breeze, and Seasons 52. As of May 30, 2010, DRI operated 1,824 restaurants in the US and Canada. They also have franchised 5 restaurants in Puerto Rico and 25 Red Lobsters in Japan.

Sales, Earnings, Free Cash Flow

Darden is almost a hybrid of the last few restaurants I have analyzed. Like Cracker Barrel, they own and operate the large majority of their stores. But like both McDonald’s and Yum! Brands, they do have some franchisees. All of the franchised restaurants are based outside of the US and Canada, and from what I have read it does not seem like DRI has a hunger for large international growth. I would expect any future restaurants outside the US and Canada to be franchised, but they seem intent on keeping operations close to home, and attaining growth by building new brands. Their newest brands are the Longhorn Steakhouses and Capital Grilles, which were acquired from RARE Hospitality in 2007.

| Years | Revenue (in millions) |

|---|---|

| 2006 | 5,353.6 |

| 2007 | 5,567.1 |

| 2008 | 6,626.5 |

| 2009 | 7,217.5 |

| 2010 | 7,113.1 |

Sales have grown by an average of 6.6% over the past decade, and decreased 1.5% this past year. This number is actually slightly off, since Fy 2009 had an extra 53rd week, which added 124 million of revenue. If this is taken into account, Fy 2010 actually had a sales increase of 0.3%: not exactly the annual growth target of 7-9%, but not a loss. Still, the small revenue growth of 2010 was the combined result of a 2.6% decrease in same stores sales partially offset by 51 new restaurants opened.

Darden is on track to increase sales by 5.5% for the current fiscal year, 2011, which ends in May. Same store sales for their 3 largest chains (Red Lobster, Olive Garden, and Longhorn) are expected to be up 1.5-2%. In addition, they expect to open 70-75 new restaurants. Assuming 60 new restaurants open in fy 2011, a conservative guess, this would mean 1,884 total units, and a 5 year growth rate of 7.7%.

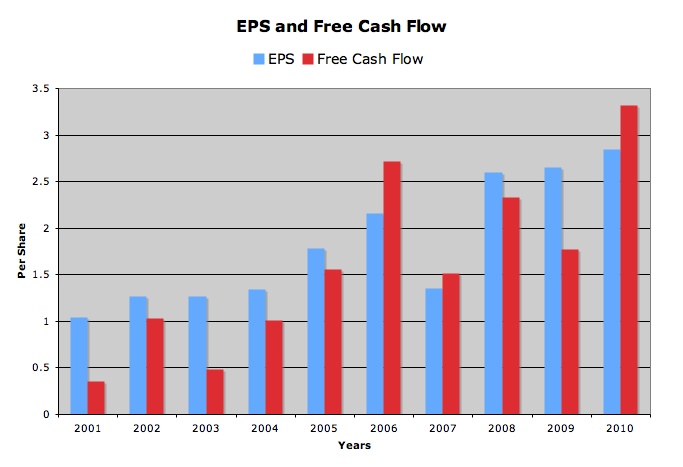

Earnings have grown by an average of 11.7% over the past 10 years, and analysts expect this to increase in the future, with a 5 year estimated growth rate of 12.2%. $3.41 is expected in Fy 2011, and $3.81 in Fy 2012, representing increases of 20.1% and 11.7%, respectively. Share buybacks have slowed in recent years, but I’m not complaining because they have used that cash to provide stellar dividend growth. The 5 year average buyback rate is 2.4% a year. Although in 2010, average shares outstanding actually increased 1.3%.

Free cash flow has grown by an average of 27.9% over the past decade, albeit with slightly more volatility than earnings. Still, there have been no years of negative free cash flow, and it has always been enough to cover the dividend.

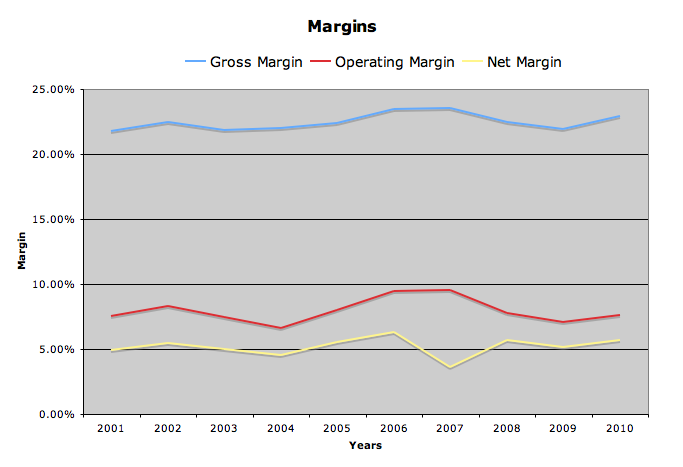

Margins have remained stable, with 10 year averages of 22.4% gross, 7.9% operating, and 5.2% net. Though increasing food costs are a concern for any restaurant, it does not seem to have affected DRI.

Dividends

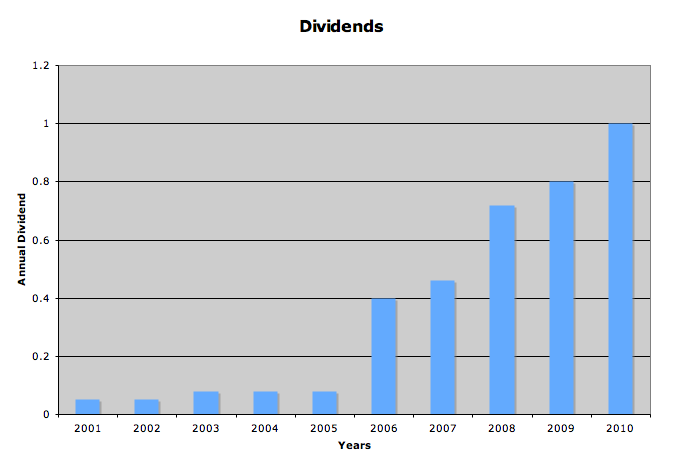

Darden Restaurants has paid a dividend for many years, but only began regular increases in 2006, when the dividend jumped from $0.08 annually to $0.40, a 400% increase. The current quarterly rate was last raised in August of 2010, from $.25 to $.32.

*Note – DRI’s fiscal year ends in May, and their dividend increases usually take place in the second quarter of their fiscal year. Because of this, the annual dividend reported by DRI is usually less than the dividend for that calender year. For example, in fy 2010 DRI paid $1 in dividends. However, in calender year 2010, they paid $1.14.

The dividend CAGR of 39% for the past decade is slightly skewed from that 400% increase in 2006. Going forward, I still expect great dividend growth, somewhere in the mid-high teens. I get this number from 1) The past two years have had dividend raises of 25% and 28%, respectively. 2) If this new policy of increasing dividends continues, which I think it will, a 5 year estimated EPS growth of 10-15% coupled with the low payout ratio (35%) will give darden plenty of room for growth.

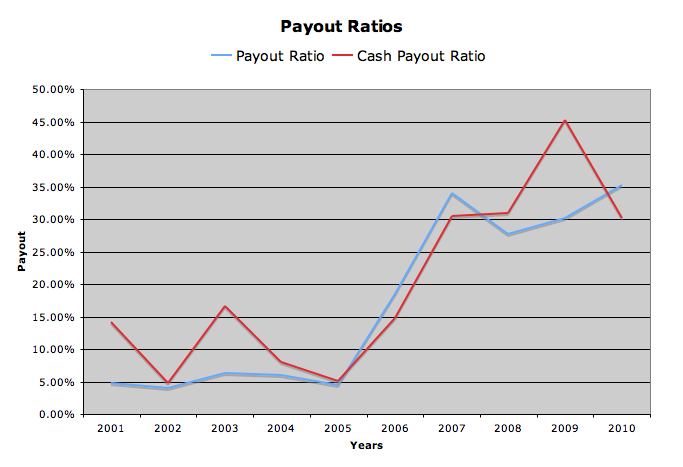

Both payout ratios, earnings and cash based, a very reasonable, below 40%.

DRI increased its cash position in 2010 substantially, from 62 million in 2009 to 248.8 million in 2010. This is more than enough to cover the 140 million paid out in dividends.

Balance Sheet

The financial position of this company is good, not great. Debt comprises 46.3% of total capital employed, and this number is actually lower than the past two years, where debt to total capital was over 50%. Interest coverage is 5.8, so they should not have any problems servicing their debt.

The current ratio is low at 0.54, slightly lower than the generally accepted “safe” level of 1. There is however enough cash on the balance sheet to cover short term debt of 139 million as of Feb 2011.

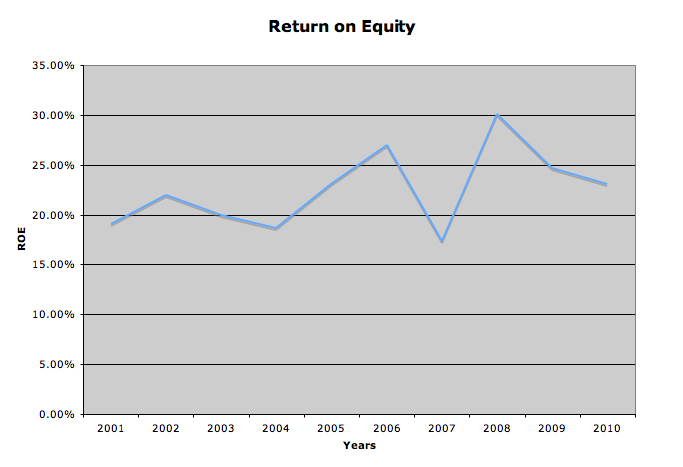

Return on Equity has bounced around a bit, especially during the past recession, but it bounced back and has stayed above 20% for the past 3 years. The most recent years ROE was 23.1%, in line with the 10 year average of 22.5%.

Stock Price Valuations

current price – 48.18

5 year low p/e – 12.7

p/e (ttm) – 16.9

p/e (forward) – 14.1

peg – 1.4

5 year high dividend yield – 3.09%

dividend yield – 2.66%

Conclusion

Overall, I find Darden Restaurants Inc. to be an attractive company. The have a large portfolio of profitable restaurants, sales and earnings growth, and have grown to be very friendly to shareholders. After recovering nicely from the recession, the diners are back at Darden.

I am not ready to buy into DRI just yet. For one, I would like to see a few more years of consistent, and strong, dividend growth. I will sacrifice some initial yield for a strong growth rate, so if the dividend increases continue I will accept a yield as low as 2.5%, but would rather see it above 3%.

16.9 x ttm earnings is reasonable with a combined dividend return of above 20% (growth rate plus yield) and eps growth near 15%. I’ll add DRI to my watchlist, and if they continue on this path I would consider adding a position in the future.

To get all my updates, please subscribe to my rss feed

Full Disclosure: I do not own any CBRL, Yum!, or DRI. I am long MCD. My Current Portfolio Holdings can be seen here

6 Comments

Way too much consumer spending exposure here, for me. As far as I’m concerned, if I’m going to enter a volatile industry like food service, I want some GARP. No GARP to be found in DRI, not by a long shot.

I’m sorry to admit that I was in the restaurant business up until just last year. Working two jobs is never fun! We had some brutal seasonality and like JT pointed out, crazy consumer spending exposure. Eating out has got to be the absolute first thing that families cut out of their budgets when they are trying to save money.

But the flip side of that is that restaurants are among the first to benefit from a cyclical consumption rebound. I noticed in the last few employment reports that food service and hospitality has been growing well lately so Darden could be a great way to get early exposure to any uptick in the U.S. economy. I would be very interested in seeing which restaurant company came out of the recession in the best shape, though and I’d focus any investment in the sector on that business.

Great analysis!

Don’t be ashamed of that SS! I still occasionally pick up bartending shifts for a little extra dough. Nothing wrong with making some extra money on the side!