Finally, the hot month of July is over and I’m happy to report my cool dividend income and net worth. July was great a month with the 4th holiday and we’ve picked up a new hobby, canoeing on our local river.

July Dividend Income

I am thrilled to post this months dividend income. While the dollar figure is half the gain from last month, the percentage increase ranks as one of my best.

This month I received $762.78 in dividend income! On average, I was paid $31.78 from 24 different companies!! This month’s dividend income is a solid 175.3% increase over July 2107.

That’s $485.715 more dividend income than last July!

Dividend Income - July 2018

Here is a chart of my passive dividend income progress over the last 3 years.

The dividend portfolio has been updated.

This month’s dividend income covers my utilities, groceries and car insurance for the month!

June Dividend Increases

Here are the realized dividend increases I received this month. I happily welcome large and small dividend increases… though, the large ones are my favorite. A large portion of my future income is centered around a dividend growth investing strategy, so I hope to have something to report on this every month.

Dividend Increases - July 2018

Name Ticker New Div Old Div % Increase Ex-Date Payment Date Philip Morris International Inc. PM 1.14 1.07 6.54% 6/20/18 7/10/18 WP Carey Inc WPC 1.02 1.02 0.49% 6/27/18 7/15/18 Realty Income Corp O 0.22 0.22 0.23% 6/28/18 7/12/18

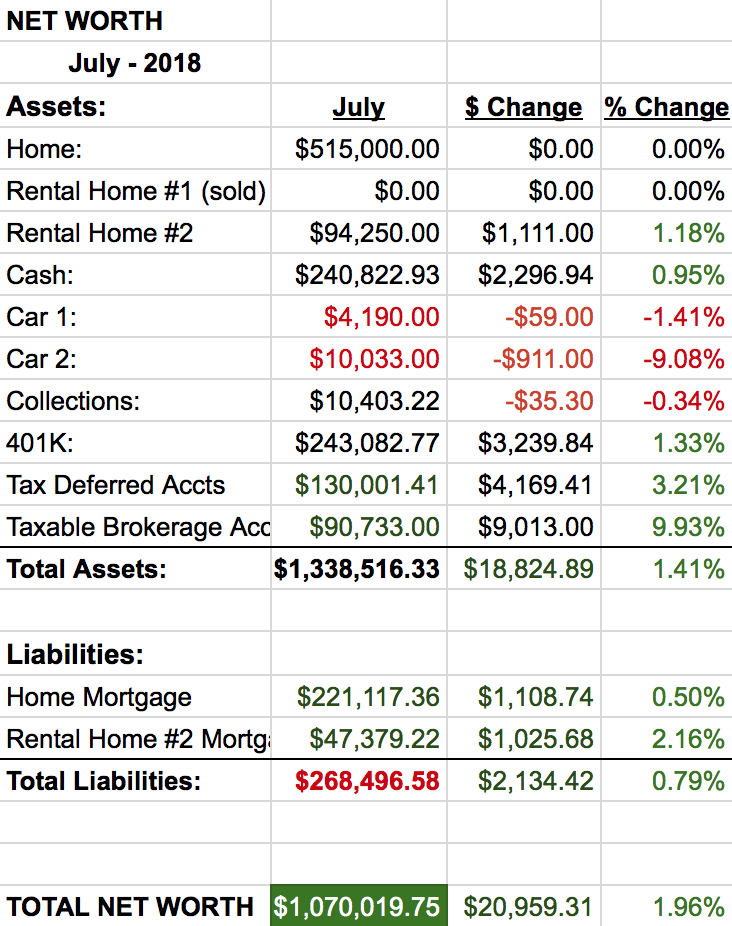

Net Worth

Another net worth increase in the record books thanks to paying down my mortgages and a rising stock market.

Let’s do the numbers…

Cash

As I mentioned last month, I’m going to hold on to my cash from the sale of rental property #1. This large cash reserve will eventually be added to my taxable account (or another rental property). In the mean time the cash is earning 1.85%.

Real Estate

Slow and steady wins the race, right? I’ve been paying off my mortgages at a pretty decent pace, but I still have a long way to go. While I plan to sell my primary home before I retire, I am still driven to eliminate that debt best I can.

Rental property #2 will receive special attention in roughly 2 years with a balloon payment to pay it off. Its been rented to the same person for 4 years now and there are no signs of any change… that I’ve heard of at least.

I am actively looking for rental property in the greater Atlanta area. However, I’ve seen NOTHING where the math works. Atlanta real estate is crazy expensive! But I’ll keep my eyes open.

My tax value appeal letter was acknowledged by the county. Now I have to wait until they give me a date for the actual meeting. Hopefully, it will go as well as it did three years ago when the tax commissioner asked what I thought it was worth, and he said “okay” and I was out the door!

Wrap-up

I am happy with the progress made this month. I continue to see healthy YOY dividend income gains and my portfolio is producing a growing stream of income. I just need to keep up my dividend growth stock purchases just like the buys I made in July.

Now, I do have a lot of cash sitting on the side lines as I am slightly concerned about this trade war with China. I know this is “just a negotiation”, however, I suspect there really isn’t a solid plan behind these import penalties.

Here is why: companies that buy goods, manufactured in China, and then sell them in the USA are everywhere. These companies, large and small, can’t just change their whole supply chain at a moments notice and/or there might not be existing options to produce those products outside of China.

You may not have heard, but List 3 was announced last month with a large group of items that could be hit with an extra 25% duty. Just to make sure everyone is clear, this extra penalty tariff is issued and collected by the U.S. Customs and Border Protection agency (CBP). It’s the USA government making these products imported from China more expensive. Here is an easy to read summary of the items.

This group of goods is getting big – list 1 and 2 were mostly industrial products. However, List 3 is just shy of hitting the average consumer everyday buys as it did not include apparel, consumer electronics or toys. But, adding a 25% EXTRA penalty duty to these list 3 items is going to impact the average American, but not significantly.

Anyway, my concern is there isn’t a lot more room to wiggle without blowing up the average American consumer’s wallet. That will be a big problem for us all. So, I’ll keep some cash on the sidelines and wait and see what happens. Just to be clear – I have no doubt the trade issue will get resolved… eventually.

10 Comments

I doubled my net worth today!! I realized I was not counting the value of my car against it’s liability. While it’s a wash I do have to consider that the liability is backed by an asset.

Stoked to see these yoy increases on dividend income. I’m only one month into my journey so I’m excited to see those increases in a year.

Thanks for the reports!!

HA, nice work! Bank error in your favor… even if its only on paper 😉 Thanks for the kind words, the dividend increases are the key. The larger dividend income will come with time as long as we keep finding great dividend GROWTH stocks. Thanks for dropping in!

Just WOW! that is all I can say! Congratulations on the amazing month of July! do you mind me asking how many months it took to reach this goal? Also great job on the outstanding net-worth! I can only aspire to reach that number.

Hi DD. I started tracking my dividend income online May 2015. So, a little over 3 years – but I started actively dividend investing a few months before. It’s not a fast process, but it’s clearly worth the effort. Just keep saving and investing! Its nice to meet you and I look forward to following your journey.

That is awesome progress! Really impressed with that payout from DIS too!

On the Net Worth, unless the cars are at 0% is there any reason you’re not thinking of paying them off out of the cash reserve?

Thanks DivvyDad! I added a lot of DIS a few months ago. As for the cars, we do own them. They are assets, granted – deprecating assets. Our most recent used car purchase was made three years ago after my wife and child were rear-ended and the car was totaled. 🙁

Div Pig –

Nice job and that growth is fricken awesome. Further, love that you use Bank on CIT at 1.85%; solid yield on such a large cash position, earning $12/day isn’t a bad trade off : )

-Lanny

Thanks Lanny! That’s a nice way of looking at it, a dozen or so dollar bills handed over daily is a nice chunk of change!

Over $750 with some monster growth, too. Excellent job, Blake! DIS really delivered in July for you… although IRM and GPC weren’t too far off from cracking the century mark.

Good luck with the tax commissioner with regard to the rental value. Sounds like your previous experience was a good one.

Thanks ED! A lot of good payers this month throwing money into the account. The tax commissioner is actually for my primary home. They bumped up property taxes by roughly 2k this year. It’s crazy!