In my Interactive Brokers review, I share my real experience with applying for the account, depositing cash, making trades and my initial opinions of my new broker.

In my Interactive Brokers review, I share my real experience with applying for the account, depositing cash, making trades and my initial opinions of my new broker.

Interactive Brokers

My new broker for my taxable account is Interactive Brokers (IB), and I’m very excited to have an account with them. If you haven’t heard of them before, IB is one of the top rated brokers for professional traders. We’ve all seen their commercials on CNBC… I personally like this one.

Commissions

First, let’s talk about the stuff that we actually care about, commissions. Simply, Interactive Brokers trading COMMISSIONS ARE SUPER CHEAP. That deserves to be in all caps because they really are SUPER CHEAP! You aren’t going to find a more reasonably priced broker.

For people of my ilk (not trading thousands of shares at a time), we’ll be paying $1.00 per trade (their minimum commission). I’ll muse more about the benefits of a $1.00 trade a little bit later.

For me, low fees are the key to a happy relationship with my broker. How many times have you thought to yourself, I’d like to buy [whatever DGI stock you’ve been watching], but you didn’t have a lot of money in your account or you thought there might be some news coming out would bring the price lower and you didn’t buy (or take a small position) because you couldn’t justify the trading costs? That is no longer a concern with Interactive Brokers! You can make small purchases worry free. I made my first trade with them last week and bought 2 shares of 3M (MMM) . It cost me one buck. That’s a large coffee from McDonalds (MCD). In my opinion, making a small to reasonably sized trade shouldn’t cost more than coffee. And if you’re paying more, than you’re paying too much!

Here is How They Getcha

So everything sounds great so far right? Well, here is the kick in the pants. Interactive Brokers charges a $10.00 monthly maintenance fee to their customers with less than $100,000 in their account. I agree, that sucks. However, your monthly trading costs are deducted from that $10 fee. So, if you make three trades (that each cost $1) then your monthly maintenance fee will only be $7 for that month. They also automatically waive the first three months of maintenance fees while your getting setup.

Maintenance Fees Stink, But…

I’m a Costco and Amazon Prime member. I have studied the values that I receive by paying a yearly charge to purchase things at discount and know the deals can be considerable. With Costco I can purchase items at a discounted rate in a retail environment, get free food samples, and go home with products immediately. This benefit costs me $50 a year.

Amazon Prime offers a less immersive shopping experience but allows me to purchase items online and get items delivered to my house, often for free and sometimes on the same day (pretty darn cool)! It also gives me more TV than I need to watch. Amazon Prime costs me $100 a year.

I say all that to make it clear, I don’t mind retailers offsetting lower margins with membership fees. That’s pretty much what Interactive Brokers is doing. I pay membership fees to Costco and Amazon, so I can’t baulk about Interactive Brokers $10 monthly account maintenance fee.

Kinda High Account Minimums

UPDATE: IB no longer has an account minimum. You can have an account with $0 if you choose. However, the monthly activity fees are still applicable.

Being that IB’s target audience is the professional trader, they don’t cater much to the smaller investor. One of the ways they keep the riff raff out (people like me who aren’t making several trades every day) is they set their minimums high. They require you have $10,000 in your account. Compared to most other brokerages, this is 10,000 times more than the rest.

One thing worth mentioning: I wasn’t given a timeline to get my account to their required minimum. In fact, I transferred only $1,000 into the account to make a few test trades. So they might give you a month or two to get your account up to their minimum. I called to ask them this question, but never got through to a person. At this point, however, I have met the account minimum. Oh, and if you are under 25 years old their account minimum drops to $3,000.00.

Super Security

IB doesn’t mess around with security. They now require double authentication before they’ll even allow you to make any ACH money deposit. So, you must use an app on your phone (Android or Apple) or get a device mailed to you before you can deposit money into your account via ACH. The process is simple, you go through the install on your phone and login to your account on your phone app. This links your new super security code generator phone app with your account. Once you take an ac tion on their website that requires you to prove who you are (login to your account, deposit/withdraw money) they give you a series of numbers that you then type into your phone. The app on your phone generates a new number that you then type back into the form online. Challenge/Response is a great extra security method to prevent people from logging into your account and either making trades or stealing your money by transferring your cash into another account. And it kinda makes you feel like a spy 🙂

tion on their website that requires you to prove who you are (login to your account, deposit/withdraw money) they give you a series of numbers that you then type into your phone. The app on your phone generates a new number that you then type back into the form online. Challenge/Response is a great extra security method to prevent people from logging into your account and either making trades or stealing your money by transferring your cash into another account. And it kinda makes you feel like a spy 🙂

Trading Platform

Frankly, IB is not nearly as user friendly as Tradeking, Schwab, TD or Scottrade. To be fair though, this site is built for the “professional trader” where all those images and pretty formatting cause things to be less efficient and slower. I haven’t had any problem figuring out how to buy/sell or add money to the account. Here is a screenshot of Interactive Brokers web trading platform.

Frankly, IB is not nearly as user friendly as Tradeking, Schwab, TD or Scottrade. To be fair though, this site is built for the “professional trader” where all those images and pretty formatting cause things to be less efficient and slower. I haven’t had any problem figuring out how to buy/sell or add money to the account. Here is a screenshot of Interactive Brokers web trading platform.

As you can see, there isn’t a lot of fluff to the interface. They also have a downloadable trading platform for your computer and phone. At this point, I’ve only placed trades with their web trading system.

Yikes, Customer Service

My experience so far with Interactive Brokers Customer Service has been pretty poor. I’ve tried to call them two times now and have hung up after waiting for over 12 minutes listening to hold music. I believe they would be much better served by airing a few less TV commercials on CNBC (even if they are funny) and hiring some more customer service representatives. But, since I can do pretty much anything I need to on their website without having to speak with a customer service rep, this experience didn’t keep me from opening an account. If I ever have cause to call them again and actually get to speak with someone, I’ll provide an update of my experience.

Some Other Stuff

UPDATE: You now get one ACH withdrawal free every month! That’s much better!

They charge $1.00 for an ACH withdrawal. This kind of bothers me as it costs them nothing to transfer cash back into my bank account. However, since it will be a minimum of 10 years till I’ll need to withdraw money from the account I’ll let this one go.

And while we’re on the topic of ACH transfers, Interactive Brokers has a four day holding period before the money is deposited to the IB account. Once again, not a big deal, just something to keep in mind.

Since I opened a taxable account this didn’t apply to me but might be relevant for you. For IRA accounts, they charge a $7.50 quarterly fee. This fee would be added to their $10 account maintenance fee. I don’t know if I would choose IB to house a brand new and blossoming IRA account.

The Power of $1 $0.33 Trades – a Dividend Growth Investors Dream

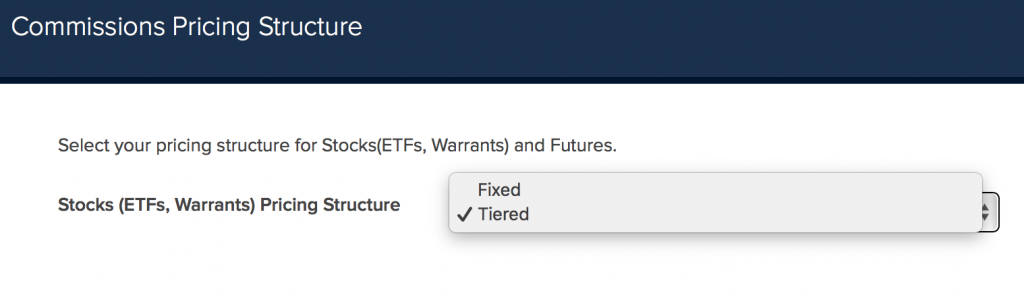

UDPATE: A little while after I wrote this, I realized that the IB tiered commissions pricing structure was by far the best for smaller investors. With the tiered commission pricing structure you pay a measly $0.33 a trade! So, everything below is actually two thirds better!

As I mentioned above, the power of $1 $0.33 trades is truly liberating. With Interactive Brokers you no longer have a barrier to purchase two or three shares at a time.

Since I’m not buying thousands of shares in one trade, trading costs actually matter to me. For example, if I want to buy $500 in stocks, it costs $5 or $9 (with TradeKing or Schwab). This means you’re already down 1% or 1.8% in just trading costs. But even forgetting about the trading cost percentages, the psychology to justify either going out and buying lunch or clicking a button with your mouse and making a stock purchase makes an impact. In my case, Interactive Brokers has greatly reduced my cognitive dissonance of making trades.

With $1 trades (and making those trades in real-time, as opposed to Loyal3 where you get “free trades” but your final buy price is one of the higher daily prices) you have the benefit to dollar cost average to the nth degree.

For example, I no longer have to limit my purchases of what I perceive are the two best values for the month, I can now buy the 10 best values for that month. I no longer have to only make 2 or 3 sizable trades a month, I can make ten or fifteen smaller trades and really diversify. It costs me no more.

This adds rocket fuel to my portfolio diversification and allows me to buy many companies in smaller quantities to mitigate my risk and add super diversification to my portfolio. To further quantify this, I can now buy one single share of 3M (MMM) at a current price of $150 and my trading cost is only $1 – that’s (0.66%). Many in the DGI world like to keep their trading costs below .5%. With Interactive Brokers, you only have to buy $200 worth of stocks to meet that requirement, not $1,000 or $2,000.

Summary

So, there you have it, that’s pretty much my thoughts and experiences with Interactive Brokers so far. I hope you found my Interactive Brokers review useful. If you are a dividend growth investor and can round up $10,000, than I highly encourage you to take a look at Interactive Brokers for your taxable account.

How many separate stock buys do you typically make a month? Do you have a per purchase trading cost maximum?

8 Comments

Nice review Blake!

I used IB a while back for day trading futures and I was very satisfied with the service / platform. I plan on opening my next account at IB once my TradeKing account crosses the $25k threshold (which will allow me to sell naked puts).

Ken

Thanks Ken!

This is my first account with them and I really like it. The only problem is; I’m having a hard time keeping myself from buying small stakes in LOTS of companies. Its so easy and cheap to buy. So far, all of my orders have been filled pretty darn quickly… and they’ve all only cost a buck! I couldn’t stop myself from buying a little oil today.

I love the idea of selling naked puts to get into a stock… I just don’t like the idea of buying in 100 share lots!

Good to hear from you!

Hi Blake! I’m seriously considering making the switch to IB so I decided to come back and read your review again. Very useful, thank you. Are you still happy with them?

One thing I noticed regarding the ACH transfers – they allow one free withdrawal per month. After the first withdrawal they will charge $1 for ACH, $4 for check and $10 for wire. This might be something they changed after you wrote this article so I just wanted to give you a heads up.

Thanks again!

Ken

Hi Ken,

Thank you for the kind words!

Definitely open an account with IB. So far everything has been great! I appreciate the update on the ACH payments… that must be a new change – maybe they read my article 🙂

Also, Interactive Brokers does offer a DRIP program now. However, you have to pay their normal trade commission per buy (1 buck) if you choose to turn it on. I don’t DRIP anything with them.

I’m sure you’ll have a great experience. Interactive Brokers low trading fees will allow you to do a lot more smaller trades (should you choose). Let me know how it goes!

Blake

I heard IB does not offer reinvesting dividends. Basically they give you the cash but you have to rebuy the stock manually yourself. Is this true?

Also do they allow fractional shares to be bought?

Hi Youngdiv,

Great question about dividend reinvesting, I should have mentioned that above. You heard correct, IB does NOT offer a DRIP service. It will cost you a buck to reinvest the dividends if you choose, and you would have would have to do it manually. With IB you are better off accumulating money in the account and making a purposeful buy. As for fractional shares, I don’t know… I’ve never tried to buy .2 or .5 shares before. I’ll give it a shot on my next buy and update the post.

Thank you for commenting!

What if I want to buy 6000 shares of a penny stock using Interactive brokers, the cost as I understand it would be 0.005 per share which equals $30. I thought IB was for the big players?

Hi Graeme,

$30 bucks sounds high. Here is a link to Interactive Brokers fees in the USA. It obviously varies in different parts of the world but they do have a maximum % fee per order that sounds like it would apply in this case. Their example might be helpful.

Let us know what you find out!