I can’t believe it’s time for another one of these reports. It’s really startling how quickly time has been moving now that things are getting (slightly) back to normal. Anyway, April was a great month with dividend income and net worth continuing its upward trend.

April Dividend Income

This month I received $1,261.28 in dividend income! On average, I was paid $26.28 from 48 different companies! This month’s dividend income is a fantastic 23.12% increase over April 2020.

That’s $236.85 more dividend income than last April! Thank you sir, may I have another!

Dividend Income - April 2021

Here is a chart of my passive dividend income progress over the last 5 years.

The dividend portfolio has been updated.

Here are the dividend stock purchases I’ve made between April 2020 and 2021 that have added to this dividend income growth.

April’s dividend income covers all my utilities, food and insurance for the month!

April Dividend Growth (Dividend Increases)

Here are the realized dividend increases I earned this April. Dividend growth is the best metric to report. This month we are seeing a decent uptick in dividend growth as compared to last April!

This April I received 11 dividend increases! Sadly zero of the dividend increases were over 10%. 🙁

Dividend Increases - April 2021

April’s dividend increase adds a good $52.65 in annual dividend income. These 11 dividend increases are the equivalent of investing an extra $1,504.29 of new money at 3.5% yield!

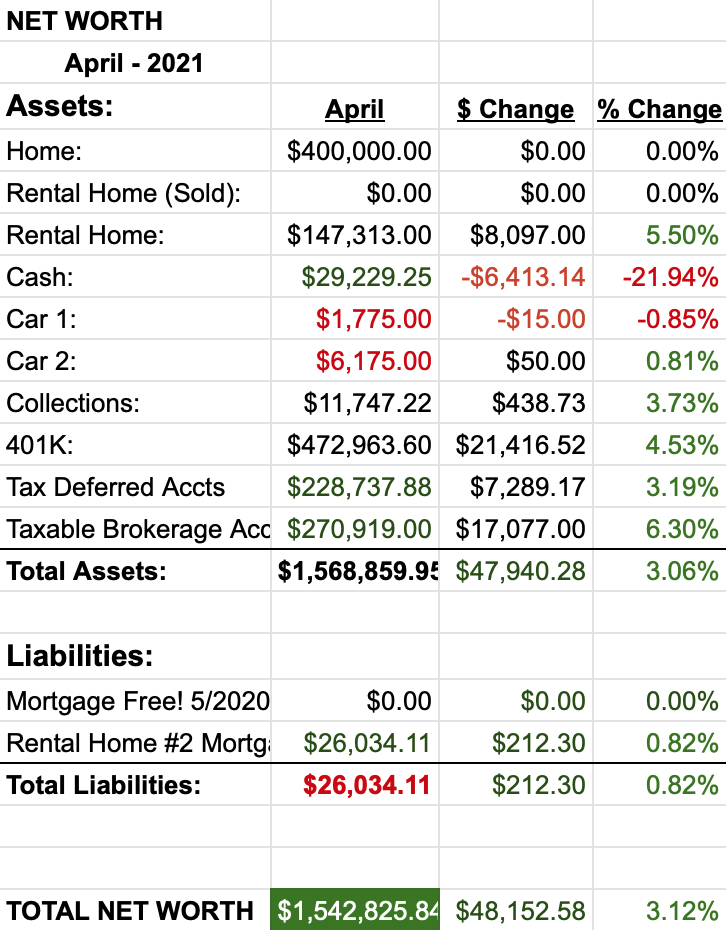

Net Worth

The market ballooned net worth again!

Let’s do the numbers…

Cash

So, we saw a HUGE cash decline this month. Fortunately, we have the cash (as we budgeted for this stuff) to spend on some necessary purchases. First, our little one got some braces… that was $5.5k gone really quickly. We did receive a 2% discount by paying for everything upfront, and I got some extra miles. The other large expense was our home insurance policy. I have considered dropping the insurance policy and saving the $1k, but I’m just not ready to roll the dice. For example, the day I renewed the policy, we had a tornado touch down not too far away from our house. I just don’t have the cajones to take on that financial risk and self insure.

Real Estate

Our new home and the cost savings it provides has been significant. For April, our electricity bill was $120 and our gas bill was $45. A total of roughly $165 – which was $35 less than March. I suspect this is about the lowest it will ever get. The April weather was pretty mild and things are about to get HOT here in Georgia.

Our rental is doing great and still receiving rent checks on time and no service calls!

Wrap-up

April’s dividend income was pretty good – another new monthly high! My dividend income is growing at decent rate and the market soaring upwards is taking my net worth into the stratosphere. However, I’m afraid my early retirement dreams might be delayed. While I still have 4 LONG years left to go to reach my goal (in the allotted 10 year period)… it may take closer to 5 years to actually get there. Ugh.

I’m not giving up hope on trying to retire in 4 years… but I am trying to manage my expectations of the current situation. The goal – to reach 40k/yr in dividend income prior to retirement from dividend stocks – is looking like it’s going to be a stretch. The market is trading at crazy highs which in turn pulls down yields of the companies I’d like to own. Combine that with a few of my larger holdings suspending their dividends just doesn’t help at all! I am testing the waters with higher yielding instruments, but I don’t think it’s a very good long-term solution. Anyway, I’ll get there, and it might even be in 4 years! We’ll just have to see what happens with the market and how aggressively I’m able to save and invest. Keep at it, I know I will!

2 Comments

Congrats on the huge Dividend payout. Interesting that your biggest payout is IRM, If i remember correct you were adding them last year.Good Luck.

Thanks DD! Yeah, $IRM took the podium this month with $GPC in second. I’ve been dripping $IRM so I actually pickup a couple of shares every quarter 😉