Many investors are flocking to dividend stocks as a means for generating a passive income and/or amplifying their current investment strategies with the help of dividend reinvestment plans (DRIPs). However, in the midst of all this hype, it’s important to remember that not all dividend stocks are created equal (hence the necessity of using a dividend yield formula to help determine whether a stock is worth investing in – more on this simple, yet important equation later).

In some cases, you might be inadvertently dealing with a dividend trap (also known as a “dividend yield trap” or “value trap”), which involves unsustainably high dividend yields on a stock that has either plateaued in value or is on the downswing. There are many different reasons behind dividend traps, ranging from unrealistically optimistic outlooks on a company’s future growth and/or poor management to market volatility and changing consumer preferences that rattle a once-dependable, dividend-paying company’s stability.

In order to avoid these yield traps, the dividend yield equation is highly useful to implement into your investment strategy. If you’re unfamiliar with the concept or haven’t paid much attention to it in the past, here’s everything you need to know before wading further into the waters of dividend investing:

What Is The Dividend Yield?

Simply, the dividend yield is how much a company pays out in dividends (cash payments to you) each year compared to its share price and is represented as a percentage. Eg. Stock YZX has a dividend yield of 2.8%.

Why Should You Care About Dividend Yields?

This question is trickier than you might imagine; of course we care about yields when it comes to dividend-paying stocks because it’s a great passive income opportunity for some people, while other investors reinvest earned dividends back into their portfolios to maximize their long-term gains. Regardless of your preferred approach to dividends, the fact remains that stocks with high dividend yields are not automatically the best options out there.

For example, if you had the choice between a long-established company that has consistently yielded a 4% dividend and a newer company that currently has a 7% yield, which one would you choose? The predictable, consistent investment or the one with potential to generate high returns (at least in the short-run)? This is where the dividend growth rate would come in handy to help you determine which stocks are more likely to boost your portfolio’s value and your cash flow in the future.

A company’s dividend yield gives you a quick tool to compare a company’s value to others in the stock market. For example, lower yielding companies are often faster growing or overvalued stocks. In contrast, higher yielding companies can be undervalued or out of favor stocks. High yielding stocks (6%+), that aren’t REITs, can also be a warning sign that something is seriously wrong with a company.

When companies are having to payout huge percentages of their earnings to cover their dividends, this is a telltale signal that something is amiss and more research is necessary.

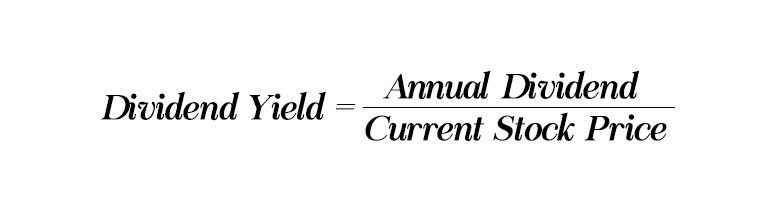

The Dividend Yield Formula

To calculate a dividend yield of a company, simply take the annual dividend and divide it by the current stock price. Once again, the dividend yield formula is a simple financial calculation that tells you how much the company disperses to shareholders in annual dividends with regards to the company’s current stock price. Also, you do not include special dividends (1 time and non-recurring dividends) in the equation. Here’s an example to help you out:

Stock XYZ current share price: $45 | Stock XYZ annualized dividend: $1.50

Stock OPQ current share price: $80 | Stock OPQ annualized dividend: $2.00

Without taking the dividend yield into account just yet, which stock would you invest in? Some people see the higher annualized dividend ($2.00 for OPQ versus $1.50 for XYZ) and pour their money into that one to grow their dividend income. However, the math might not necessarily add up for OPQ in this scenario – here’s why:

Yield Formula for OPQ: $2.00 divided by $80.00 equals 0.025 or 2.5% dividend yield

Yield Formula for XYZ: $1.50 divided by $45 equals 0.033 or a 3.3% dividend yield

Now that we’ve run the numbers, would you invest more into OPQ or XYZ? Assuming all other factors remain equal (e.g., company’s management and financial history, current market conditions, etc.), XYZ might be the better option.

Furthermore, if Stock OPQ’s price per share went up to $100 with no increase in dividend payouts, the dividend yield would decrease to 0.02 or 2%. If you’re the type of investor who goes beyond share price fluctuations and wants the most value out of a dividend-paying stock, then the dividend yield formula is a great first step you should calculate before deciding whether a certain stock is worth your investment.

Forward and Trailing Dividend Yield

The dividend yield can be calculated in two different ways, a forward dividend yield and trailing dividend yield. Both are acceptable, but the dividend yields values can vary quite a bit using these two different calculation methods, especially for companies with large dividend growth.

Forward dividend yield is calculated by taking the most recent dividend yield and using that dividend amount for the next 12 months in the calculation. While the trailing dividend yield (or TTM dividend yield) is calculated by taking the sum of the last 12 months of dividend payments.

Once again, either way is acceptable, but you will see many online dividend yield readings displayed using a forward dividend yield.

How Big Does The Dividend Yield Need To Be?

It’s hard to say what an overall dividend yield should be before its worth your time to invest in the company. For example, if you’re interested in investing in companies that will grow their dividends double digits every year, then you will most likely be investing in companies with smaller starting yields – like .5% – 1.5%. However, just because a company has a small dividend does not mean it will grow quickly.

On the other hand, if you’re interested in investing in companies that will pay above the S&P average yield (currently 1.92%), and will raise dividends modestly (3% – 9%) each year, then you are most likely looking at companies currently yielding 2.5% – 4%.

Using Dividend Yield Theory To Determine Value

The dividend yield theory is an easy technique for defining a stock value based on the companies dividend yield. For companies with long track records of dividend payments (10+ years), a solid yield trading range can be identified.

With historic data on your side, it is simple to determine a whether a company’s current dividend yield is overvalued, undervalued or average based on its typical dividend yield range. The theory assumes that as long as no dramatic business changing events happen, these big solid companies’ dividend yield, will overtime fall back to their average yield inside the range. And as long as yearly dividends continue to grow, then you will also see capital appreciation.

Dividend Yields Are Too Important To Ignore

As you can see, dividend yield is a great equation for assessing how much a company is going to distribute in cash. Don’t just assume that a high annual dividend payout is automatically the best option. Sure, there might be stocks paying out 10-18% yields to their shareholders, but this is likely an unsustainable (and inefficient) investment for a dividend portfolio focused on long-term growth.

Rather than falling prey to hype surrounding a stock’s astronomical dividend yields, be sure to research why the stock’s dividend yield might be so high first. The dividend yield formula is only a first of many equations you should use to uncover whether the stock is truly as valuable as it may seem.

2 Comments

These days I usually target new companies – startups that have had recent IPOs and read all their past financial reports to see what I can expect. Of course, like you said, they start low at 1.5% yield but it’s a longterm game. Snap Inc. is one that I would give an example of, but lately it has been giving me the upsets…

Hi Jake,

For me, since SNAP pays no dividend, it wouldn’t be a stock I would invest in. But, established companies that are just a few years into their dividends policy are fantastic! They start minor, but they grow quickly!