After a long month of traveling (for work) I’m happy to be back at home to report on this month’s dividend income and net worth. Sadly, this month isn’t anywhere close to last month’s record breaking dividend income, but this month is special for another reason.

Dividend Income

While October’s dividend income wasn’t close to a gigantic hull, it was a special month regardless. Special not because of the dollar amount or the number of paychecks (dividends) I received, but because I surpassed a big milestone.

This month, I surpassed $1,000.00 in dividend income received for the year. This was a goal not of only money, but also persistence. I started along this journey 1 year ago and have already earned $1,054.61 in dividends from the companies I’ve invested in. It’s incredible how quickly this is happening! As a point of reference, this time last year I had only received $170.00 in dividend income. That’s an increase of $884.71 or 520% in a year! Making small investments of a few hundred dollars at a time really can pay big dividends.

This month I received $81.84 in dividend income!

[table id=4 /]

October Buys

I did a horrible job of listing my purchases in other posts this month so I will list them here. I set up quite a few limit orders before I began traveling this month. Unfortunately, the market moved quickly away from the limits after I left. As you can see, I didn’t quite hit my goal of investing $3,000 but still made quite a few buys.

[table id=5 /]

This increases the number of positions in the dividend portfolio to 36 with an average yield of 3.6%.

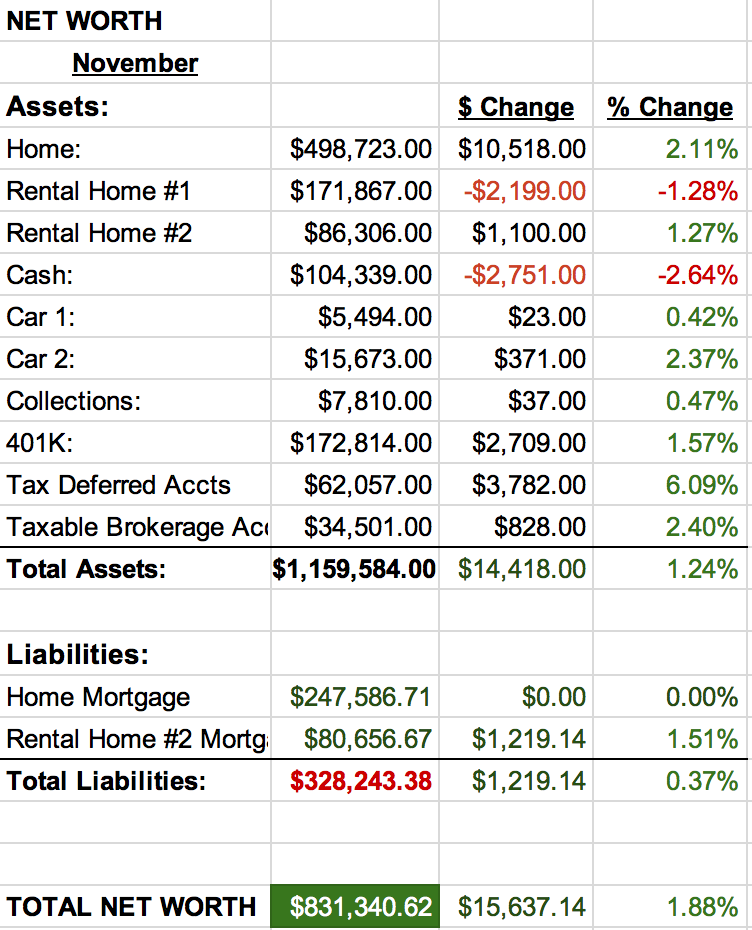

Net Worth

As I mentioned, I was traveling a large part of the month so a lot of my normal day to day costs can be expensed. That doesn’t play a large part here other than the cash portion of the report as I deduct monthly credit card bills directly from cash.

Let’s do the numbers…

Real Estate

Real Estate

Our primary home shot up 2.11% this month. It’s always fun to see that number increasing, but unfortunately, it’s just a number. I suspect it would be quite difficult for us to get that much for our house in its current condition. However, after we finish the renovations on the home, we’ll be set. We did decide that we are no longer going to pay extra towards principal on this house as we don’t see ourselves living here in another 10 years. On a side note, you may notice that our primary home mortgage didn’t come down at all this month. We accidently paid early last month and a double payment was recorded in the last report. Oops.

Rental property #2 is now the focus of our paydown efforts. We think we can continue at a pace to have it paid off in 5 years! While that is early, it still feels like a REALLY long time!

Rental property #2 was sold to a smaller (shady) loan servicer about 2 years ago. Everything had been fine until I started paying more attention to our statements because of this report. After doing some complicated math (subtraction), I discovered these guys had been taking our extra principal payments and had been applying it towards future payments. We had 2 months of extra payments sitting in the account doing nothing. We called and told them to credit the money towards the principal and they agreed to do it. When checking the total today I see they have only applied one of the payments towards principal and the other payment has gone missing. These guys are crooks. I’ll get it taken care of, but the moral of the story is pay attention to your statements. If you are paying extra each month, be certain that money is going towards your principal as requested.

Cars

A new and unexpected occurrence this month… both of our cars have increased in value! I wonder if this is a seasonal thing or KBB just had a bit of a hiccup calculating their values this month. Either way, I’ll happily take the 0.42% increase and the 2.4% on my wife’s car. As we all know, cars are more like depreciating tools than assets (but I include them in the report as they are easily exchangeable for cash).

Cash

As I mentioned, I have quite a few expense reports waiting to be paid from this month’s travel. So, cash on hand is down a bit. I’ve been saving for some large home repairs so we have plenty of cash on hand. I hope to get the repairs started by the beginning of the new year so that total will quickly decrease.

So there you have it, another successful month down in the history books. Dividend income is soaring along, net worth is the highest it’s ever been and I have a bowl full of candy at home to devour. Life is good!

How did you do this month? Were you also surprised by the quick rebound in the market?

2 Comments

Congrats on hitting the $1k milestone! That really is incredible progress. I like all of your purchases as well – I own all of them except for DE. Have a great November!

Ken

Hi Ken!

Once again, great minds think alike 🙂 I hope we get some pull backs in November… it’s getting really difficult to find deals at the moment!

As always, thank you for stopping by and commenting!