When it comes to growing wealth with your investment portfolio, consistency is key. That’s where dollar cost averaging really shines! Whether you prefer investing in dividend stocks or taking a multi-faceted approach to your portfolio, committing to regular contributions to your investment account is one of the most important factors to a successful investment strategy.

For these reasons, one of the easiest ways you can grow your portfolio is through something called dollar cost averaging. It sounds more complex than it actually is, and the benefits of dollar cost averaging are remarkable, especially for newer investors. If you want in on this simple, yet highly effective investment approach, then here’s everything you need to know to get started:

What is Dollar Cost Averaging?

Dollar cost averaging (also referred to as DCA) allows investors to buy the same dollar amount of a stock, bond, mutual fund, ETF or other investment at regular intervals set by the investor. The asset price is less of a concern with DCA than the regularity of the investment account contributions themselves. This is a popular strategy for saving for retirement with a 401(k) or IRA, but that doesn’t mean it’s limited just to retirement accounts.

Dollar cost averaging is popular among newer investors and those who don’t have much available income to dedicate to investing but they still want to get involved anyway. Thanks to DCA, you don’t need thousands of dollars saved up in order to open an investment account and start growing your portfolio on a regular basis – you can simply contribute whatever you can afford as your income level rises.

How Does Dollar Cost Averaging Work?

The main purpose of dollar cost averaging is to accumulate a sizeable savings and generate wealth over the long run. A common misconception prevalent among newer and would-be investors is that you need at least $5,000-10,000 upfront to open an investment account. On the contrary, many investment and retirement accounts managed by robo-advisors and other online platforms have tiny or even no minimum deposit requirements, which means you can literally open an account today and start investing when your next paycheck comes in.

The most important thing to remember when it comes to dollar cost averaging is that you stay consistent. So if you’re paid twice per month and have about $300 total to allocate to investments, then a dollar cost averaging strategy dictates that you should set up biweekly auto-deposits to your investment portfolio ($150 per pay period).

Dollar Cost Averaging Benefits

You’re probably already recognizing some of the best benefits of dollar cost averaging:

- Minimal barriers to getting started in investing

- Freedom to invest as little or as much as you want/are able to (as long as you’re consistent with recurring deposits)

- Greater access to the lucrative world of investing for low-income workers or students

- Neutralize temporary volatility in the markets for long-term gains

- Get in the habit of saving regularly (especially for retirement)

Dollar Cost Averaging Formula

To determine how successful your dollar cost averaging investment strategy is, you’ll want to use the harmonic mean formula to calculate the price-per-share over time. This formula sounds complicated, but in simple English, it’s the number of time periods (e.g., weeks or months) divided by the various prices-per-share you paid each time you made a contribution to your investment account.

Dollar Cost Averaging Calculator – Example

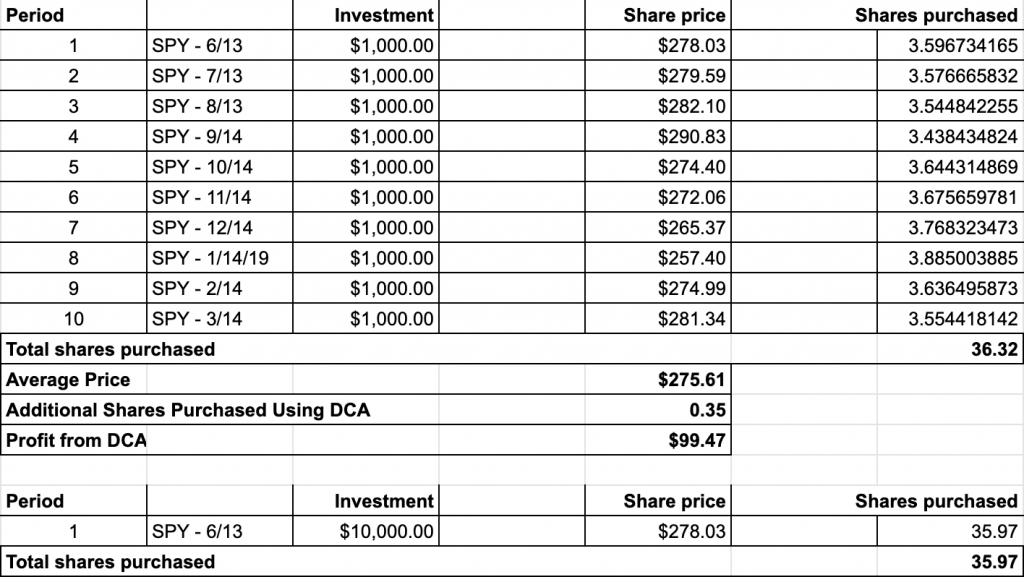

To clarify with the example above. Imagine you had $10,000 (or $1,000 per month for 10 months – large sums are not required, it’s just easier math) to put into your investment account. After 10 months of investing $1,000 in the SPY ETF that initially traded at $278.03, what would the price-per-share over a 10 month period if you used DCA? Here’s how we would break down this hypothetical scenario using real world numbers:

- Month 1: Trading at $278.03/share (you buy 3.59 shares that month)

- Month 2: Trading at $279.59/share (you buy 3.57 shares that month)

- Month 3: Trading at $282.10/share (you buy 3.54 shares that month)

- Month 4: Trading at $290.83/share (you buy 3.43 shares that month)

- Month 5: Trading at $274.40/share (you buy 3.64 shares that month)

- Month 6: Trading at $272.06/share (you buy 3.67 shares that month)

- Month 7: Trading at $265.37/share (you buy 3.76 shares that month)

- Month 8: Trading at $257.4/share (you buy 3.88 shares that month)

- Month 9: Trading at $274.99/share (you buy 3.63 shares that month)

- Month 10: Trading at $281.34/share (you buy 3.55 shares that month)

In this example – at the end of ten months, you now own about 36.32 shares of the SPY ETF and you would calculate the actual price-per-share as such:

$10,000 spent / 36.32 shares = 275.61 average price

DCA compared to a lump sum buy of $SPY ETF on 6/13/18 would net you .35 additional shares and a value increase of $99.47. It all adds up!

Here is a link to the dollar cost averaging calculator spreadsheet pictured above to create this example.

Is Dollar Cost Averaging Ideal for Your Portfolio?

If you have an irregular income or high-interest debts you’re working hard to pay off, then dollar cost averaging might not be ideal for your current situation. However, anyone with a regular income who lives below their means (i.e., has even $10/month available to invest – check out my Stockpile review) should consider adopting a dollar cost averaging strategy when they’re first starting out – at least until you learn enough about the different types of investments and the risks they carry enough to make informed decisions about optimizing your investments for maximal gains.

4 Comments

It works I’m a testament to that small amounts generally throughout the year and generally 1 or 2 bigger purchases of $500 plus and I have a nice portfolio. The cheaper the trading platform the better. Right now mine is free so I take advantage of that to the max. I do pay some fee for selling but it’s been 3 cents so far. Great article.

Thanks Doug! Sounds like you’ve got it down! It’s a lot easier to say time in the market, then it is to actually make that happen. Systematic buying is very important. Keep up the great work and great to hear from you!

Thanks for your transparency , motivation and tips! I’ve just started my countdown and decided to go he dividend growth route. I look forward to seeing your April purchases ! .. but wish I could what you’re considering before April is over. Considering some stocks now but of course it is tough to find value so I’m hesitant and always researching.

I look forward to following your journey. All of the best and thanks so much

Hi Sunny, i’ve been traveling and haven’t had access to my accounts. I normally post my buys the first week of the month and keep it updated daily. I’ll get back to that next week 🙂