Company Overview

Northrop Grumman NOC is an integrated enterprise consisting of businesses that cover the entire security spectrum, from undersea to outer space and into cyberspace. The Company operates in four segments: Aerospace Systems, Electronic Systems, Information Systems and Technical Services.

Northrop Grumman NOC is an integrated enterprise consisting of businesses that cover the entire security spectrum, from undersea to outer space and into cyberspace. The Company operates in four segments: Aerospace Systems, Electronic Systems, Information Systems and Technical Services.

Sales, Earnings, Free Cash Flow

| Years | Revenue (in millions) |

|---|---|

| 2006 | $28,655 |

| 2007 | $30,341 |

| 2008 | $32,315 |

| 2009 | $33,755 |

| 2010 | $34,757 |

Revenue for NOC has grown by an average of 11.4% over the past decade, and about 5% over the past 5 years. The 3% growth between 2009 and 2010 was lower than the historical average.

The most recent earnings release came at the end of September, and the close of Q3. Sales were down both quarter over quarter and year over year. Full year 2011, NOC is expecting sales 2-3% lower than 2010, due to “market environment’.

Like we have seem with other defense companies,

[with] the possibility of further budget reductions, our customers continue to be cautious in releasing funds for their activities. While there is uncertainty regarding future budget levels, we believe there is clarity regarding the threat environment and our customers’ need for affordability.

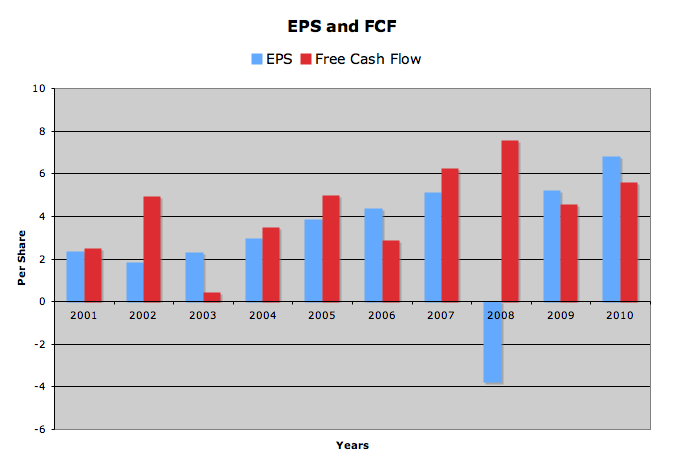

Earnings have grown faster than revenue, though only slightly. The 10 year compounded average growth is 12.3%, though from 2009 – 2010 eps grew a whopping 31%, from $5.21 to $6.82. Analysts expect full year 2011 earnings of $7.00, inline with NOC’s guidance of $6.95 – $7.05.

Free cash flow per diluted share has grown by an average of 9% over the past decade, and has not had a single negative year, but they were close in 2003 when fcf dropped to $0.44. FCF has not yet recovered to the high of $7.56 in 2008, though has been more than enough to cover the dividend of the past 5 years.

Both earnings and fcf have been bolstered by a steady share buyback program, and NOC manages to take about 4% of outstanding shares off the market every year. The company expects to spend about $30 billion buying back shares this year, and has already purchased 12.7 million on the open market.

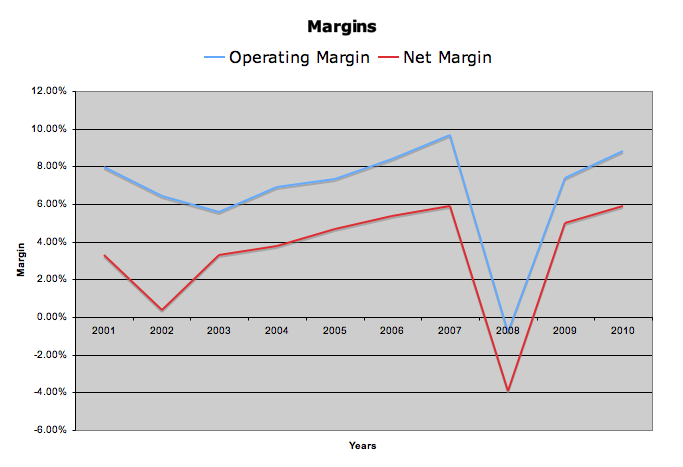

Both operating and net margin trended up for many years, after some razor thin years in the early 2000’s. After hitting highs of 9.6% and 5.9% in 2007, both dipped substantially in 2008, and seem to have recovered since. Operating margin is up this year 230 basis points, to 12.5%, and net margin is up to 7.8% (for last reported quarter, Q3)

Dividends and Stock BuyBacks

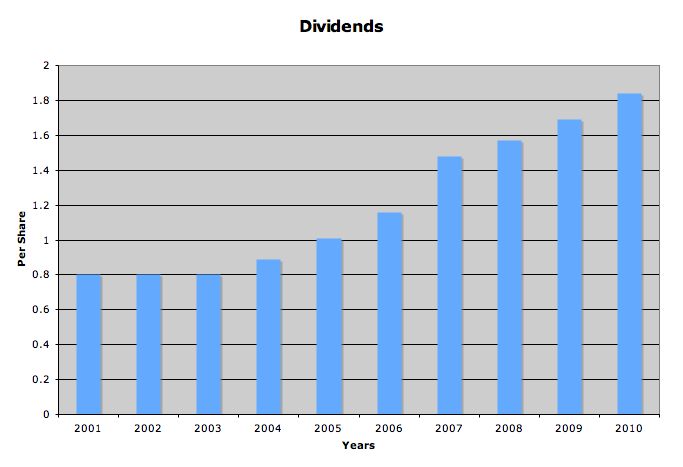

NOC has a long history of paying dividends, but only began regular, yearly increases in 2004, similar to LMT, which began consistent increases in 2003. Over the past 5 years, growth as averaged 12.2% – the last dividend increase came in June of 2011, when the quarterly rate was raised to $0.50, from $0.47, for an annual dividend of $2.00.

The 5 year rolling dividend growth rate has been in the low teens for the last 4 periods, and should stay about there with the latest increase.

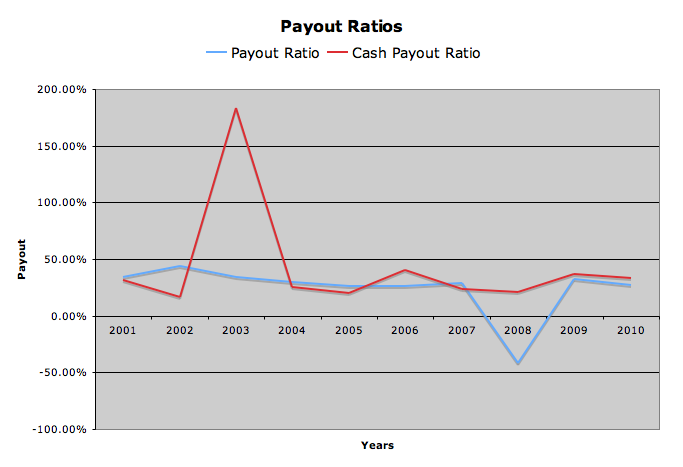

Payout ratios are safe. The earnings based ratio was only 27% in 2010, and the cash based ratio only slightly higher at 32%. Even if the company has stagnant, or slow growing earnings for the next few years, they should still have money left for dividend growth.

Balance Sheet

Northrop Grumman has a moderate balance sheet. The current ratio is 1.2, and the interest coverage ratio is 10.9. Debt to total capital is acceptable, at 25.2%.

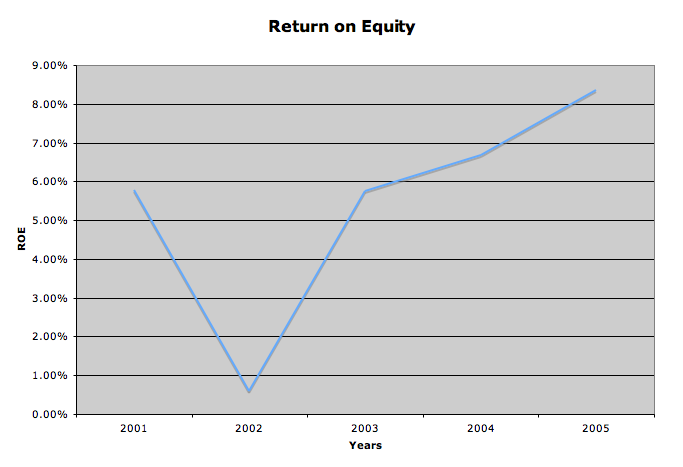

Return on equity has had a bumpy ride, and is not as consistent as I like to see it.

Stock Price Valuations

current price – $58.63

5 year average low p/e – 8.2

p/e (ttm) – 8.6

p/e (forward) – 8.4

peg – 1.1

5 year high dividend yield – 3.3%

dividend yield – 3.4%

Conclusion

Overall, I will pass on Northrop Grumman right now. The defense industry is very vulnerable at the moment, and if I planned to ride out this volatility with any one company, I’ve been leaning more towards L-3 than either NOC or LMT.

To see other analysis of defense stocks, check out L-3 Communications and Lockheed Martin

To get all my updates, please subscribe to my rss feed

Full Disclosure: I do not own any NOC, LMT or LLL. My Current Portfolio Holdings can be seen here

3 Comments

I’m a little leery on defense companies at the moment. I think the hangover from total constant war over the last decade — and coming cutbacks — has yet to be felt.