Company Overview

Universal Corporation (UVV) is a global leaf tobacco merchant and processor. The company is involved in buying, processing, packing, storing, shipping, and financing leaf tobacco for sale to, or for the account of, manufacturers of consumer tobacco products throughout the world.

Universal Corporation (UVV) is a global leaf tobacco merchant and processor. The company is involved in buying, processing, packing, storing, shipping, and financing leaf tobacco for sale to, or for the account of, manufacturers of consumer tobacco products throughout the world.

Sales, Earnings, Free Cash Flow

| Years | Revenue (in thousands) |

|---|---|

| 2007 | $2,007,272 |

| 2008 | $2,145,822 |

| 2009 | $2,554,659 |

| 2010 | $2,491,738 |

| 2011 | $2,571,527 |

Revenue growth has averaged 6.4% over the past 5 years, though that average is a little misleading since the past 3 years have been pretty much flat. The growth really came between 2008-2009, when revenues increased from 2.1 billion to 2.5 billion, where they have stayed since then.

This year is off to a bad start (which UVV, to their credit, they did warn against), with revenues down 11% from Q1 last year.

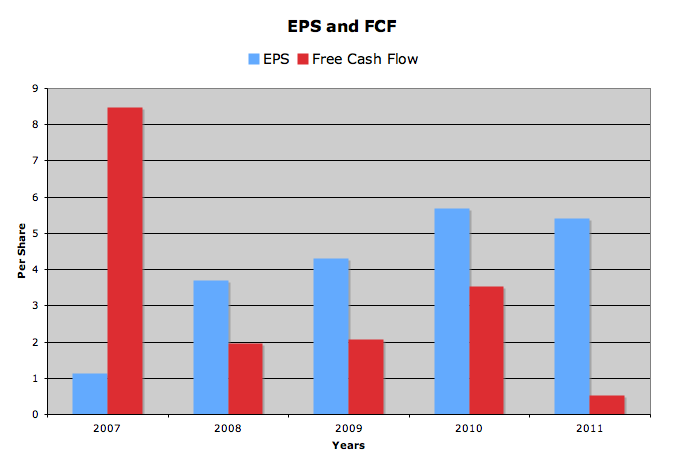

EPS has grown by an average of 3% over the past decade, but dropped by 4.6% from 2010 – 2011. Though the graph only shows the past 5 years, with a growth trend, in reality UVV was earning $4.34 a share in 2003, not far below the $5.42 earned in 2011.

Analysts are expecting UVV to earn $4 a share this year, a decrease of about 27%. So far, Q1 earnings were $0.52 a share, down from $0.87 a share a year earlier.

Free cash flow has been erratic over the years, reaching a high in 2007 of $8.47 and occasionally going negative. I generally look for companies with stable and growing free cash flow, and UVV does not fit this bill.

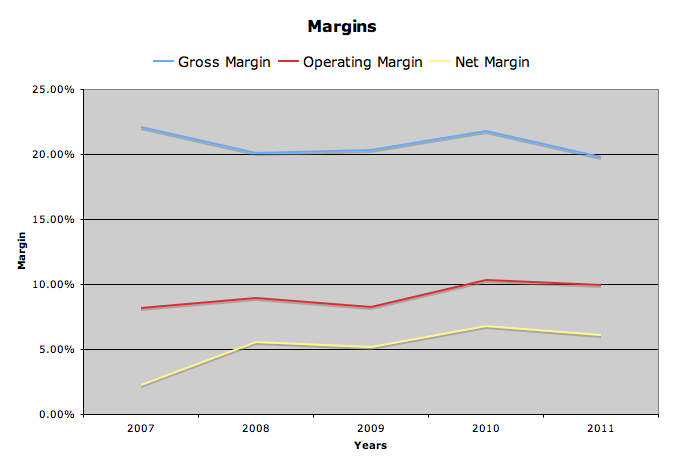

Universal has down a good job of keeping margins steady, although they have been warning that future margins will decrease, as 1) tobacco companies continue to shift to purchasing tobacco directly from farmers and 2) tobacco use decreases, leading to an oversupply of leaf.

Dividends and Stock BuyBacks

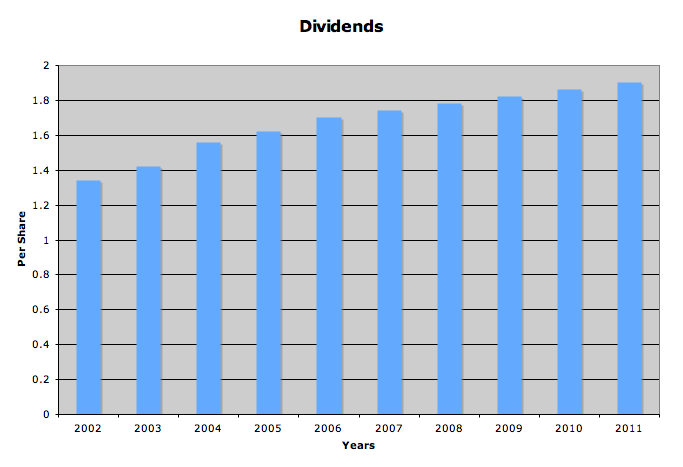

UVV has paid an increasing dividend for 40 years, and the most recent increase came in the fall of 2010, when the quarterly dividend was increased 2% to $0.48 a share.

Over the past decade, dividend growth is a bit on the slow side, averaging 3.9% a year. Growth has been slowing, as the past three years have only seen dividend increases of 2.3%, 2.2%, and 2.2%. The 5 year rolling dividend growth has also slowed considerably, from 6% in the early 2000’s to just 2.2% today.

What’s interesting about the dividend is how it is linked to preferred dividends. The company currently has about 219,000 preferred shares outstanding, which earn about 14 million dollars each year in dividends. Should the company fail to pay a preferred dividend, it will be barred from paying a common dividend for 4 consecutive quarters.

In addition to dividends, UVV has a stock buyback program, but it hasn’t been all that effective. Diluted shares outstanding have grown by an average of 2% a year.

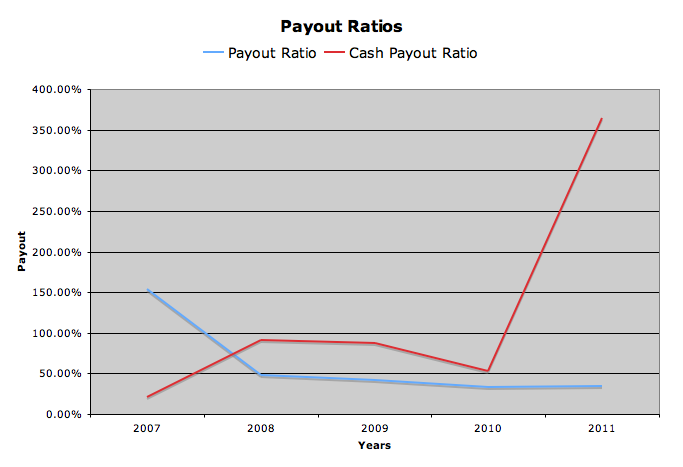

Payout ratios are erratic, occasionally crossing the 100% barrier in both earnings based and cash based.

Balance Sheet

UVV has a good balance sheet. Debt to total capital employed is 32%, and the current ratio is a solid 3.1. The interest coverage ratio is 11.

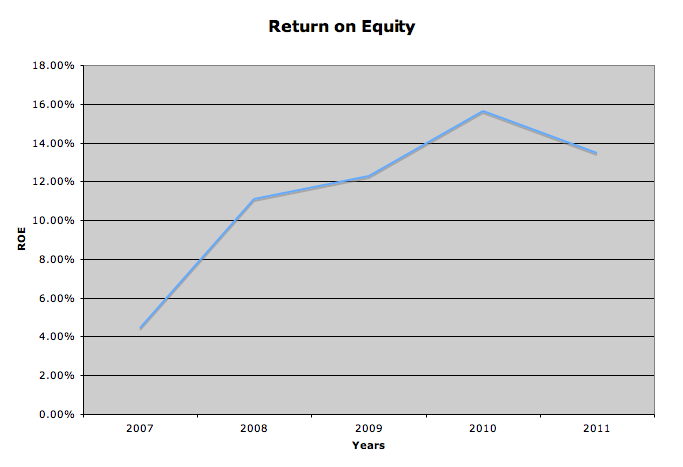

The ROE for UVV has shown strong growth over the past 5 years, but take a look at where it started – it’s easy to grow your return when your base value is 1.7%. Even with the strong growth of the past few years, an ROE of 13.5% is not spectacular.

Stock Price Valuations

current price – $37.62

5 year low p/e – n/a

p/e (ttm) – 6.9

p/e (forward) – 9.4

peg – n/a

5 year high dividend yield – 5.6%

dividend yield – 5.1%

Conclusion

I don’t find UVV to be an attractive investment. While the price is low and the yield is high, both dividend and earnings growth has stalled, and unless they can find a new business model, being the middleman in an increasingly smaller market just doesn’t have great growth prospects.

To get all my updates, please subscribe to my rss feed

Full Disclosure: I do not own any GPC. My Current Portfolio Holdings can be seen here

2 Comments

Good insight on the business model. That, more than anything, would discourage me.

Ya I agree I think there are more attractive tobacco stocks…as given in my post below 🙂