With over half of 2020 in the history books and Covid-19 still spreading its way into peoples lives, it’s comforting to know the world is still indeed turning and (most) dividends are still being paid! However, if you thought last month’s dividend cut report was rough, wait till you see this month’s! With regards to net worth, we are still moving on up following the market’s remarkable ascension.

July Dividend Income

This month I received $1,120.88 in dividend income! On average, I was paid $26.07 from 40 different companies! This month’s dividend income is a tiny 3.86% increase over July 2019.

That’s only $41.69 more dividend income than last July! Not exactly what I was hoping for!

Dividend Income - July 2020

Here is a chart of my passive dividend income progress over the last 5 years.

The dividend portfolio has been updated.

Here are the dividend stock purchases I’ve made between July 2019 and 2020 that have added to this dividend income growth.

July’s dividend income covers all my utilities and food for the month!

July Dividend Growth (Dividend Increases)

Here are the realized dividend increases I earned this July. Dividend growth is a metric I usually really enjoy reporting. However, this month, it’s not as sweet as normal.

This June I received 3 dividend increases! Sadly, zero of the dividend increases were over 10%!

Dividend Increases - July 2020

June’s dividend increase adds a paltry $4.35 in annual dividend income! These dividend increases are the equivalent of investing an extra $124.29 of new money at 3.5% yield! It’s not a lot, but it’s free!

July Dividend Cuts (Dividend Decreases)

Well, another crappy month of dividend decreases. Again, this isn’t the plan, but unfortunately the market and corona don’t really care what my plan is 😉

Here are the realized dividend decreases I had this July.

This month I received 4 dividend decreases! This sums up to $276.32 of lost dividend income this period! That’s the equivalent of flushing $7,894.32 instead of investing it at a 3.5% yield. Ugh!

Dividend Cuts - July 2020

The total net dividend decrease for July was ($271.97 [increase – decrease]).

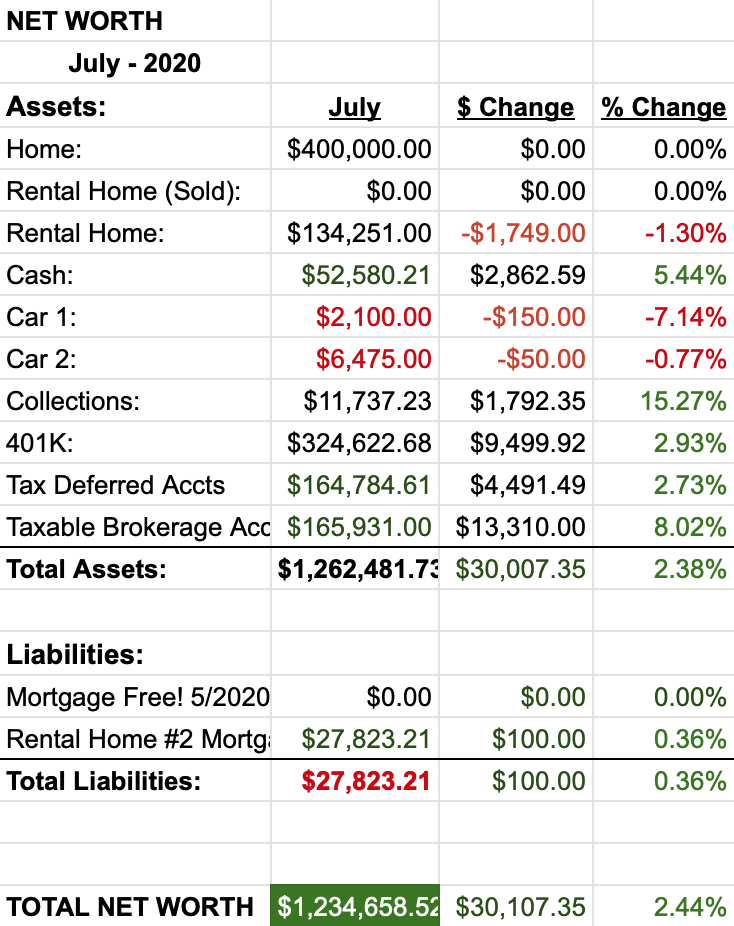

Net Worth

Net worth is growing nicely while the markets continue to climb.

Let’s do the numbers…

Cash

Well, how about that. Cash grew a little this month… that was a mistake. I bookmarked some cash for some additional home purchases that we didn’t end up making in July. However, those purchases will be made in August. Decorations for the new house (eg. a new dining room table, some wall decorations, home networking and home gym stuff). That will set us back roughly 2k. I promise, I really am a frugal guy!

Real Estate

Our home is continuing to be everything we had hoped for. Our new home is much smaller, tighter and better insulated than our last. This month, our electricity bill is about $150 less than last year! Cha ching!

Our tenant is still paying their rent. I thought we would receive a $50 a month rent increase starting this month with the signing of a new 2 year lease. Apparently, it starts the next month 🙁

Wrap-up

Except for the dividend cuts, everything is going great! Dividend payments have, for the most part, been left unaltered. My issue, is that some of my largest holdings decided to suspend. This month Disney was clearly my largest dividend offender.

My time to retirement (TTR) has been a wash even with the cuts and suspensions thanks to our downsizing. I am very fortunate that I’ve had the extra money to invest these last few months to make up the those missed dividend payments. I’m comfortable that the vast majority of the my dividend offenders will start paying again (soonish)!

Delta ($DAL) is really my biggest concern and I have been wrestling with reducing my risk here. While cost cutting is great, eliminating hoards of pilots and flight attendants positions and reducing routes isn’t enough to stop the bleeding (though govt subsidies are a big bandage). We really need more people comfortable with traveling again!

I’ll keep trying to find the best deals I can during these interesting times, I hope you will as well!

2 Comments

DP –

I hear you on the cuts. What I am most curious about is Disney and when a dividend reinstatement will happen. It’s amazing to me to see where their share price is at with no dividend. This market… so unusual over the last few months. A lot of optimism and hopefully these earnings will follow.

-Lanny

Hi Lanny! I’m staying positive on Disney. A vaccine will be a slow working steroid for their revenue and I suspect (hope/pray) they reinstate the dividend with their December 2021 payment. However, they could just as easily switch to a quarterly payments then too – in which case it would be a quarter earlier (hopefully). Either way, we need the world to get back to normal prior to that happening!