Not every dividend income and net worth report will be a doozy. This happens to be one of those slow months with regards to dividend income. However, it certainly wasn’t slow with cash expenditures. Oh boy!

Dividend Income

Even though this month wasn’t a huge rake, its still a milestone. I believe I can accuratly say, “this month will be the least amount of dividend income I will ever make again”. How cool is that? I think that’s a nice way of looking at unremarkable results. (Not sure that is 100% true with the POT dividend cut)

Let’s get to it.

This month I received $119.33 in dividend income. On average, I was paid $10.84 from 11 companies (specifically 10 companies and 1 fund). That’s a good amount of side jobs! This month’s dividend income is a 26.22% increase over July 2015.

July - 2016 Dividend Income

Here is a chart of my dividend income progress over the last 2 years.

The dividend portfolio has been updated.

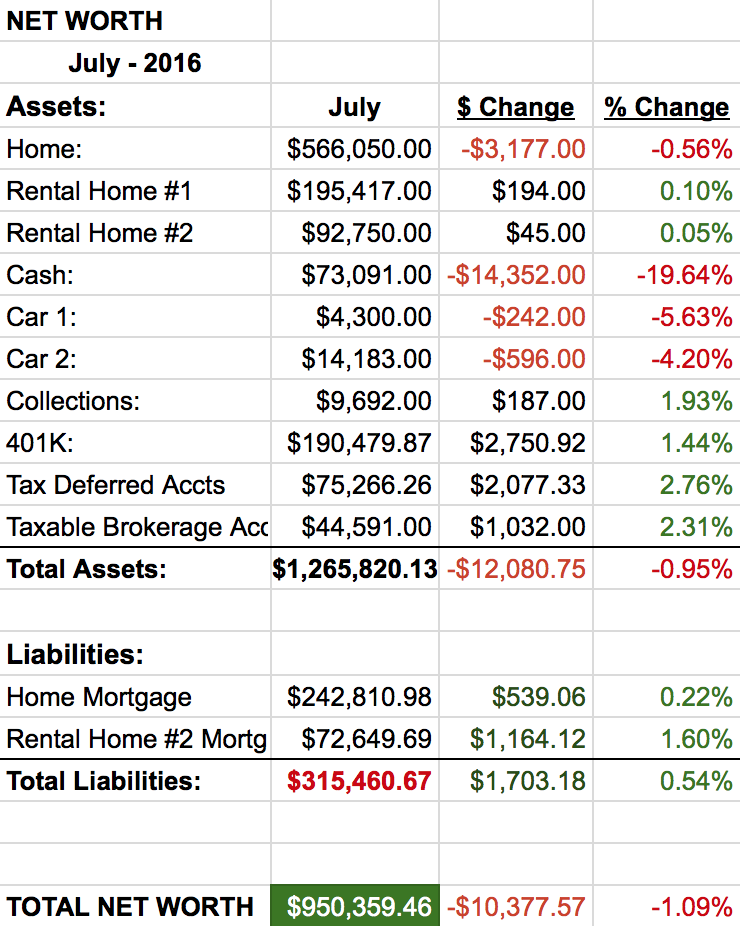

Net Worth

The real estate market in my area seems to have finally leveled out, which makes the home prices a little easier to believe.

Let’s do the numbers…

Cash

So, you wanna know what it’s like to have almost $10,000 of SURPRISE expenses? Well, it’s not pleasant. We had doctor bills, trees that needed to be cut down, school bills, plumbing bills, dental bills and more doctor bills. It was a crazy month of bills for which we hadn’t budgeted.

Fortunately, we have the cash to cover all those bills (in addition to an emergency fund) and didn’t have to make any hard decisions on what not to do. We are still working on the home improvement projects and cash will continue to dwindle.

Real Estate

Something new here, a down month? That’s a good sign that maybe Zillow isn’t as broken as I thought. To remind you, my primary home has gained $82,000 in value in the last few months (according to Zillow). Needless to say, it’s been a little suspicious.

The rental properties have been a headache this month. Both units had problems again. One with the HVAC (that we just replaced 2 years ago) and another with some more plumbing problems. It’s cost us a little over $200 in repair costs and a heap of time.

Cars

Our cars took a little larger hit than normal. We estimate cars should decline in value by 1 – 2% in value every month.

Wrap-up

Even with a somewhat ho hum month, dividend income is still growing at a nice clip. It’s important, and I have to remind myself often, dividend growth investing is a long term strategy. The best way I’ve found to combat the need for instant results is by tracking progress. That way, when I don’t see impressive numbers, or feel like anything is happening (which was the case this month), I can just look back and remember how far I’ve come.

Having my net worth drop a little over 1% in a month is a little disappointing. However, there isn’t much I can do about it and I suspect I’ll have significantly worse declines in the not to distant future. I just need to keep my head down and keep chugging along Everything is going according to plan!

How did you do this month? Did you find you dividend income was also lower than you hoped?

8 Comments

Solid month on the income front. Knowing that things will only continue to improve is a GREAT feeling.

Quick question – I’ve just started tracking and posting my investment income on my blog. I notice that although you post your dividends received, you don’t list your rental income. Am I missing it, or was that done for a reason?

Hi Money Commando,

You didn’t miss anything, I haven’t posted rental income. I’ve never thought that I should as it would skew the numbers quite a bit. If I just listed the rent received, it would be really off. If I went through all the costs, property tax, HOA, repairs, electricity… it would be much more accurate, but it would be a pain to report. All the rental income goes directly into paying the mortgages down. At the moment, I net roughly $800 a month off the rentals.

Thanks for the comment and stopping by!

With that intro, I thought you made $5 dollars in dividends. Pulling in over $100 and proclaiming that it’s the lowest month you’ll ever see. Nice work!

Ha! You’re right! This was by no means a terrible month, just a lot less than the previous. Perhaps the opening was a little too dramatic? 🙂

As always, thank you for stopping by!

$100+ in dividend income is nothing to sneeze at for sure. I’ve not quite gotten that much in a month, but it’s important to start somewhere I suppose. We share KO as a holding. I like its payout.

Agreed. It’s 119 bucks I didn’t have before the month. KO is great holding. They should be a steady, growing dividend payer for years to come!

Thanks for stopping in and saying hi!

I have to re-align my stock portfolio to be more dividend minded. It’s tough to find good value in this market however! Do you ever think of selling stocks you own which have a good return on your original cost?

My July was at $42.70.

Congrats on the nice July!

No, I wouldn’t sell any of the winners. My goal is to build dividend income, so selling holdings that are paying several hundred bucks a month without a better plan for the money would be going the wrong direction.