As a dividend growth investor, i’m constantly buying dividends for future income. While i’m not exactly thrilled with the prices I’m paying right now to be buying dividends stocks, I doing the best with what I’ve got.

It’s not an easy task to continue to diversify my dividend portfolio (at decent values) and to be buying dividends that will grow into the future. I think I have some winners below but, only time will tell.

As I mentioned in my December 2016 dividend income and net worth report, I must work harder this year to buy the best values I can find monthly. Only buying during dips won’t get me to where I want to be in eight years. [Ha, i’m actually following through on my 2107 resolutions]

Here are the dividend stocks I bought so far this month.

Buying Dividends - January 2017

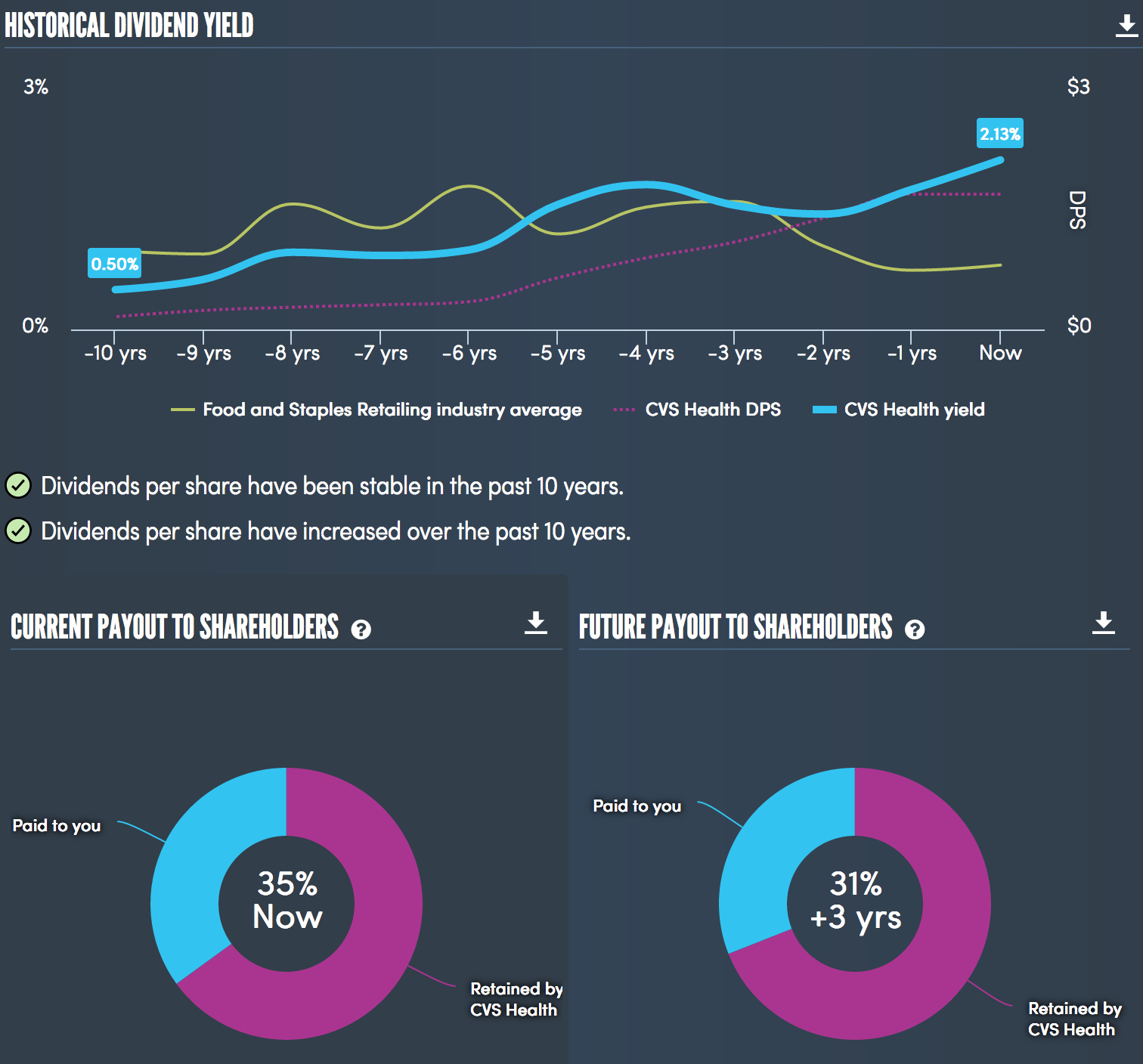

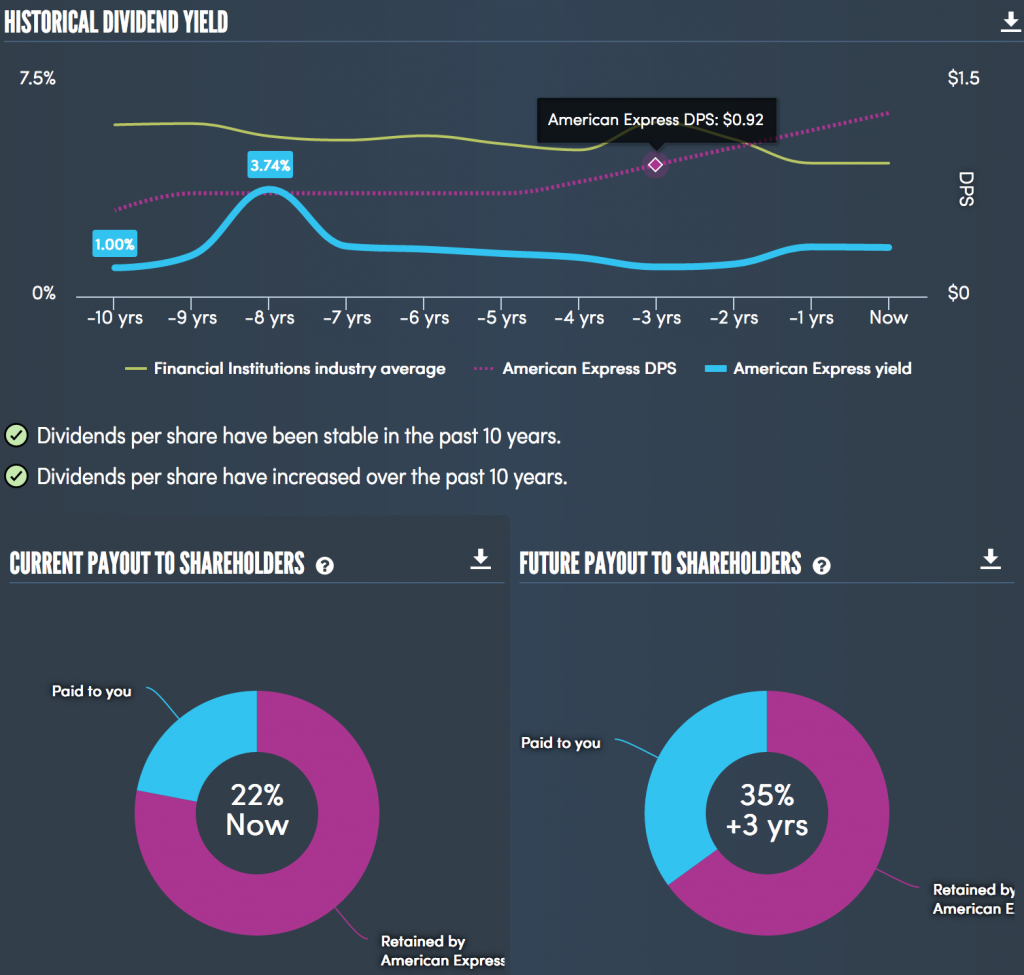

Below are some graphic charts from Simply Wall St that show the dividend yield range for the stocks purchased above.

CVS Dividend Yield

AXP Dividend Yield

My dividend portfolio has been updated with these buys.

What have you been picking up this year? Any glaring values I’ve missed?

14 Comments

Great stuff, love the charts! So far this year, I’ve been picking up shares of WSM, which I believe to be undervalued. My theory is that it benefits secondarily from any positive in the housing market. As people move into new residences, they tend to want to upgrade, including cookware. Yield has recently gone up to 3%, and dividend growth is good, so I figured it was a good time to buy.

Hi SeekingtheDividends,

Thank you for the recommendations. Williams-Sonoma is having a great day today! I’ll have to do some further research as they aren’t on my watch list… but just after a quick look – they do appear to be undervalued. Thanks again for the heads-up!

Thanks for sharing your recent buys. It’s nice to see many in the DGI community buying in earnest at the start of 2017. While super bargains may not be out there these days there are still some good value and yield plays. I don’t hold either of your buys but it’s nice to keep building that passive income stream.

Hi DivHut,

I’m trying hard this year. Last year’s me wouldn’t have bought either of these companies. I’ll try going this route (of finding the best values every month) and see how it plays out.

We’ll have to see some extreme adjustments in values before I do any “backup the truck buying” though 🙂

As always, thank you for dropping by and commenting!

I agree with DivHut. It’s refreshing to see a bunch of fresh buys in 2017. It was pretty slow for a while. Nice job.

Thanks IH,

I suspect we will continue to see limited buying unless there is some real sentiment change. Everything I’m itching to buy is so expensive at the moment. Thanks for stopping in and commenting!

Nice buys! Just used my AMEX a few minutes ago as a matter of fact. Unfortunately it wasn’t at CVS haha Great way to start the year off strong and work on getting the dividend snowball rolling sooner rather than later. Keep it up and I’m really looking forward to seeing what the rest of 2017 will have in store for you if you can keep this kind of pace up!

Bert

Hi Bert,

1 out of 2 isn’t bad 🙂 Hopefully, we’ll see some real deals start popping up soon! I need to put roughly 35k to work this year to hit my 2017 goal. It’s going to be tough.

Thanks for stopping by and commenting!

These are the type of growth shares you love to see. Long term holds that can increase over the short and long term. As long as these businesses can continue to grow they will produce an nice dividend.

Hi BHL,

That’s exactly what I’m counting on! I think the companies listed above should do very well over the years.

Thanks for dropping in and commenting!

AXP and VFC are both stocks that are my next target to add. Good to see other fellow bloggers getting into the action also.

Hi D4F,

You obviously know my thoughts on those two companies… good choices. It will be interesting to see what happens over the next few days. There might be some better prices for you shortly.

Thanks for stopping in and commenting!

Great buys. I don’t own any of them myself, but it’s nice seeing others find more opportunities in this high market. And never hurts to add more passive income with the dividends. Good start to the year.

Thanks DD! Looks as if it’s going to continue to be a difficult market for us. These highs make total overall portfolios seem great – which is fun to look at. However, adding new money at reasonable values is increasingly difficult. I’ll keep working on investing into the best values at the moment…

Thanks for stopping in and commenting!