Even though the market continues to drop (and take my net worth with it) I find great comfort in these types of reports. Dividend growth investing is still doing its job well with a nice new monthly dividend income record.

April Dividend Income

This month I received $1,543.65 in dividend income! On average, I was paid $28.07 from 55 different companies! This month’s dividend income is a good 22.39% increase over April 2021. That’s $282.37 more dividend income than last April.

Dividend Income - April 2022

Here is a chart of my passive dividend income progress over the last 5 years.

The dividend portfolio has been updated.

Here are the dividend stock purchases I’ve made between April 2021 and 2022 that helped fuel this month’s dividend income growth.

April’s dividend income covers my food, utilities and insurance for the month.

April Dividend Growth (Dividend Increases)

Below are the realized dividend increases I received this April. Dividend growth is an incredibly important metric and one of my favorite to report!

This April I received 11 dividend increases. Unfortunately, none of these dividend increases were over 10% 🙁

Dividend Increases - April 2022

April’s dividend increase adds $82.62 in annual dividend income! April’s dividend increases are the equivalent of investing an extra $2,360.57 of new money at 3.5% yield! Not too shabby.

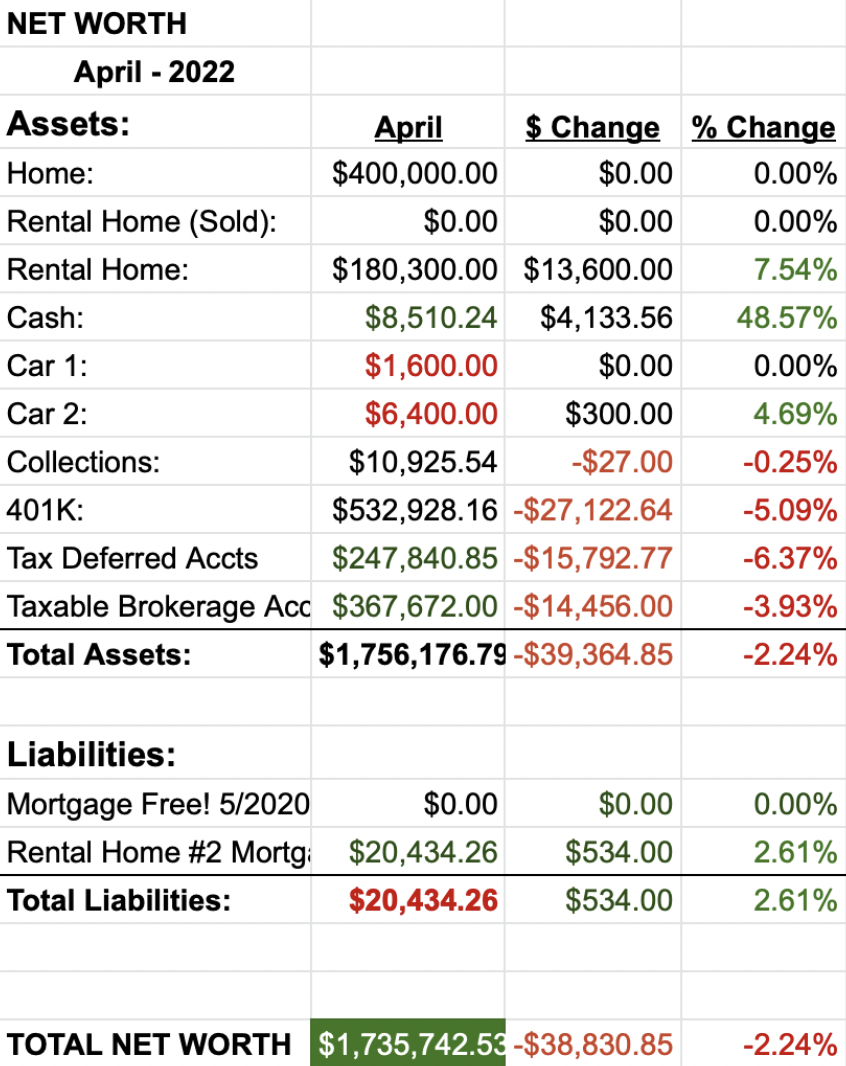

Net Worth

Net worth resumed its downward trend!

Let’s do the numbers…

Cash

After I cast and read the bones, I started saving a little cash just in case there was a greater market downturn. (writing this in May, all that cash is gone again).

Real Estate

For April, our electricity bill dropped to $144.67 for the month and our gas bill went to $38! That totals to $182. April was really nice weather wise, May’s bill will be much more expensive.

While we didn’t do any home improvement work this month, we have started looking into battery backup solutions. Our electricity goes out enough that investing a couple thousand dollars to keep most things running during a blackout might be worth the extra comfort. So far, most solutions are super expensive. Ecoflow’s Delta Pro might be the solution.

Nothing new on the rental. Rent came in on time, and no service calls. The new 2 year lease we signed for a 15% increase starts in 1 month.

Wrap-up

April’s dividend income and dividend growth were great this month. A +20% increase in dividend income is always good news. Net worth is obviously following the markets, however, not in lockstep.

The dividend portfolio has been holding up well so far this year during the downturn. Before new money added, the dividend portfolio total value is down just a little over 10% so far this year. With new cash added and dividends, the portfolio is (only) down 6%. Sucks being down, but all in all… not bad!

I will continue to save as much as possible and put that money to work as quick as I can. Keep investing!

Comments are closed.