Finally, the first of the month has arrived and its time to report on my monthly dividend income and net worth. It’s been a great month… heck, lets just get started.

Finally, the first of the month has arrived and its time to report on my monthly dividend income and net worth. It’s been a great month… heck, lets just get started.

Dividend Income

July’s dividend income was pretty much middle of the road. I received $84.52 in free dividend income. This was the first month I received a dividend from Realty Income (O) which was very exciting! It’s awesome to finally have a monthly dividend payer in the portfolio. All of the dividend income received this month was reinvested back into additional shares to allow for compounding.

So far this year, I’ve received $620.79. This isn’t a lot compared to some, and certainly not enough for me to retire at 45. However, it is 611.18% more dividend income than I received this time last year. Pretty awesome right?! It really goes to show you how quickly one can ramp up a dividend portfolio.

Now that I have my new brokerage account (read my Interactive Brokers review here) setup with money ready to invest, I anticipate these dividend income reports will have much bigger numbers! The last half of the year is going to be an exciting time!

Net worth

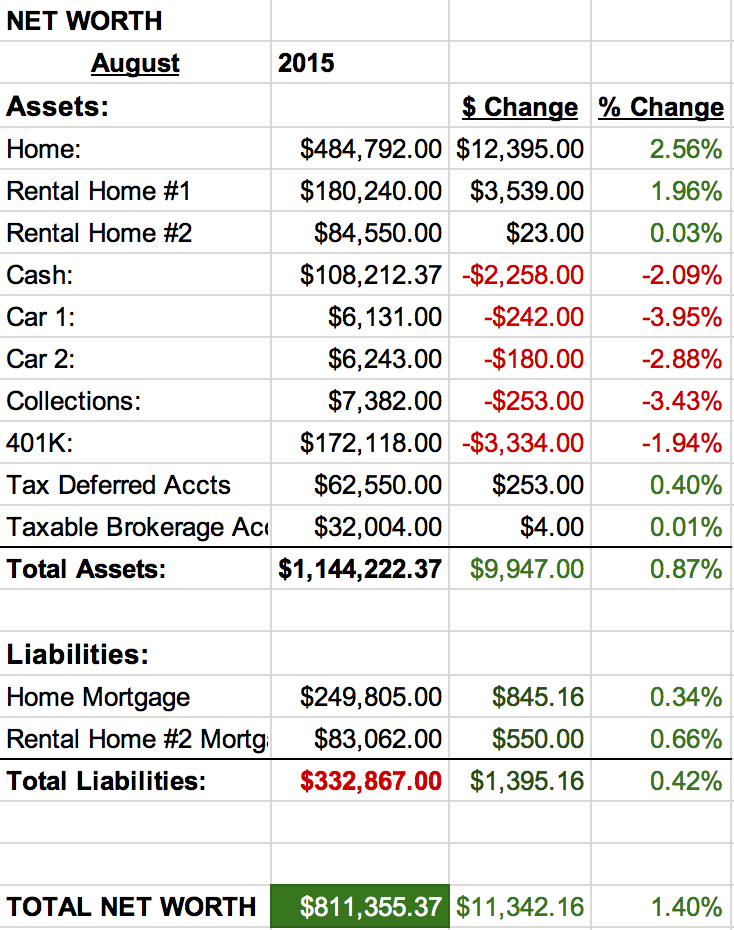

Coming off last month, it’s actually nice to have a somewhat normal monthly net worth report. Don’t get me wrong, I would love to raise my net worth by 3.2% every month, but that’s just not possible for me. August’s net worth report shows a very respectable 1.4% increase over last month. This has mostly to do with a very large increase in my home values. I’ll get to that in a bit, but for now, let’s do the numbers.

I again still have way too much cash. This is due to some large repairs/upgrades that we’ll be doing to the house. Once I determine what everything is actually going to cost, I’ll be able to reallocate this cash into more productive assets.

My primary home shot up 2.56% (according to Zillow) this month. I can’t say for certain how accurate this projected value is though. To put it into perspective, I wouldn’t pay that much for my house in its current state. However, this is only a fraction of the value that the county would like to tax me on this house. I mentioned last month that I was appealing my new property tax bill from my county. I’m still waiting for the appeal board to get to my case.

Rental property #1 & #2 are still chugging along. We’re very fortunate that we have stable, long term tenants in both these properties. We will most likely sell property #1 at some point as we are making a dismal return on that unit (even though we don’t have a mortgage on it). But until the tenant decides to leave, we’ll hold on to it.

Cash was down a little this month due to some large purchases and other miscellaneous expenses. Car insurance was due (always a big expense) and I also made a switch to a new mobile phone company. The initial costs were high because I purchased new phones for me and my wife. However, the long term savings are huge for making this switch, I’ll write about this incredible find later.

This monthly report once again shows me how awful vehicles are as assets. We have never been fancy car people and this has obviously served us well. We lost another 3.95% and 2.85% on our car values this month. The takeaway, don’t waste your money on expensive cars.

We’re continuing to pay extra every month on our mortgages. I’ts not much, but every little bit helps get this suffocating debt paid off. I’m hoping that once we have this property tax issue solved and change our home insurance, we’ll be back to chipping $1,000 a month off our primary residence.

I still have a long way to go before I can retire, but I’m getting closer every month. The dividend income portion of this report will really get exciting in the next few months. Stay tuned..

How did you do this month with your dividend income? Was July a little slow for you as well?

4 Comments

Great dividend income, keep the snowball rolling.

Still a long way to go but I’m making decent progress every month.

Thanks for stopping by!

Great month Blake! Congrats on the dividends and the increases in your real estate. Dividends were very low for me in July but I guess that is normal. I’m curious – why the drop in dividend income when compared to April (same with June compared to March)? Do you have some companies paying on a wacky schedule or did you sell some stock?

Hope you have a great August!

Ken

Thanks Ken!

Real estate is a big question mark at the moment. There is some very expensive new construction (4x my house value) going up across the street. I suspect that is skewing my house numbers. I guess I won’t know the real value until I sell it.

Good catch on the April dividend income. I have an old position in Windstream (WIN) that I’ve been waiting to sell (which is why I don’t list it in my portfolio). Anyway, April was an inflated payment as they were spinning off their real estate into a REIT (CSAL). The March and June dividend discrepancy is the product of owning (BBL) a semi-annual payer.

As always, thanks for stopping in and commenting!