It’s hard to contain my excitement, so I won’t… a new dividend income record has been reached!!! This is the level I’ve been eyeing for over two years and it’s finally here. Fortunately, net worth also crept up a little to keep this March dividend income report nothing but great news!

March Dividend Income

Dividend income, in dollars (not percent gains), has grown substantially this year! It’s been a wonderful story of ascension the last few months. This was only made possible by a large infusion of cash that took place over the last year and a half when we were given control to invest our own 401k.

This month I received $2,114.15 in dividend income! That’s right, OVER TWO THOUSAND DOLLARS in dividend income. Heck yeah!! On average, I was paid $33.03 from 64 different companies!! This month’s dividend income is a healthy 45.95% increase over March 2108.

To put things in dollar figures, that’s $665.59 more dividend income than last March! While the total dividend increase in dollars was more than last March, the percentage of growth has slowed, and will continue to slow, until my extra cash finds a home in equities.

Dividend Income - March 2019

Here is a chart of my passive dividend income progress over the last 4 years.

The dividend portfolio has been updated.

March dividend income covers everything except my mortgage and food. Which is kind of unfortunate as those two categories are really the most important… but I have internet, cell phone and everything else taken care of.

March Dividend Growth (Dividend Increases)

Here are the realized dividend increases I received this month.

This month I received 13 increases. 4 of those dividend increases were 10% or greater. $HD built a treasure box and pulled out a whopping 32% dividend increase! Thank you very much Home Depot.

Dividend Increases - March 2019

March’s dividend increase adds $299.75 in annual dividend income. This is the largest dividend growth I’ve received since starting to track this very important data point. This is the equivalent of investing $8,564.29 of new money this month at 3.5%. That’s a LOT of money!

Since I’ve been tracking dividend growth (over the last 7 months), I’ve added $637.01 to forward dividend income through just dividend raises. I would have needed to invest $18,200.29 in new money at 3.5% in order to equal that amount. That’s in only 7 months of dividend raises! How can you not love dividend growth investing!?!

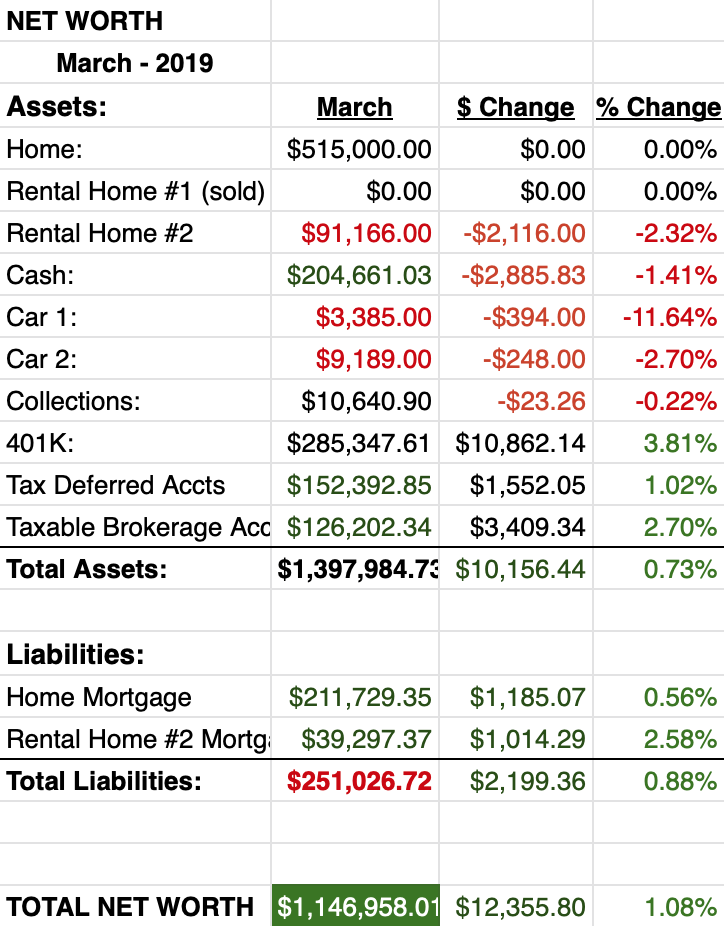

Net Worth

Another great result for net worth this month. The market is continuing it’s upward trajectory and taking my net worth with it.

Cash

Cash declined a bit again this month. We had several unexpected costs that popped-up. We are having to spend a good chuck of change on some home repairs 🙁

The cash I’m sitting on will soon have a new house to live in… but for now, the money is sitting in a high yielding money market account and earning 2.45%.

Real Estate

Big update here, we are buying a new home! It’s very exciting and a very scary all at the same time. Here is how it went down.

Last month I wrote this in the real estate monthly wrap-up”

After I wrote this last month, I’ve been really focusing on cutting costs and making some hard choices about my life and living situation. Currently, we own a house that is much larger than we need and in an area where home price are extremely inflated. We are paying ridiculous sums of money each month to own and heat square footage that we rarely use. There is no concealing this waste and something must be done, so….

We put an offer on a new house. This house is new, as in brand new, it’s not even built yet and super energy efficient. The size is exactly what we need with zero extra space and property taxes will be half what we are paying now!

If everything goes to plan, we’ll be able to sell our house and use the proceeds to pay for our new home – in CASH! No more mortgage! It’s a very exciting/scary time for us. We now need to prep our home for sale. We estimate that it will cost about 18k to get the house up to par which should enable us to sell our home for over 550k. But who knows.

I’ll obviously keep you posted on the results of our offer and the process/costs of selling our current home.

UPDATE (3/18/19) – We were told to take a hike – our offer for the house was not accepted. Back to the drawing board.

The no offer reply was delivered with a message that they were moving plenty of homes in this neighborhood and they didn’t need to deal.

Well, I of course took the denial gracefully and kindly said, if things slow down later, let me know, we are still interested.

With the end of the quarter quickly approaching, I emailed the agent and politely asked, how things were going and if they wanted to sell another house before the end of the quarter. They got back to me the next day with an offer only good till the end of the month. Needless to say, we got busy and got very close to what we asked for in our original offer. YAY!

So, now we have to sell our house. The trick here will be getting our current home ready to sell. That means fixing it up (spending money) and emptying it out (selling and donating a LOT of stuff). We will be substantially downsizing our home size and I’m very relieved and overwhelmed!

As far as the fixing the place up, we’ll spend roughly 20k doing all the repairs and cosmetic improvements. Ugh, hate to spend the money! Hopefully this translates to an extra 25k+ when we sell our home – and a quick sale!

Our rental is doing just fine. Our tenant paid on time and the only work we had to do this month was to go to the mailbox to collect a check!

Wrap-up

The dividend income was massive this month. This has been one of those “I can’t wait/imagine what it will be like when I received 2k in dividend income per month”.

While these kind of sums will only be reached 4 times a year… it’s still 4 times a year! It’s amazing and I can’t express in words how wonderful and freeing dividend investing has been for me. I hope you have all found the same joy that I have in this dividend investing strategy. I still have a long way to go… but i’m actually getting there!

2 Comments

Good job that cash would buy a lot of slop but then im just Oinking around LOL. that dividend increase you got this month isnt bad either. Keep it up.

Thanks Doug! Love the pig puns!