Sadly, its finally arrived. My first drop in my monthly net worth report. I knew I would see red in the net worth department, I just didn’t think it would happen this quickly! But, let’s not dwell on the negative, we should start with some good news!

Sadly, its finally arrived. My first drop in my monthly net worth report. I knew I would see red in the net worth department, I just didn’t think it would happen this quickly! But, let’s not dwell on the negative, we should start with some good news!

Dividend Income

August’s dividend income was great! I’m happy to report that even the “less common” dividend months are starting to pay, well… dividends! I received $105.61 in dividend income this month. HECK YEAH! My new monthly payer Realty Income (O) has been a big help. The extra $12.40 I received this month put me over the $100 threshold.

On another happy note, I anticipate my last sub $100 dividend income month will be this October! I just need to keep putting money to work and I’ll never report under 100 bucks in monthly dividend income again!

Below is a list of the company and the dividend amount received this month.

[table id=2 /]

All of the dividend income received this month has been reinvested back into additional shares.

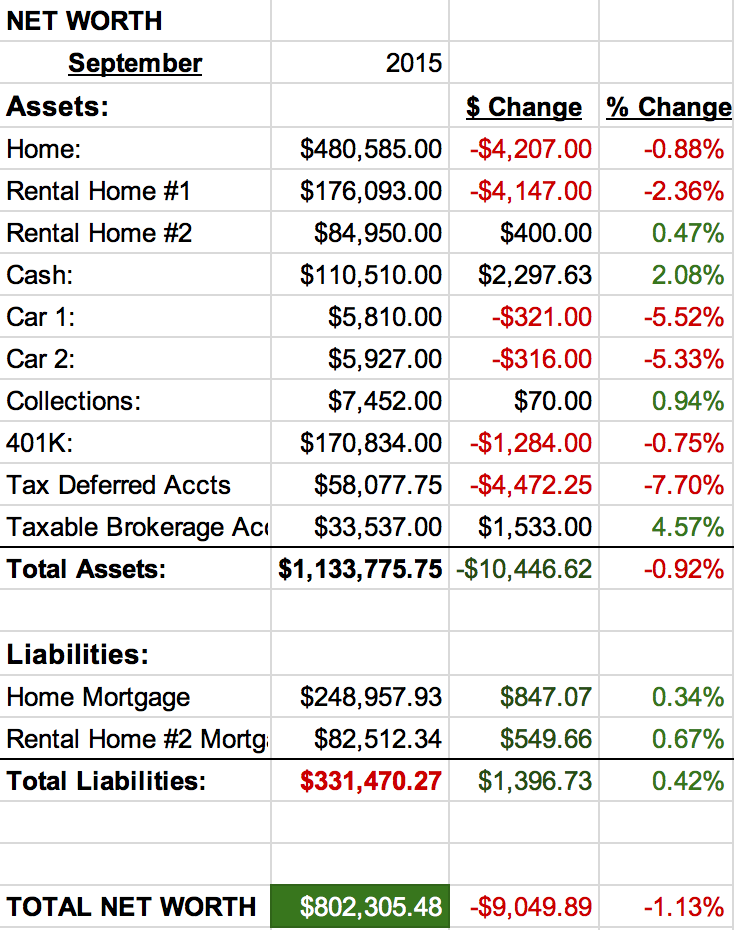

Net Worth

Here is the not so good news, I’m not worth as much as I was last month. I had a feeling it was coming. Unfortunately, I bet this is only the start of a few more red months in the net worth report. I now have over $250,000 invested in the stock market. As the market moves up and down, it will now be much more impactful on my net worth.

Let’s start with cash. I still have quite a few home improvement projects that must be completed on the house. These projects could very well cost $30,000 – $50,000! Naturally, I’ve been putting them off as long as possible as I don’t want to hear the bad news.

My primary home dropped over $4,000.00 this month according to Zillow. However, according to my county, the house is valued at over $560,000 (which would be +80k). Obviously the county is extremely happy to tax me on that value. The more I look at this the more I realize I won’t have a truly accurate value of the house until I sell it. Unfortunately, paying extra every month on this mortgage is about to get harder. With our new tax bill from the county, the new required payment is going to go up $200 a month. It’s insane. My tax appeal hasn’t gone anywhere yet.

The rental properties are going strong. I’m now trying to workout if I should raise the rent on property #1. After looking at it over the last few months, I think and extra $100 a month would make me much happier with holding this rental. At the moment, the return on this property is terrible. Rental property #2 has an ARM that readjusted this month. The rate went from 2.85% to 3.125%. However, since I’ve been making extra payments, the monthly required payment actually went down a couple of bucks. I think I’ll work harder to get this rental paid off quicker.

The cars are once again a drag. This month was especially bad with values dropping over 5% each. Actually, I suspect the value on my car is even less now as I was in an accident this month (the other guy’s fault). Fortunately, no one was hurt but it’s going to cost over $2,000 to have my car repaired!

As you can see, I still have a LONG way to go before I can retire. This is not a quick process. I need to keep my nose to the grindstone, continue saving and investing more into dividend growth stocks as values come up. I’ll get there. Thanks for reading!

Here is a link to the updated dividend portfolio

How did you do this month? Did the market dip greatly affect your net worth as well?

Comments are closed.