I’m not going to get into the “double-dip” debate, because I honestly have no idea whether we are headed for a double dip, a triple dip, a triple scoop, or a major boom in the stock market. That’s what’s dangerous about the future – no one really knows.

What I do know is that I feel like it’s a double-edged sword for dividend investors. Sure, I want the economy to strengthen and grow – I can’t invest if I lose my job. But on the same token, I’m excited to see a major drop in the market.

I’m confident that most, if not all, of my favorite companies will continue to pay dividends, even if we do hit the dreaded “double-dip”. Many of these businesses have weathered multiple downturns over the past 30 years, so what’s one more?

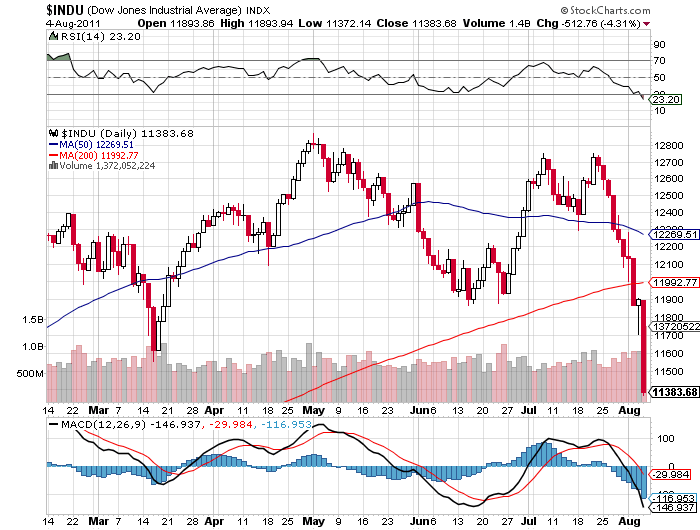

As Buffet always says, buy when others are fearful, and if the market sell-off today was any indicator, investors are fearful. Just take a look at this chart of the DJIA

It’s fallen from 12,700 to 11,383 in a matter of weeks. Today alone the DJIA lost 4.3% while the NASDAQ plunged 5%. This could be nothing – last summer stocks dropped 17% before rallying. But with almost no good economic news on the horizon, chances of a bull market seem unlikely.

As an avid reader of Paul Krugman, my biggest fear is the liquidity trap. Essentially, we may be at the point that monetary policy can no longer stimulate the economy. Interest rates can’t go much lower, the possibility of QE3 slipped away in the debt debacle, and investors are pulling out of the market and fleeing to low yielding government bonds – hoarding liquidity and unwilling to invest.

I most definitely do not wish upon the US, or the world, the economic malaise I fear is setting in. Another bad recession could have incredibly long lasting effects on our society – forget lost decade, what about lost quarter century?

Nevertheless, I cannot hide my excitement at the possibility of some fire-sale prices. Two of my favorites are 3M and Illinois Tool Works. Both have dipped over 15% in the past month alone. Once MMM gets close to (or breaks) the 3% yield level, I’m buying.

1 Comment

Pig,

Thanks for reminding me on 3M. That has been off my watchlist for quite a while now, as I thought it was expensive. It is now trending back into reasonable territory. It will be interesting to see how the markets react to the S&P downgrade on Monday. I think further drops await us, and I’m excited!