Want to give the gift of stocks to a friend or loved one? This is how I chose to introduce my child to the wonderful world of investing. In my Stockpile review, I share the process of creating a custodial account (with pictures) and how quickly one can setup an account after receiving a Stockpile gift card.

The financial technology (“fintech”) sector is booming right now, as more and more people want to get involved in more complicated aspects of investing that used to be reserved for wealthier individuals and finance professionals. Thanks to the rise of low-fee investment platforms like Stockpile, achieving financial independence is no longer a far-fetched fantasy – middle class and even low-income folks can also get more involved in wealth accumulation without requiring the help of a human financial adviser.

Stockpile, an online broker that gives everyday investors access to fractional shares of stocks and ETFs, is a great place to start investing in stocks. Better yet, Stockpile has a gift card option, which is truly a gift that keeps on giving over time (even if it’s not as exciting as a new video game or spa treatment).

Want to give your family and friends the gift of financial prosperity for the holidays? Here are some reasons why Stockpile is an unusual, though awesome gift idea for any celebration:

Buy Partial Shares of Stock

One of the best benefits Stockpile offers is the ability to buy partial shares of stock. This means that popular-but-expensive stocks like Apple, Amazon, Google and Netflix are no longer out of reach for casual investors who simply can’t afford to drop hundreds or thousands of dollars on a single share. With Stockpile, go ahead and invest whatever amount you can afford into a particular stock or ETF (there are more than 1,000 to choose from), whether that’s $10 or $800+ (one-time deposit or monthly; Stockpile lets you set up recurring deposits, if you’d like).

There are no monthly account fees or account balance minimums – just a $0.99 fee each time you buy/sell stocks (plus a 3% surcharge, if you pay with a credit card). Compared to E*Trade’s $6.95/trade, Charles Schwab’s $4.95/trade and AmeriTrade’s $6.95/trade fees, Stockpile is one of the most affordable online stock trading platforms out there. However, this is not the trading platform for an active investor. If your looking for a professional brokerage for an active investor, I recommend IB – here is my Interactive Brokers review.

Reinvest Dividends

How much money are you currently investing in dividend stocks? If you’ve been focused on other investment options because prices for full shares of dividend stocks are too expensive, then Stockpile is an excellent resource for accessing fractional shares of stocks that pay dividends.

Of course, it’s not enough to simply invest in dividend stocks – you should be maximizing your gains with a dividend reinvestment plan (DRIP). As the name implies, a DRIP automatically puts your dividend payouts right back into your portfolio, thereby exponentially increasing your potential for higher returns on your investments than if you had pocketed the dividends instead.

Stockpile accounts come with the option of reinvesting all dividends earned, which presents a great passive income opportunity for anyone who wants to venture further into the world of stock investing.

How to Setup a Stockpile Custodial Account (10 Steps)

Here is the process to create a custodial account with Stockpile. The setup is simple and really only took a few minutes. The longest part of the account creation was scouring the house for a social security number. Be prepared to enter the SSN for both you and your child.

Creating a Stockpile account with a gift card looks like this.

Step 1 – Enter Gift Card – (this code in the picture isn’t going to work). The real one is an alphanumeric code.

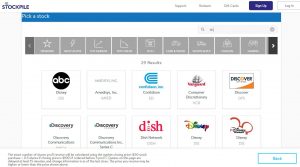

Step 2 – Pick which stock or ETF you would like to invest in. (The process is targeted towards kids and has many options and logos for the same company)

Step 2 – Pick which stock or ETF you would like to invest in. (The process is targeted towards kids and has many options and logos for the same company)

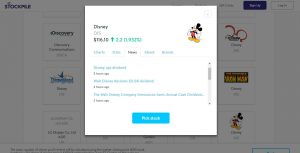

Step 3 – After clicking on a ticker symbol, you see charts, data and news for the company. – DIS just raised their dividend a little over 4%.

Step 3 – After clicking on a ticker symbol, you see charts, data and news for the company. – DIS just raised their dividend a little over 4%.

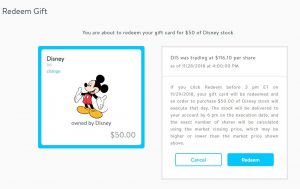

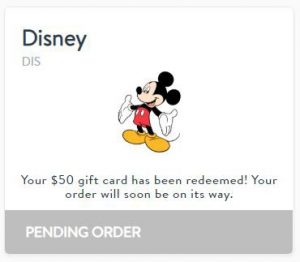

Step 4 – Confirm you want to redeem your Stockpile gift card for your selected stock or ETF.

Step 4 – Confirm you want to redeem your Stockpile gift card for your selected stock or ETF.

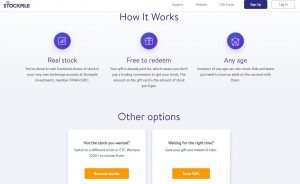

Step 5 – Here is a summary of how the account creation process works.

Step 5 – Here is a summary of how the account creation process works.

Step 6 – First you create an account for yourself, then you create the custodial account for your minor.

Step 6 – First you create an account for yourself, then you create the custodial account for your minor.

Step 7 – This is the hardest part… go find your child’s social security #, or better yet, go ask your wife. The rest of the data you should have memorized 😉

Step 7 – This is the hardest part… go find your child’s social security #, or better yet, go ask your wife. The rest of the data you should have memorized 😉

Step 8 – Your account is now setup and you get a last chance to confirm the purchase. If you have already created an account and it’s before 3pm, your trade should go through that day. If not, then your trade will be process the next business day.

Step 8 – Your account is now setup and you get a last chance to confirm the purchase. If you have already created an account and it’s before 3pm, your trade should go through that day. If not, then your trade will be process the next business day.

Step 9 – The order has been processed and will be executed the following day. All trades happen before the end of the trading day at 4pm.

Step 9 – The order has been processed and will be executed the following day. All trades happen before the end of the trading day at 4pm.

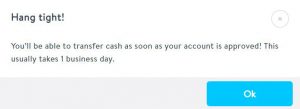

Step 10 – If you are making an account for the first time, it will take a business day for your account to be approved before your purchase will be made.

Step 10 – If you are making an account for the first time, it will take a business day for your account to be approved before your purchase will be made.

Stockpile Gift Card

If you love investing, then why not spread the joy to other people in your life? Stockpile offers e-gift stocks ($2.99 for the first stock and $0.99 for each stock thereafter) and physical gift cards (add a $4.95 to $7.95 fee* depending on the face value; $25, $50 and $100 gift cards are currently available). Stockpile gift cards can be purchased here.

You can even give a share of stock to children and teenagers, thanks to Stockpile’s custodial account option for parents who want to maintain control over their kids’ portfolios until they reach adulthood. Since Stockpile is the only brokerage that currently has an easy option to give shares of stock to other people, there’s no need to look elsewhere for financially sustainable gift ideas for the winter holidays and/or birthdays.

*Total price is a little higher than face value to cover credit card or other payment processing fees, trading commission, and other costs so your recipient doesn’t pay anything when redeeming your gift.

Stockpile App

With a human financial adviser, it may take a few days (or weeks) to give you all the details about your portfolio’s current standing and historical performance. With Stockpile however, you can view your portfolio whenever and wherever you’d like, thanks to the Stockpile app. You can add more funds to your account and invest in new stocks while on-the-go, or you can partake in Stockpile’s mini investment lessons to improve your stock picking strategy.

Is Stockpile Safe?

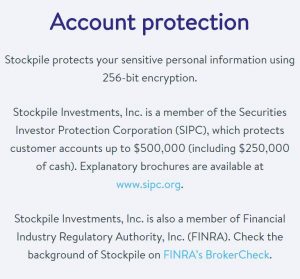

Online brokerages, including Stockpile – typically come with top-of-the-line security features, such as bank-grade encryption technologies and highly secure transactions. Rest assured, Stockpile is legit and your personal financial information is safe when you use the platform to transfer funds between your bank and Stockpile accounts. Stockpile uses 256 bit encryption to keep prying eyes out of the data transfer process. Also, they are SPIC insured and protect accounts up to $500,000.

Online brokerages, including Stockpile – typically come with top-of-the-line security features, such as bank-grade encryption technologies and highly secure transactions. Rest assured, Stockpile is legit and your personal financial information is safe when you use the platform to transfer funds between your bank and Stockpile accounts. Stockpile uses 256 bit encryption to keep prying eyes out of the data transfer process. Also, they are SPIC insured and protect accounts up to $500,000.

Stockpile Review Summary

Whether you’ve been looking for better low-cost trading opportunities or you want to give the gift of stocks, Stockpile is a great place to start. With more than 1,000 stocks and ETFs to choose from, the ability to purchase fractional shares of stock, and the availability and affordability of Stockpile gift card options, Stockpile is one of the best resources for investors who want easier way to gift stocks to family members and friends.

Comments are closed.