That went up fast… nothing like a tech sector steroid shot to reinvigorate the stock market. Unfortunately, my dividend income is languishing with dividend cuts, suspensions and significantly slowed dividend raises. On the other hand, net worth is soaring to new highs with big money flowing into the market.

August Dividend Income

This month I received $1,540.09 in dividend income! On average, I was paid $36.67 from 42 different companies! This month’s dividend income is a tiny 9.8% increase over August 2019.

That’s a decent $138.48 more dividend income than last August! Not bad, but it should be more!

Dividend Income - August 2020

Here is a chart of my passive dividend income progress over the last 5 years.

The dividend portfolio has been updated.

Here are the dividend stock purchases I’ve made between August 2019 and 2020 that have added to this dividend income growth.

August’s dividend income covers all my utilities and food and insurance for the month!

August Dividend Growth (Dividend Increases)

Here are the realized dividend increases I earned this August. Dividend growth is normally a really exciting metric to report, but this month, it’s a little bit underwhelming.

This August I received 2 dividend increases! Sadly, zero of the dividend increases were over 10%!

Dividend Increases - August 2020

August’s dividend increase adds a small $4.84 in annual dividend income. The two dividend increases are the equivalent of investing an extra $138.29 of new money at 3.5% yield! I’m happy to have any increase and free money is free money but, I need to do better!

August Dividend Cuts (Dividend Decreases)

Here goes another unfortunate month of dividend decreases. This makes the third straight month of dividend decreases.

Below are the realized dividend decreases I had this August.

Dividend Cuts - August 2020

This month I received 2 dividend decreases! This sums up to $21.75 of lost dividend income this period! That’s the equivalent of torching $483.14 instead of investing it at a 3.5% yield. Ugh! However, this is significantly better than the last few months!

The total net dividend decrease for August was ($16.91 [increase – decrease]).

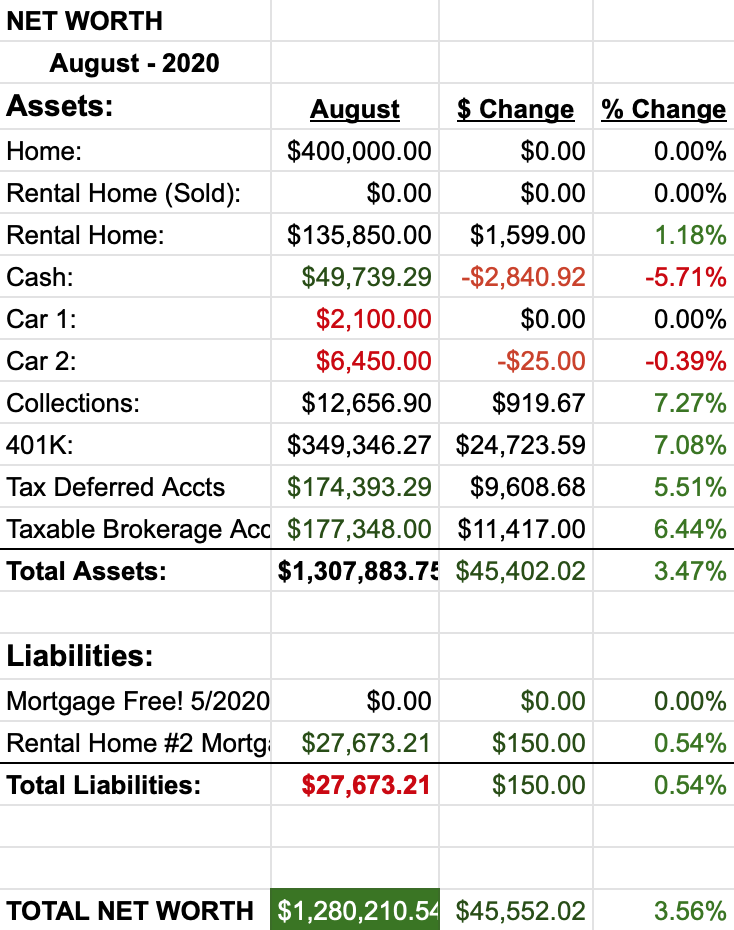

Net Worth

Net worth is flying to new heights on the back of the rising stock market.

Let’s do the numbers…

Cash

We finally made some purchases that we had been holding off on for the house. There was some home decoration, home workout and networking stuff that set us back a little over $2,500. We purchased our new home in March this year and had some final things to purchase to get the home “situated”.

Real Estate

Speaking of our new home, we still love it. It’s been a massive money saving move for us. Downsizing really did provide the freedom we were looking for. We had a 5k+ sqft home that was sucking up our time, energy and money. Our new half size home is incredible. It’s easy to maintain, clean, organize and keep cool (it’s hot in GA). Granted, the downsizing process SUCKS but the results truly were worth the effort.

Our tenant is still paying their rent and even paid a little extra this month. Our $50 a month rent increase went through (finally) this month when they signed their 2 year lease! YAY!

Wrap-up

Dividend cuts are miserable and dividend raises have been slower than normal the last few months. In August 2019, I had 8 individual raises for a total or almost 70 bucks – this month only 2 raises. Dividend increases are a very important part of my retirement plan and the corona virus has truly gutted dividend growth. While my dividend income is up YOY (better be with all the new capital added over the last year) I apparently need to be a bit more selective with the companies that I add to the portfolio… you never know when a global pandemic will hit and the world stops turning.

I’ll continue to stay the course and keep putting money to work every month and I hope you do too!

4 Comments

I think your Dividend Cuts table need a second look. First I think the “New Div” and “Old Div” columns are reversed since the new dividends are higher than the old dividends (which is not a cut/decrease). Second, taking CBRL as an example, if the dividend went from $1.30 to $0.00, that is a 100% decrease not a 1.3% decrease. Likewise WRK should be about a 42% decrease.

Name Ticker New Div Old Div % Decrease Shares Lost Income

Westrock Co WRK 0.47 0.20 -0.27 33 -8.75

Cracker Barrel CBRL 1.30 0.00 -1.30 10 -13.00

∑ = -21.75

Thanks for your blog, I follow it every month and am basically seeing the same effects that you are. I had set a dividend goal to reach this year and I got up to just shy of reaching it when the bottom dropped out of the market. Then COVID-19 hit. Stock prices have recovered in some cases, not in others, but the dividend cuts and suspension have really hurt. The remaining income is still very nice to see though!

Hi Ernest, thank you for the heads-up! It’s been corrected. I mistakenly formatted and titled the column and switched the titles of the old and new column. The 5th column was just the difference between the previous (what was normal) dividend and the current (cut or suspended) dividend.

I’m hoping we’ll see dividends reinstated a quarter or two after vaccines become available – so middle of next year? Fingers-crossed!

DP –

Congrats on today’s TXN dividend increase of 13%+! HUGE!

-Lanny

Thanks Lanny! Agreed, $0.12 is massive!