Even with the month we’ve had, I’m still excited to post my dividend income & net worth report for January. Once again, dividend income investing has survived and thrived during the January correction (or start of a bear market… who knows). It’s never easy to see a report full of red, however, it is important to remember this is when some serious deals can be found for dividend growth investors. Let’s get to it.

Dividend Income

I’m happy to report, January’s dividend income set a new monthly record!

Dividend Income

This month I received $110.91 from 9 of some of the best run companies in the world. That’s a 54.6% increase from last January! This averages out to a little over $12.32 paycheck per company. Not a bad month!

At first glance, you may think $110 bucks isn’t anything even worth mentioning. I agree, the total isn’t a lot. However, it’s the percentage increase that’s really important. If I can continue to increase my January dividend income by 55% every year I’ll be golden. In 10 years I’ll be receiving over $2,200 in dividend income in January alone. Here is the break down.

For the record, increasing my January income by 55% every year IS NOT an actual goal as I DO NOT buy dividend growth stocks based on their dividend pay dates. The purpose of the spreadsheet above is to be an example of the power of dividend growth stocks combined with adding new money every month… which is what I’ve done over the last year. This spreadsheet would be better to forecast estimated yearly dividend income based on yearly averaged gains (but I made it for January just for fun).

Here are the dividend growth stocks I purchased in January. The dividend portfolio has also been updated.

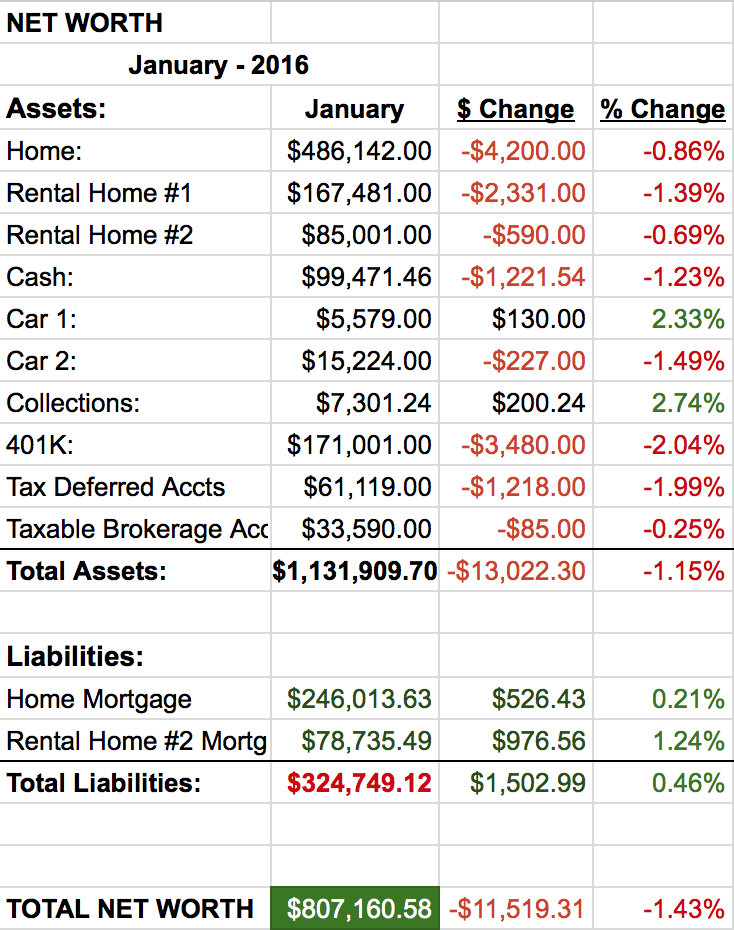

Net worth

This has been a difficult month. Not only because of the market but because of health problems. My wife recently learned she will need to have surgery in the next few weeks for a serious health condition. This has obviously been a stressful time for us. She will get better, but it will take a few months for her to recover from the surgery. Fortunately, we have health insurance and funds to handle this type of health care emergency. If you’d like, your prayers for her health are certainly welcomed and appreciated!

Let’s do the numbers…

As you can see, another down month. This seems to be somewhat of a trend as it’s the third consecutive drop in net worth. Sadly, I don’t see this trend reversing for the next few months, especially with surgery costs. But, instead of dwelling on the negative, let’s see if we can’t find some silver lining in this red cloud.

Cash

No silver lining to be found here. Simply, we’ve been spending too much money. However, I have a drawer full of excuses… my wife’s doctor bills, car insurance, eating out ( I don’t cook well & my wife has been taking some time off )… Anyway, its not a huge decline, but it’s not going to get better anytime soon. My wife’s surgery will cost us a maximum of $10,000 over the next few months. But, there isn’t any cost I wouldn’t pay to get her healthy again.

Real Estate

Zillow says our primary house value is declining pretty drastically. But, according to anecdotal evidence of friends moving, how quickly houses are selling and the prices being paid, I suspect Zillow’s number is incorrect. Other than it showing as a big loss on the net worth report, real estate values don’t really matter month to month. We aren’t planning on selling anytime soon so a small swing down ( if you can call -$4,200 a small swing ) doesn’t affect us.

Rental property #2 mortgage is our current debt focus right now and we are attacking it hard. We are chipping away almost $1,000 dollars a month and will work hard to have it paid off in under 4 years.

Cars

Well, one of our vehicles has shot up 2.3% while the other dropped 1.49%. They should both be averaging down by a little over 1% every month. Strange.

So that’s pretty much it. Good news for dividend income, bad news for net worth and horrible news regarding my wife’s surgery needs. I’ll keep buying good deals as they pop-up but I’ll continue to do it cautiously. The big boys seem to think if we do find ourselves in a prolonged bear market that the bottom should be around (S&P 500) 1650. That’s a long way to drop.

How did you do this month? Did you find any great deals during the big January decline?

4 Comments

Not a heavy dividend investor myself (yet). This here is inspiring though.

Definitely a better way to retire then depending on a pension or 401k as is evident here 🙂

Love these breakdowns!

Hi Konrad,

Dividend growth investing isn’t right for everyone, but it’s certainly worth your time to checkout to make that determination for yourself.

Thank you for the feedback and comment!

Tough luck that your NW took another hit for the month. I think we are all pretty much in the same boat :-).

All the best to you and your wife as you work through her health issue and surgery!

Hi Derek,

January was a rough month for net worth… but a few bumps in the road won’t slow us down right?

Thank you for the well wishes for my wife’s surgery! I see your son also had a bit of surgery this month. I hope the procedure was successful and he is recovering well!