I have encountered a first for me this month, and it’s not one of those good firsts. This is the first time my monthly dividend income has declined YOY. However, net worth is still growing solidly and I’m making big strides at reducing my living expenses.

April Dividend Income

Monthly dividend income declined. It’s not something that should happen often, but on rare occasions it obviously can occur. It can come from surprise dividend cuts or random huge special dividends from the past. This month I can blame my dividend decline on BEN.

April 2018 was a great month for dividend income. The month showed solid growth but it also had a cherry on top – a special cash dividend from Franklin Resources ($BEN). Now, this wasn’t a normal special dividend it was $3 bucks per share special dividend, which is obviously HUGE! That special dividend added almost $175 to my monthly total. This month’s decline stemmed from not having that extra $175 bucks. Frankly, this isn’t something I’m worried about as it’s was a one time gift that skewed the numbers.

Enough of the excuses, let’s get to it.

This month I received $757.18 in dividend income! On average, I was paid $24.43 from 31 different companies!! This month’s dividend income is a unfortunate 5.2% DECREASE over April 2108.

To put things in dollar figures, that’s $41.57 LESS dividend income than last April! This is my first, and hopefully last, monthly dividend decrease.

Dividend Income - April 2019

Here is a chart of my passive dividend income progress over the last 4 years.

The dividend portfolio has been updated.

April’s dividend income covers my groceries, cell phone and insurance for the month.

April Dividend Growth (Dividend Increases)

Here are the realized dividend increases I received this month.

This month I received 5 increases. All of the dividend increases were less that 10%. $CSCO won the award for largest dividend increase with a 6% raise!

Dividend Increases - April 2019

March’s dividend increase adds $35.91 in annual dividend income. This is among the lowest dividend growth I’ve had since starting to track eight months ago. However, this is still the equivalent of investing $1,026.00 of new money this month at 3.5%. I’ll gladly take the equivalent of a free 1k invested!

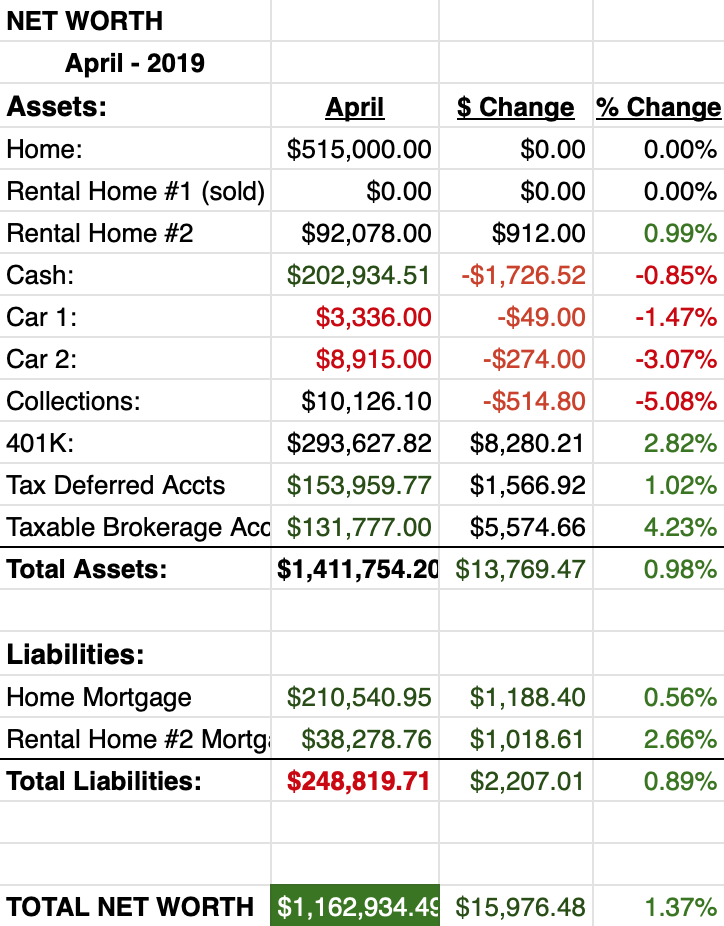

Net Worth

Net worth is continuing to grow as I pay off mortgages and invest in a rising stock market.

Cash

Another big cash decline this month. As we are now preparing our home for sale, we have found many things that need to be touched up and repaired around the house. Funny how that works. This month we had a chimney leak that came from the chimney pan that needed to be replaced. This plus some extra chimney stuff cost us roughly 3k!

Next month it’s going to be much worse. We have a painting crew coming in and freshening up our home. This will run us about 13k!!!! Apparently, houses are expensive to get ready to sell. We ended up putting in a similar proportion of money (to the value of the home) into our rental we sold and it worked out well. Hopefully that will be the case this time too!

Collections

This normally isn’t a section… but you may have noticed that my collections lost roughly 5% or their value. It turns out, my collection of older weapons wasn’t worth $2,000. I ended up selling them for $1,500 (as we are downsizing). I sold them in May so we’ll see the reduction of the the complete value in the next report. Kinda sad to see them go 😐

Real Estate

So, not a darn thing has happened with our new home. Since we are “building” a home, we can’t do anything until the city provides the permits to begin. For now we just sit and wait.

Our primary house that we’ll be selling requires some TLC to get it ready. We are repainting the complete interior walls, ceilings, cabinets and cleaning the carpets. We have a few minor tweaks to do – and some shelving to install as well as some random home customization to remove. But all in all, the hardest thing we have to do is downsize our stuff. That has been rough!

As far as the rental, our tenant is continuing to pay on time and has agreed to renew for another year. This starts in August and the tenant will now have to pay their own water bill!

Wrap-up

Dividend income this month wasn’t fantastic. However, even with a decline, which really wasn’t due from any dividend cuts, the dividend investing strategy is still working as it should. Dividend income continues to increase organically with yearly company dividend raises while I’m also adding roughly 2 -4k each month to the portfolio.

On a personal note, we lost our 16 year old dog this month. She was a wonderful dog and will be greatly missed. It’s been difficult couple of weeks but all the home stuff has been a great distraction from the loss.

I hope you all had a fantastic month! Keep putting that money to work!

8 Comments

Wow – Pig. That’s just freaking awesome. I wouldn’t even thing about the BEN special dividend. Just ignore it and focus on the regular, consistent dividend paying companies.

Bert

Thanks Bert! I’ve had plenty of special dividends in the past but this is the first time I haven’t been able to makeup the difference the next year. I guess it’s a good problem to have, but still I would have preferred to cover the difference. This month is messing up my dividend income chart 😉

DPIg –

Hey, you’re up excluding the “one time” impact, as Bert said. Also, your cash isn’t down that much, as it’s less than a 1% change. Do you spread your bank accounts or do you have just one main one?

-Lanny

Hi Lanny! Yeah, I have a couple bank accounts. Some old checking accounts, savings accounts… I put off moving them all over to my primary bank because of the auto pays associated with these random accounts. Lazy, I know. Cash will be down big time next report, UGH! Just paid a gigantic bill to the painter.

Interested in that ‘old weapons’ collection, any other link to more info on this?

No, not really any more info. This was a collection of Browning shotguns and rifles. One really old musket from the 1700s, but it was almost cracked in half at one point and was really only a mantle piece. Either way, sad to see them go 🙁

Those special dividends do throw things off sometimes but we wont count the loss against you LOL. you had a great month otherwise. Stinks when you have to let go of those collectables.

Ha, thanks Doug! I think that’s been the hard part, I’ve always had the space to keep most stuff. Downsizing is rough!