June proved to be a great month with $114.87 received in free dividend income. There isn’t much that I can add to my dividend income for the month that wasn’t included in the half year report. To say that I’m happy would be an understatement. This is money that will keep rolling in for a lifetime and beyond.

I still have quite a bit of cash to put to work in my taxable brokerage account. I will be starting this account from scratch later this month. I’ve finally picked a new broker (I’ll be talking about that in the next few weeks) and I’m just waiting for funds to get into the account.

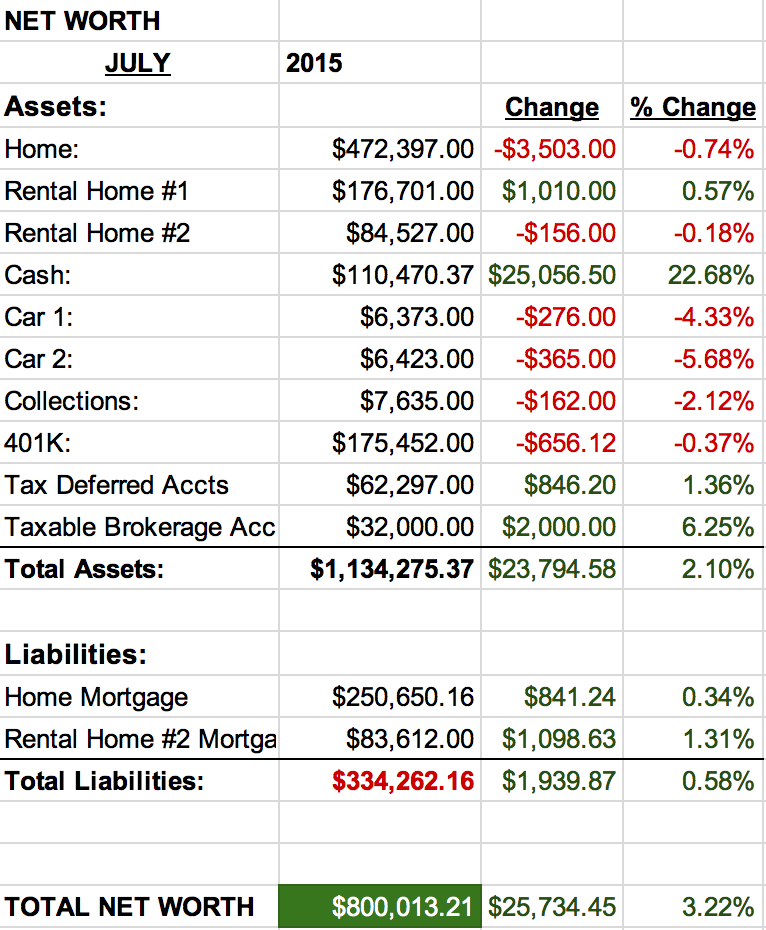

Net worth

So this month has been interesting. An extreme anomaly occurred. While I’m rather pleased with the anomaly, I’m unhappy that it’s going to skew numbers like crazy… especially since I just started net worth reports last month. (good problem to have right?)

The big news… I received a bonus this month based on last years performance. I normally get yearly bonuses but not like this. And, while I’m happy and grateful to receive it, I’m going to chalk it up to a bank error in my favor; move along and not count on this kind of bonus again.

My net worth grew quite a bit this month. Somewhere in the order of 3.2% mostly because of this bonus.

So the highlights…

I have way too much money in cash. I do have quite a few large home improvement expenses coming up so a big percentage of the money is “already spent.” The rest of the money needs a home… most likely in my new taxable brokerage account.

Rental property #2 is no longer underwater. Even though zillow says the property has fallen in value by .18% I made my monthly mortgage payment and I’m back in the black… or kind of in the black as I still have another 83k to go. I take the properties monthly income and put it completely towards the mortgage. I also threw in some additional cash as well. If I continue at this pace it will take a little less than 7 years to pay it off.

I’ve never tracked my vehicle value monthly before, and I suspect you don’t either. Well, I learned a lesson, cars suck as assets. According to Kbb.com my cars have dropped 4.63% and 5.68% over the month. Ouch.

My mortgage is coming down slowly but surely. At one point, I was chipping away $1,000 a month of the principal. However, with rising taxes and insurance costs, this is no longer the case.

While on the topic of taxes, my county has decided to add an additional $2,000 a year to my tax bill. I’ll obviously be disputing their new assessment of the property value. If anybody has any experience getting this kind of thievery reduced, I’d love to hear your success stories.

If I continue on this paydown pace it will take me roughly 20 years to have this property paid off. Bad news! I need this mortgage gone in 10 years if I hope to retire in 2025.

So thats pretty much it… some good news with the bonus and some bad news in the realization that I need to figure out a viable plan to get my house paid off in 10 years. I’m looking forward to putting some of this cash to work in my new brokerage account!

How did you do last month? Did your monthly budgeting dreams come true? Have you ever fought your county about your property value and won?

10 Comments

Congrats on the bonus and 3% increase in net worth! One million is just around the corner. Can’t wait to see what you do with all of that cash!

Ken

Thanks Ken! I’m looking forward to putting this cash to work. Its going to be an exciting few months!

I also have quite a chunk of cash (which I call the war chest). If the market continues to go down, I will open up the chest into my dividends (taxable) account. So, it’s probably not a bad thing if this is the case.

D4s

Hi D4s,

I agree, cash is great during a falling market. We just can’t forget to pull out the war chest and put the money to work once deals pop-up! Thanks for stopping by and commenting!

Dude. You have a net worth of 800k?? That is more than enough to be 100% retired already. Get your spending under control and put your cash and equity to work.

Check out this website. http://www.mrmoneymustache.com/2013/02/22/getting-rich-from-zero-to-hero-in-one-blog-post/

Hi Stu,

Its getting close. Net worth and spendable/investable assets are two different beasts. If I had 800k in cash, I would have checked out some time ago. Thanks for the link, I’m a big fan of MMM. Unfortunately, I’m a long way off (roughly 10 years) from my dividend income covering my expenses [that are pretty trim already].

Thanks for stopping by and commenting!

$800k is not sufficient cash in order to retire. Even with 4 to 5 % dividend yield that is only 32k$ – 40k$. Not enough when you factor in future inflation. Be patient and keep investing.

Hi CLJ,

I suspect 800k invested exclusively in dividend growth stocks combined with my rental properties would fit the bill pretty nicely. But until then, I’m with you and will continue to keep investing.

Thank you for stopping by and commenting!

Congrats on dropping $1000 a month in that principle! Can’t wait till I can put that much on mortgage. As for cars, they’re are not an investment as far as appreciating assets go.

Thanks for the article! 🙂

Hi Francis,

Thank you very much! It’s nice to have those mortgages starting to fall. It isn’t a quick process is it?

Thanks for stopping in and commenting!