Company Overview

Target (NYSE: TGT) is an upscale discounter that provides high-quality, on-trend merchandise at discount prices. In addition, Target operates an online business, Target.com. The company reports under two operating segments: Retail and Credit Card. Target has 1752 stores in 49 states, including 251 Super Target locations.

Target (NYSE: TGT) is an upscale discounter that provides high-quality, on-trend merchandise at discount prices. In addition, Target operates an online business, Target.com. The company reports under two operating segments: Retail and Credit Card. Target has 1752 stores in 49 states, including 251 Super Target locations.

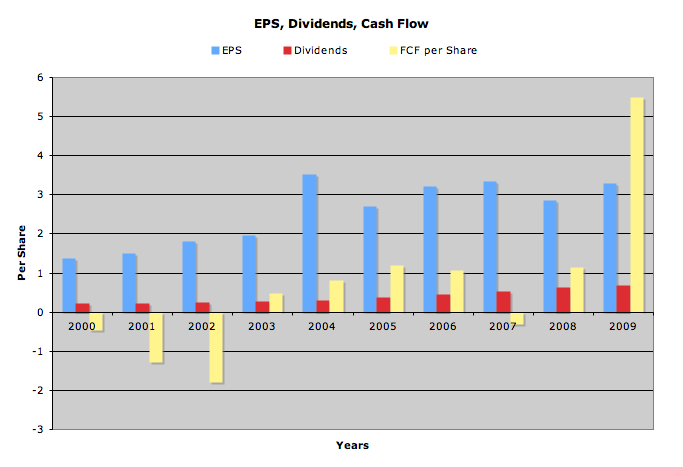

EPS, Dividends, FCF

| Annual Growth Rates | Earnings Per Share | Dividends Per Share | FCF Per Share |

|---|---|---|---|

| 10 year | 10.07% | 13.03% | N/A |

| 5 year | 5.05% | 15.23% | 46.46% |

| 1 year | 15.38% | 8.06% | 381.93% |

EPS growth has been rather erratic, but not nearly as much as free cash flow, which had 4 negative years in the past decade. Dividends have shown consistent growth, albeit at a faster pace than eps.

Expected Earnings

- 2011 – 3.92

- 2012 – 4.42

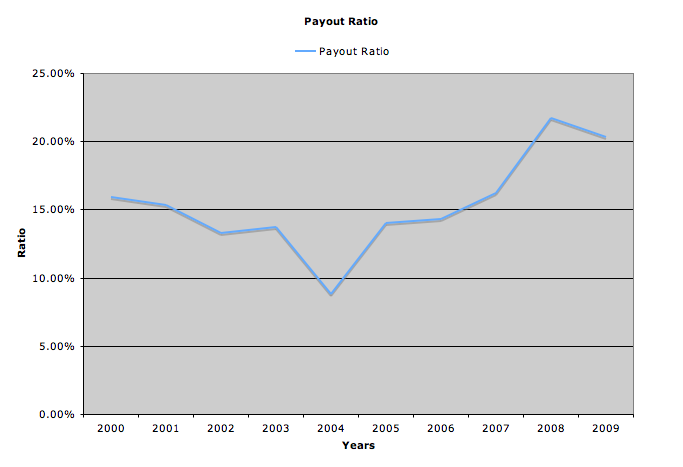

Payout Ratios

I normally graph both the earnings based payout ratio in addition to the cash based, but the numerous negative years of fcf made this difficult. This is a great example of why dividend investors must pay as much, if not more, attention to cash based metrics over earnings. If we only looked at the earnings based ratio, TGT has shown a consistent, low payout, leaving plenty of room for growth. But looking at the cash flow, we uncover a major red flag: erratic growth, negative years, and payout ratios ranging from 52% to 12%. This may signal an unsustainable dividend.

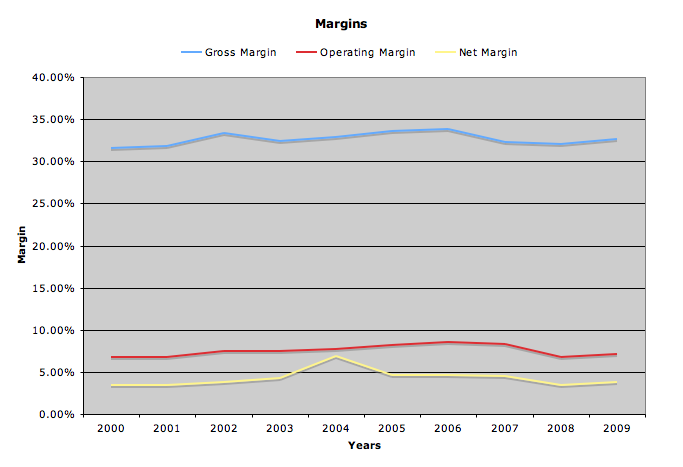

Revenue and Margins

| Years | Revenue (in millions) |

|---|---|

| 2000 | 36,951 |

| 2001 | 39,826 |

| 2002 | 43,917 |

| 2003 | 42,025 |

| 2004 | 46,839 |

| 2005 | 52,620 |

| 2006 | 59,490 |

| 2007 | 63,367 |

| 2008 | 64,948 |

| 2009 | 65,357 |

Revenue has grown by an average of 6.51% for the past 10 years

All margins have remained stable, and are in line with this industry.

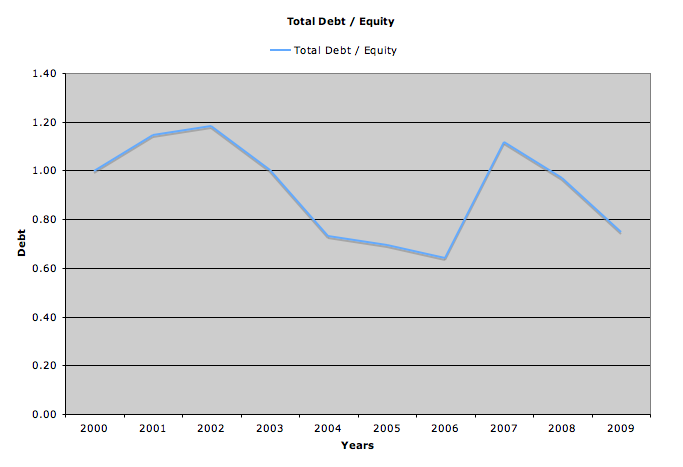

Balance Sheet

TGT’s debt is a bit higher than I normally like to see. Total Debt to Equity is 0.75, and debt is 42.71% of capital employed.

The interest coverage ratio is 5.83 and the current ratio is 1.63

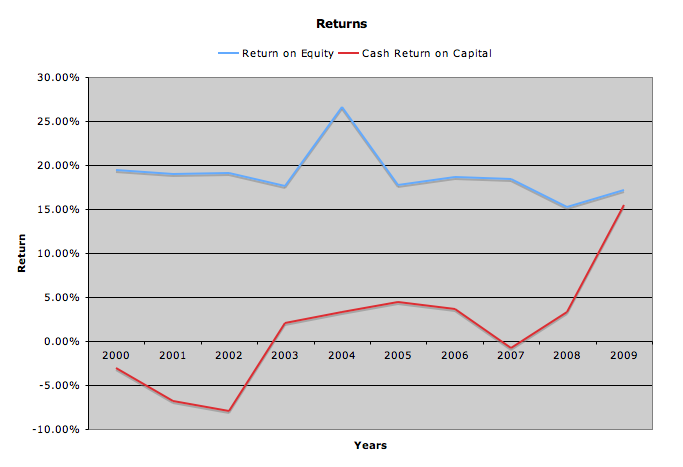

Returns

Return on equity for the past year was 17.12%, down from a high of 26.55% in 2004. Cash Return on Total Capital has grown significantly in recent years, peaking last year at 15.50%

Stock Price Valuations

current price –55.05

5 year low p/e –12.39

p/e (ttm) –16.68

p/e (forward) –14.04

p/cash flow –10.01

peg –1.1

5 year high dividend yield –1.61%

dividend yield –1.82%

Conclusion

Target has a strong brand name here in the US, and is often seen as a step up from Walmart stores, which can occasionally be disorganized and sloppy, especially in more urban or lower income areas. Their merchandise is mostly of higher quality, but still reasonably priced, and the Target name carries less stigma than the oft hated Walmart. But a major growth hurdle I see for TGT is their lack of international exposure. With operations only in the US, the most saturated market in the world, it may be difficult to produce significant growth over the long term. Walmart has a huge head start in the international markets, and it would be a formidable challenge for Target to catch up.

My analysis reveals some red flags. I don’t like the erratic earnings, and debt is a bit higher than I like to see. But what really concerns me is the inconsistent, and sometimes negative, free cash flow. Since cash is what pays dividends, I prefer a company that regularly produces enough cash to cover a growing dividend. I am not 100% confident Target can accomplish this.

In addition, I think the price is high, trading above it’s 5 year average low p/e. Though it’s yield is higher than it’s 5 year average high yield price, a 1.82% yield is below my entry point.

For comparison, see my analysis of Walmart here

This is the second installment of my January Industry Analysis of Discount, Variety Stores. Next week I will analyze Costco, followed by Family Dollar Stores. Subscribe to my rss feed to get all my updates.

Further Reading

Target Stock Analysis@ Dividends Value

Target Stock Analysis@ Dividend Growth Investor

Target Stock Analysis@ The Div Guy

Full Disclosure: I do not own any TGT. My full portfolio holdings can be seen here

12 Comments

I also see the lack of international presence also a detriment. Just announced, see link below. Perhaps the first move in an increasing trend of international expansion?

http://www.theglobeandmail.com/globe-investor/target-heads-north-in-zellers-deal/article1868308/

Great catch Rhino! I think it’s interesting they are taking over some of the locations and unloading the rest on other retailers, like Walmart. Either way, good sign for Target. I’m interested to see how it all works out.

They just bough 200+ stores from The Bay owners (US private equity firm) to acquire the Zellers stores in Canada. I believe they paid nearly 2B$ and expect to open in 2013/2014. Some of Zellers lease were quite cheap and RioCan, the primary real estate renter for Zellers, is mulling over price increase in some locations as Zellers move out.

It’s expected to give some good competition to Wal-Mart.

I can definitely see Target taking some business away from Walmart. Where I live, and among my age/income group, Target is the preferred store for it’s higher end merchandise and overall more attractive store. I wonder how Canadians will take to it…

Target will thrive in 2011. With the inflationary fears rising, consumers will spend at discount stores that provide household necessities.

@Dividend Pig-

Target increased their cash assets from 2008 to 2009 FYE. Also, they have steadily increased the dividend paid per each stock.

http://sites.target.com/site/en/company/page.jsp?contentId=WCMP04-045216

I’d buy it to earn income.

I am certain Canadians will take to it, I am a Canadian and I know that there is already a huge brand recognition here. Cross border shoppers love Target. There is really nothing in the “High-end discount” space right now.