Another exciting month down and new monthly dividend income report to share. The market has turned around nicely from March lows. I suspect we all hoped for a sharp recovery and it looks like we’re getting just that.

May Dividend Income

This month I received $1,474.24 in dividend income! On average, I was paid $37.80 from 39 different companies! This month’s dividend income is a decent 6.84% increase over May 2019.

That’s $94.36 more dividend income than last May! It all adds up!

Dividend Income - May 2020

Here is a chart of my passive dividend income progress over the last 5 years.

The dividend portfolio has been updated.

Here are the dividend stock purchases I’ve made between May 2019 and 2020 that have added to this dividend income growth.

May’s dividend income covers all my food, insurance and utilities for the month!

May Dividend Growth (Dividend Increases)

Here are the realized dividend increases I received this May. Dividend growth is always an exciting metric to report as the increases are completely FREE!

This May I received 6 dividend increases and (just like last month) zero of those dividend increases were over 10%! 🙁 Not surprising considering the times.

Dividend Increases - May 2020

May’s dividend increase adds $28.25 in annual dividend income! These dividend increases are the equivalent of investing an extra $807.14 of new money at 3.5% yield! Another decent month of free money!

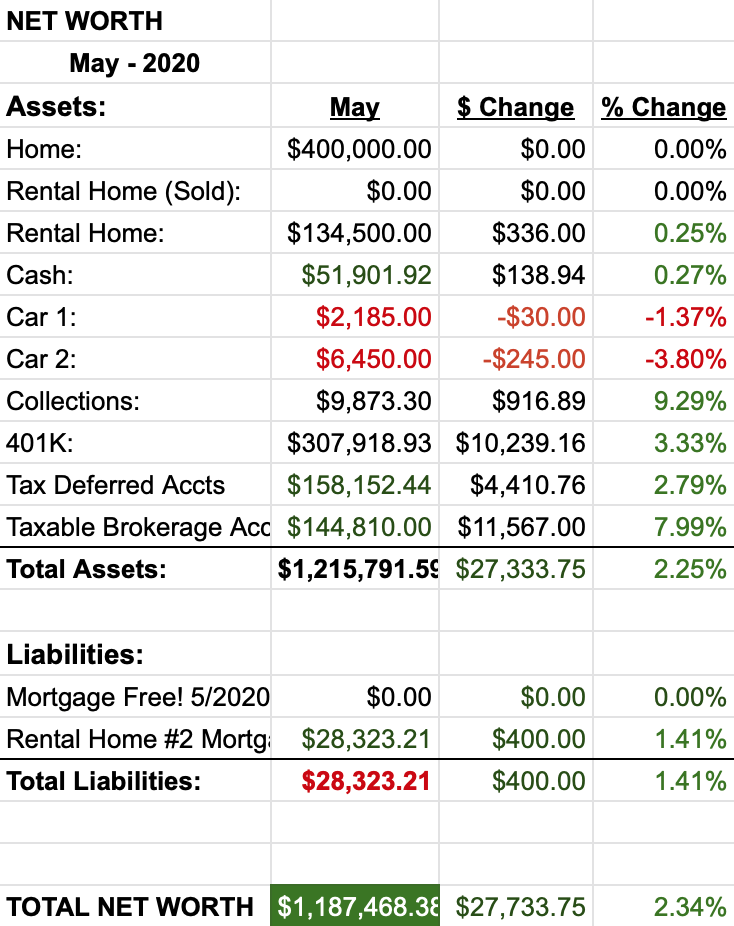

Net Worth

Net worth is starting to climb now that we have sold and downsized our home. More cash will soon be able to flow into more dividend stocks.

Let’s do the numbers…

Cash

Cash

I added a little extra to my Interactive Brokers account this month which padded it, but depleted cash. I have a few additional, and kinda large, home expenses that are coming up. For example, we are buying a dining room table that will be several hundred dollars. Ugh.

I haven’t yet really experienced the financial thrill of being mortgage free as we still have a few final costs from selling our home (that were on credit cards). However, all those expenses will be paid off soon and I’ll have an accurate picture of what mortgage free life is really like.

Real Estate

Now that our old home is sold and we are moved into our new downsized home, we are ready to save and invest more money!

Our rental home still has a great tenant that is paying their monthly rent. They also signed a 2 year lease with an additional $50 a month that will start soon. Our new, easily attainable goal, is to have the rental paid off in 2 years. This requires us to put a reasonable amount of extra money towards principal monthly. We could have it paid off earlier, but the interest charges are so minimal that it isn’t necessary.

Wrap-up

Everything is moving along well. Coronavirus is becoming more understood and states (including GA) are pretty much completely open now! I’m very much looking forward to things returning to normal.

Dividend growth is an important factor for my early retirement plan and it’s disappointing to see that the growth was $7 less than last May. However, the plan is still the same, find the best dividend stocks values I can every month and put cash to work. I’m on it, I hope you are too!

6 Comments

Hi

Love your posts!

But what about the cutters? You still count on your spreadsheet with some stocks that are not paying dividends anymore like DIS.

Thank you

Hi Alesso,

Thank you! I have been waiting for companies that suspended/cut to reduce their updated dividend amount into the dividend portfolio the month of the first reduced dividend (however, I haven’t updated May’s dividend increases or cuts yet – ex DAL). Do you think it would be more helpful to account for all the dividend updates upfront?

Thanks!

DP –

WOW, what a positive month overall. The dividend increases, the positive tenant situation, benefits from downsizing, net worth is positive – keep that momentum. Now that the market, hopefully, starts a trend downward – you can start putting that cash to work!

-Lanny

Thanks Lanny! A bunch of cash got put to work yesterday. I was thinking that the market had moved way too far away from my limit orders… and then the elevator dropped. Crazy times.

Hi,

I am glad that your dividend income is increasing and I hope you will be able to retire soon, but I have a few questions. When did you start investing? How much money did you have at the beginning? Do you only reinvest your dividend income or you also invest your savings.

Thanks Marijan! I switched to strict dividend investing a little over 5 years ago. However, I had been saving and investing previously. I don’t specifically DRIP all dividends, however, all dividend income is ultimately reinvested back into dividend stocks right now 🙂