We did it! We made it through 2018 pretty much unscathed. While net worth took a huge hit this month, dividend income finished out the year strong. It’s hard to end a year with only negatives, so I’ve also compiled some highlights of 2018 year end successes as well.

December Dividend Income

This month I received $1,734.60 in dividend income! On average, I was paid $29.90 from 58 different companies!! This month’s dividend income is a great 59.58% increase over December 2107.

That’s $647.46 more dividend income than last December!

Dividend Income - December 2018

Here is a chart of my passive dividend income progress over the last 4 years.

The dividend portfolio has been updated.

December’s dividend income covers a lot. My utilities, groceries, rental property mortgage, internet, cell phone and car insurance for the month. Thanks dividends!

December Dividend Growth (Dividend Increases)

Here are the realized dividend increases I received this month. Dividend growth is a very important part of my early retirement and this is clearly one of my favorite reports to give… especially this month! This December I received 11 dividend increases! Ever better, 6 of those dividend increases were over 10%!

Dividend Increases - December 2018

December’s dividend increase adds $86.04 in annual dividend income! It’s always wonderful to receive a raise and I’m thrilled with the amount.

2018 Dividend Income Wrap-up

2018 was a fantastic year for my dividend income. The growth has been remarkable thanks to my 401k. It was a huge advantage having the ability to invest the money myself – and specifically into dividend stocks.

This year I received a total of $13,057.19 in dividend income! This is a gigantic increase of 126.75% over 2017 total income of $5,758.37. I was able to double my 2017 total dividend income again this year!

I think it’s important to mention that this large increase was possible only because I added A LOT of capital this year and last.

Net Worth

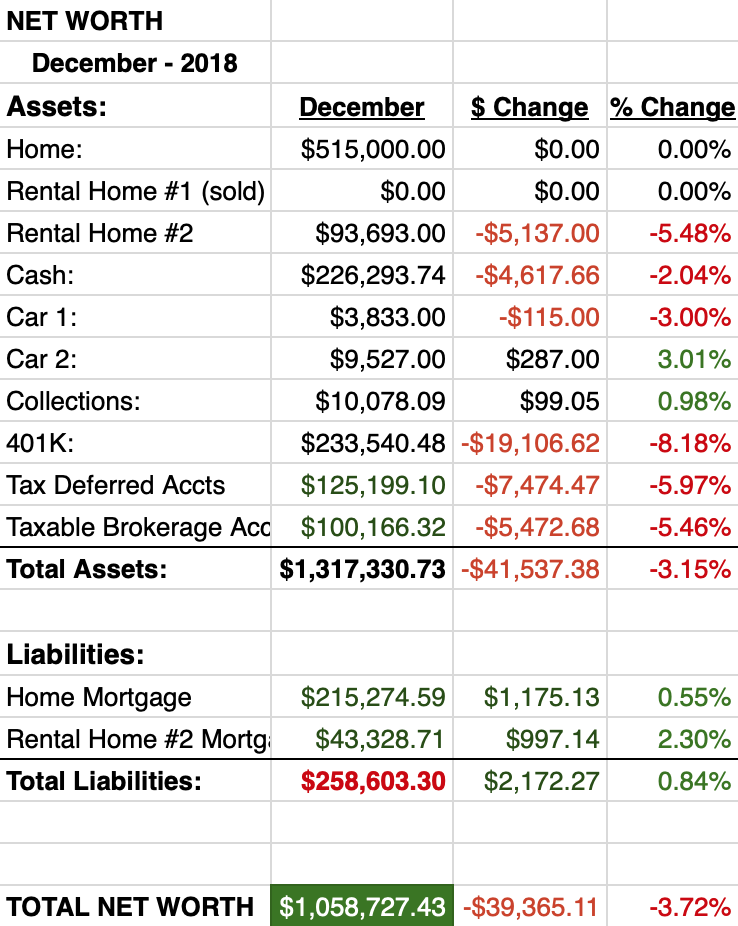

Ouch… net worth took a huge hit this month!

Let’s do the numbers…

Cash

Cash was reduced a little this month as I added $3,500 into my taxable account (which is why it was only down 5.5% instead of 8%). Other than that, everything is still moving as scheduled. I have made plans to take some cash to fully fund out ROTHs and add some extra ammo to the taxable account.

I’m still sitting on a bunch of cash. The money is held in a high yielding money market account with the cash now earning 2.45%. I’m continuing to keep this powder dry while waiting for some better deals.

Real Estate

As I mentioned last month, our tenant has been a little messy in our house. Our property manager has done a follow-up walk through on our home and everything was cleaned and made tidy. This is great news, and we would like to keep them there since they always pay on time!

While I am in the market to find some new rental property, we haven’t had any luck finding any that match our criteria. Everything is way too expensive, so we will just continue to watch and wait.

My wife and I have discussed selling our home while the market is high and, hopefully, building our own house. Based on our research, it won’t be possible for us to buy a lot anywhere close to our current location to downsize as land is so expensive. Finding land further out is an option, however, some extreme life planning will have to take place before that can happen. I will continue to do research and report back what we come up with.

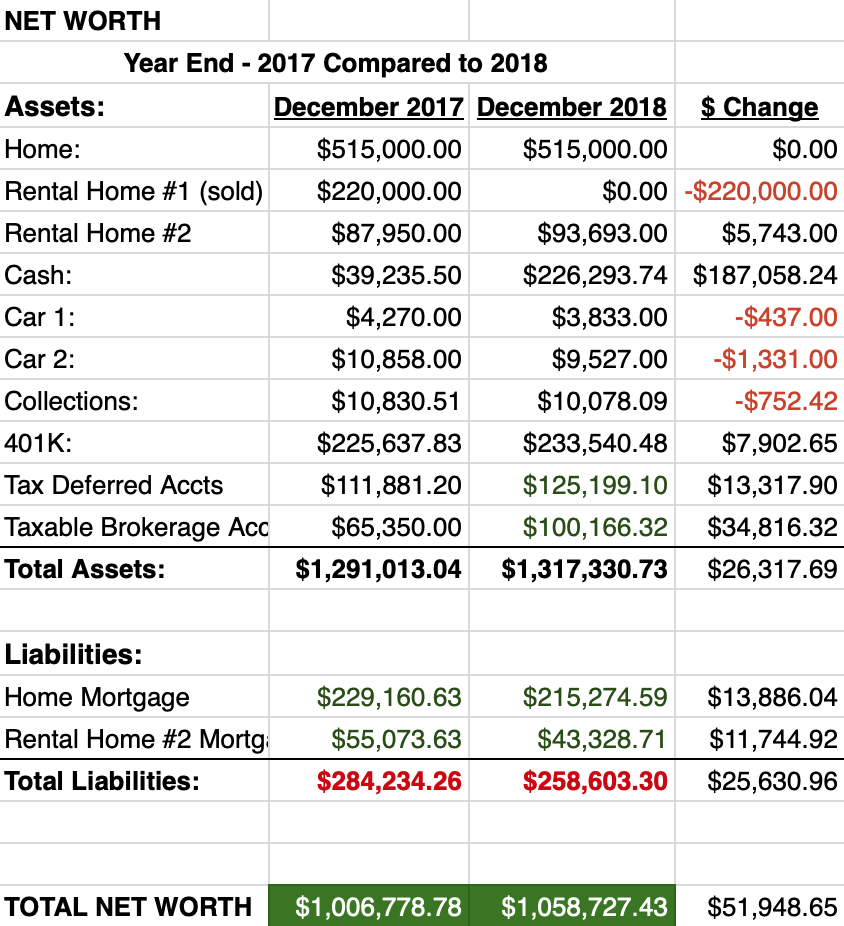

2018 Net Worth Wrap-up

In an effort to end the year with some positive net worth news, I thought I would do a year over year comparison from 2017. While I track my net worth every month, this exercise has been enlightening. Frankly, I thought the numbers would be a bit better, but there is still plenty to celebrate.

As you can see, my net worth increased by a little over $50,000 last year. Half of the increase came from paying down mortgages while the other half came from investment increases. It’s interesting what a couple of down months can do to yearly investment gains. I’m sure glad I don’t grade my success or failure based on my yearly portfolio gains. I am much more interested in increasing dividend income through strong, stable dividend paying stocks.

Wrap-up

So there you go, 2018 was wonderful and kinda disappointing at the same time. I will obviously continue the same path of dividend investing and hopefully come up with a viable plan to downsize our primary home, free up some cash and cut our monthly expenses. This will be key for me to retire early. Whatever 2019 brings, I will remember to be thankful for my family, health and the wealth we have accumulated thus far.

8 Comments

Great job and enjoy following your progress each month. Not quite to your level, but working on it!

Hi MrBob! Thank you for the comment and thanks for following along. The destination is definitely worth the journey, keep trekking!

Hi

What’s the tax impact on your dividend investing? Is it a lot? Is this portfolio your taxable account?

Hi Oscar! Yes, I do have to pay taxes on some of this dividend income. Though, a large portion of this income comes from tax advantaged accounts, ROTH and 401k. But the majority of the payments comes from qualified dividends which is taxed at 15%. Thank you for the comment!

Nice income increase! Who cares about the networth, as long as the cash is rollin’ in 🙂

Thanks DD! Exactly, net worth isn’t going provide cash flow on it’s own, just need to continue to raise that dividend income! On the other hand, net worth is an easy barometer of overall financial health. Just don’t want it going down too much 😉 Thanks for dropping in, great to hear from you!

Nice increase year over year. Keep up the great work. I love following your stuff. Cheers

Thanks BHL! Still have a long way to go, but I am thrilled with the progress thus far!