June’s dividend income exploded while net worth was squashed. I am happy to report dividend growth investing has been holding up very well over the last six months!

June Dividend Income

This month I received $4,523.56 in dividend income! On average, I was paid $43.50 from 104 different companies! This month’s dividend income is an amazing 38.4% increase over June 2021. That’s $1,255.03 more dividend income than last June. I do need to point out the massive special dividend from LYB, which added an extra $125 to this month’s total. That won’t likely repeat.

Dividend Income - June 2022

Here is a chart of my passive dividend income progress over the last 5 years.

The dividend portfolio has been updated.

Here are the dividend stock purchases I’ve made between June 2021 and 2022 that helped fuel this month’s dividend income growth.

June’s dividend income covers all my expenses for the month. If I earned this every month in dividend income, I would not need to work.

June Dividend Growth (Dividend Increases)

Below are the realized dividend increases I received this June. Dividend growth is the most important metric (to me) and one of my favorite to report!

This June I received 18 dividend increases. Seven of the dividend increases were over 10%!

Dividend Increases - June 2022

June’s dividend increase adds $196.46 in annual dividend income! On top of that, June’s dividend increases are the equivalent of investing an extra $5,613.14 of new money at 3.5% yield! SWEET!

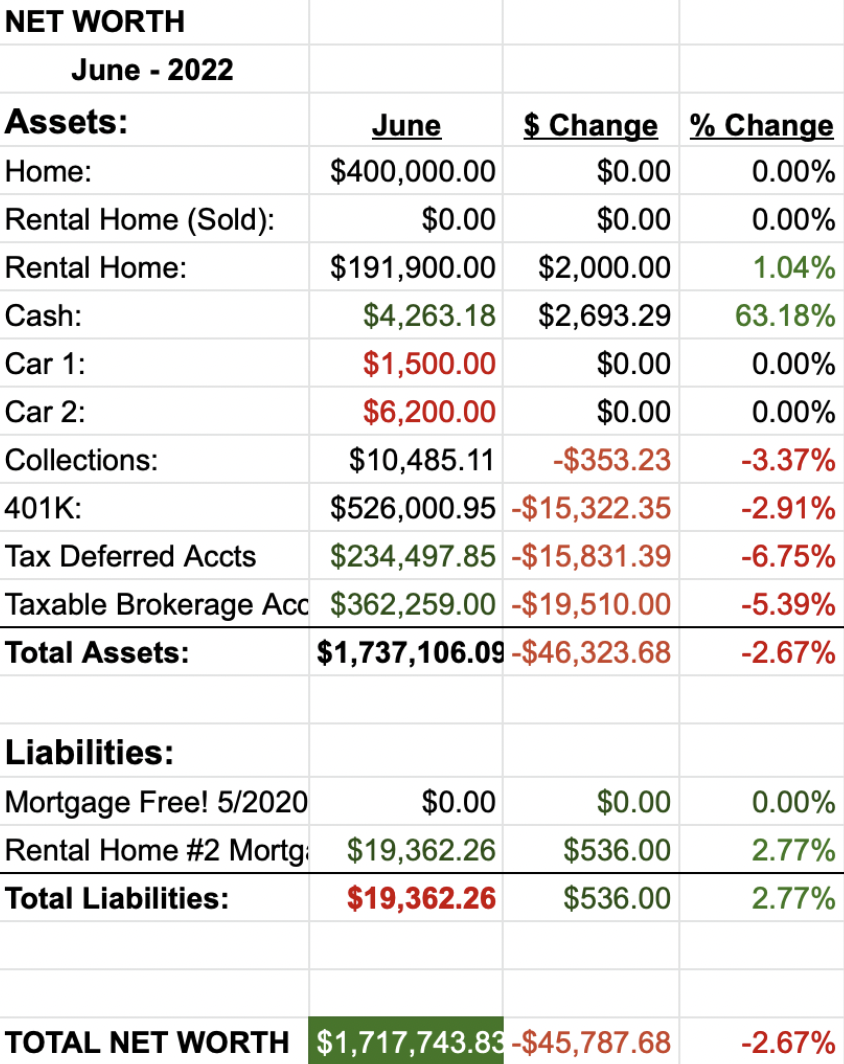

Net Worth

Net worth resumed its descent!

Let’s do the numbers…

Cash

I some how ended up with more cash this month. I’ve been scraping up cash from everywhere I can to put into the market.

Real Estate

In June, our electricity bill increased to $240 for the month and our gas bill remained about the same at $36. That totals to $276. June was SUPER hot!! July will be about the same.

Nothing new on the rental. Rent came in on time, and no service calls. The new 2 year lease we signed for a 15% increase starts this month.

Wrap-up

June’s dividend income was phenomenal! I am very excited with the progress and encouraged to continue along this journey. The dividend increases this month were also extremely remarkable. I am on track to add almost $1,800 this year from dividend increases alone.

Net worth falling is unfortunate, but par for the course this year.

I’ll continue to invest as much as possible into dividend growth stocks, I hope you do too!

8 Comments

Even discounting the LYB special payment that was still massive growth! Our monthly payouts are getting closer each month and makes sense as we are both targeting similar FI time periods (5yrs vs 4yrs).

That’s great SD! I think this time period/phase of the journey has been the most difficult for me… being close, but not close enough. Just need to keep grinding!

Congrats DP! Over $4,500 is just absolutely crushing it! And those dividend increases sure were nice for you boosting your forward dividends by nearly $200 while you did absolutely nothing.

Thanks JC! Exactly, none of this works without the dividend growth. At the moment, my average portfolio dividend growth is just a little over 5%. I will happily take a compounding $2k a year dividend growth… every year!

Blake – what do you think about buying some UHC at these levels? I am very bullish on them long term (also a former employee) and love their dividend growth and business expansion.

Hi Ted, you mean UHT? As a former employee, sounds like you may have much more actionable information than I do… what do you think? 😉

Sorry, abbreviating. UNH (United Health Group / United HealthCare)

Ah… yes. One of those, I wish I would have purchased more stocks. Super expensive at the moment, but it most often is! I’m with you, UNH looks great, but not for me at this particular valuation. They has been flying high this year!