Anybody else feel like we jumped into hyperspace and February just FLEW by!?! February’s dividend income and net worth report is an example of what I would like to post every month. A great step forward in terms of dividend income earnings and pretty darn decent net worth growth. There is no possible excuse for being dissatisfied with results like these – especially while the market continues to climb.

February Dividend Income

Dividend income has been growing like gangbusters so far this year – mostly due to a large infusion of cash that took place over the last year and a half when we were given control to invest our own 401k. Dividend income is the most important part of my early retirement path and I’m ecstatic to report the results!

This month I received $1,224.14 in dividend income! On average, I was paid $32.62 from 32 different companies!! This month’s dividend income is a great 63.45% increase over February 2108.

That’s $475.22 more dividend income than last February! While the total dividend increase in dollars was more than last February, the percentage of growth has slowed (though 63% is nothing to sneeze at). The dividend income percentage gains should continue to decline to more reasonable levels from here on out.

Dividend Income - February 2019

Here is a chart of my passive dividend income progress over the last 4 years.

The dividend portfolio has been updated.

February’s dividend income covers a a nice chunk of expenses including my utilities, groceries, home insurance, life insurance, internet and cell phone for the month.

February Dividend Growth (Dividend Increases)

Here are the realized dividend increases I received this month. Dividend growth is a very important part of my early retirement and this is easily one of the best reports I produce!

This month I received 7 increases and 5 of those dividend increases were over 10%! $MA lead the pack with a whopping 32% dividend increase!

Dividend Increases - February 2019

February’s dividend increase adds $50.54 in annual dividend income! While the dividend growth in dollars might not seem like a lot, it’s actually the equivalent of investing $1,444 of new money this month at 3.5%. That adds up, fast!

Another fun bit of information… since I’ve been tracking dividend growth (over the last 6 months) I’ve added $337.26 to forward dividend income through dividend raises alone. I would have needed to invest $9,636 of new money at 3.5% in order to equal that amount… and that’s just over 6 months!

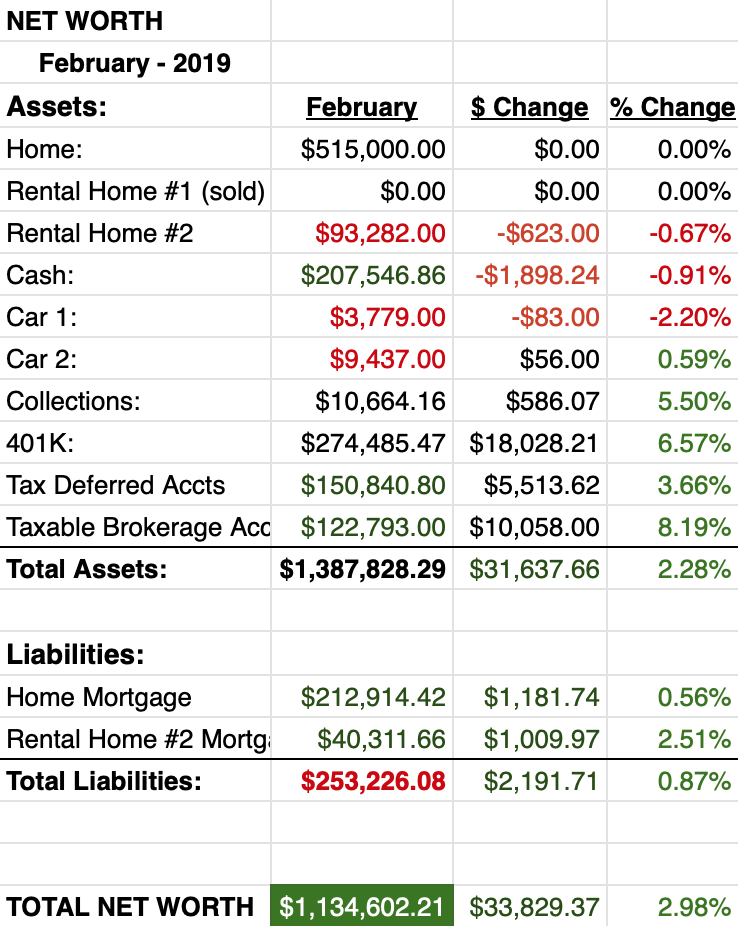

Net Worth

Another fantastic result for net worth this month. The market is continuing it’s upward trajectory and taking my net worth with it!

Cash

Cash declined a bit again this month. I’ve been moving more cash into my taxable investment account than normal and the results are showing here and there. We’ve also had some home repair expenses that popped up that have run us roughly $400!

The cash I’m sitting on may soon have a new place to live (i’ll talk more about that in the real estate section). But right now, the money is sitting in a high yielding money market account and earning 2.45%.

Real Estate

After I wrote this last month, I’ve been really focusing on cutting costs and making some hard choices about my life and living situation. Currently, we own a house that is much larger than we need and in an area where home price are extremely inflated. We are paying ridiculous sums of money each month to own and heat square footage that we rarely use. There is no concealing this waste and something must be done, so….

We put an offer on a new house. This house is new, as in brand new, it’s not even built yet and super energy efficient. The size is exactly what we need with zero extra space and property taxes will be half what we are paying now!

If everything goes to plan, we’ll be able to sell our house and use the proceeds to pay for our new home – in CASH! No more mortgage! It’s a very exciting/scary time for us. We now need to prep our home for sale. We estimate that it will cost about 18k to get the house up to par which should enable us to sell our home for over 550k. But who knows.

I’ll obviously keep you posted on the results of our offer and the process/costs of selling our current home.

UPDATE (3/18/19) – We were told to take a hike – our offer for the house was not accepted. Back to the drawing board.

As for our rental, everything is going fine, though we have now begun receiving water bills after the HOA decided to remove that benefit from the HOA dues. We are trapped for the next few months until we can change the contract with the tenant to make them responsible to pay for their own water bill.

Wrap-up

I’m continuing to work on cutting my expenses while saving and investing all I can. Getting rid of our mortgage while finding a small, more efficient home is a massive step in the right direction. This is a change that we’ve needed to make for quite sometime, but have been putting it off… cause, you know, it’s hard! I’ll keep investing in the best dividend stocks I can find and I’m sure you’ll do the same!

2 Comments

Very nicely done, those are some really nice numbers! Looks like those numbers and cash are starting to pay off to you.

How awesome is that. Cheers

Thanks BHL! Yep, everything went very well this month! The dividend increases are really starting to pay off. I was surprised at just how much its increased over the few months. Great to hear from you!