Dang, it’s cold! My fingers are freezing as I write this… I can’t remember why in the world I couldn’t wait for cooler weather back in July 😉

Anyway, October has come and gone and my dividend income and net worth report has arrived. I received some great dividend income and ate way too much candy (I identify well with pigs when free candy is near). Net worth continued to climb higher and life plans have been altered. Let’s dig into this eventful month.

October Dividend Income

This month I received $766.85 in dividend income! On average, I was paid $21.91 from 35 different companies! This month’s dividend income is an okay 19.47% increase over October 2108.

To put things in dollar figures, that’s exactly $125.00 more dividend income than last October!

Dividend Income - October 2019

Here is a chart of my passive dividend income progress over the last 5 years.

Here are the dividend stock purchases I’ve made between October 2018 and 2019 that have fueled this dividend income growth.

The dividend portfolio has been updated.

This October’s dividend income covers my utilities and food for the month!

October’s Dividend Growth (Dividend Increases)

Below are the realized dividend increases I received this month.

This month I received 10 increases. Two of my holdings increased their dividends by over 10%! It was $JPM with a 12% increase that added the most this month to the portfolio’s dividend growth.

Dividend Increases - October 2019

October’s dividend increase adds $45.94 in annual dividend income. This dividend growth is $9.25 less than I received October 2018. This is kind of a downer, but not surprising after last years super increases due to the changes in corporate taxes. October’s dividend increases are the equivalent of investing an extra $1,312.57 of new money at 3.5% yield!

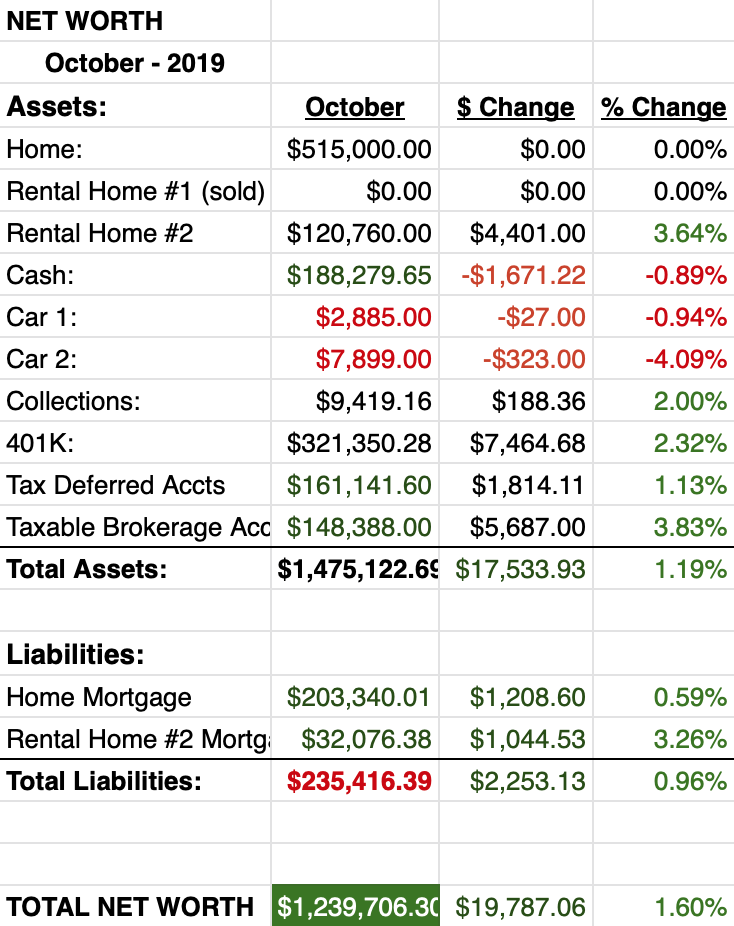

Net Worth

Net worth cruised past last month’s record high. Things are continuing to look very green!

Let’s do the numbers…

Cash

While cash looks like there was a lot of activity this month, there really wasn’t. I had some travel expenses that I haven’t been reimbursed for and… we spent some extra money eating out. This was probably due to some really destructive and bad habit forming self soothing about not buying our new house. I’ll talk about this more in real estate, but our downsizing plan didn’t work this time. Back to the drawing board.

Real Estate

As I mentioned above, some unfortunate events brought us to a decision to not purchase our home that we had contracted to be constructed for us. I’m still kinda debating on whether I should go into detail here with a “shady” builder review – but I’ll give you a quick run down though.

We put down earnest money for a national builder to build one of their floor plans, in one of their neighborhoods on the lot we selected. After some really stressful times, we discovered that this national, publicly traded builder had decided to make some changes to the level of details they put into their new homes.

Unfortunately, this change was made prior to the construction of our home, but after we signed the contract… and we were never told about the changes!

This was a big issue as the new diminished detailed homes look a lot cheaper than the other homes in the neighborhood. Sadly, we were told that “management” wouldn’t build our house as all the other homes on the street and make our home and detail quality match the other homes. So, a week before closing and trying to work with our sales agent for months, we walked away.

We have not received our earnest money back, but I’m working on getting the cash returned. I’ll let you know how that goes.

As far as our rental, our tenant payed on time and we haven’t heard a peep about repairs. No problems there!

Wrap-up

I’m very disappointed about our home downsizing plan not working out as I had hoped. So, we will regroup over the winter and devise another course of action. I have no doubt that we will work something out… its just a matter of time!

As far as dividend investing, our results are exceeding our plans! We need to keep finding the best values we can in the market and keep consistently investing. I’m only 5 years into my 10 year plan to retire by 45… I still think I can make it!

8 Comments

DP –

Sorry to hear about the builder – I really am curious on what happened… could be a great article and could share with us, what to avoid, and what to look out for if someone is considering a new build construction, etc..

On the dividend and net worth front – loving it and you are firing on all cylinders. 20% growth is sweet at these levels.

-Lanny

Thanks Lanny! Yeah, on the house side, it really stinks! I, without a doubt, learned a ton and will share more later. On the dividend investing side, everything is moving along smoothly.

On a side note: I just checked and this is second smallest percent increase I’ve received since I started. I’m not down on it, 19% is great… but dividend income growth YoY, as a percentage, is finally starting to decline… no more 30 – 40% increase. Had to happen sooner or later 😉

Wow, Blake. If 19% is your 2nd smallest YoY growth number, you are on a roll, for sure. Your portfolio has certainly grown immensely this past year. Outstanding work! Even at that decreased rate, you are in terrific shape.

Hopefully, you’ll get your earnest money for the build back in short order.

Thanks ED! Yeah, dividend income have been growing at a great clip the last few years! The earnest money is STILL up in the air… we might have to take this to a third party to get resolved. Crazy!

Hey Blake,

Sorry to hear about the house! Nice work on the portfolio. I was happy to scoop up ABBV when they got hammered in August and averaged in at $65.98. Just got my first dividend payment from them 2 days ago. I’ve been watching ABBV a long time. I’m still working on building a dividend portfolio, so I’m nowhere near as successful as you’ve been so far. Keep up the great work.

Thanks WA! Nice pickup with ABBV and congrats on the dividend! Those feel great don’t they? As you know, slow and steady wins the race and it sounds like you are on the right path – keep it up! Thanks for dropping by!

They really do. It’s funny, you see some of these stocks at 52-week highs and you think “man, the moment that stock tumbles, I’m buying it hand over fist!” But once the sky finally falls, you get all nervous like “what if this is really the end! What if Humira is all they had going for them?!” Definitely tough beating back the herd mentality sometimes hahaha. But, here I am now sitting on ~35% gains, plus averaged in at a great dividend yield. I’m happy.

I keep getting stuck between buying stocks, and buying dividend ETFs. I have a few that I really like: SCHD, DVY, VYM, and VIG to name my current holdings. I love how hands-free they are, but I really love getting these constant deposits coming in for the individual stocks. I know the ETFs have their fees, but 3 of them are really low, DVY is the worst at 0.39%. I just love not having to monitor for things like dividend eliminations, etc. The dividend life can be tough sometimes! Hahaha.

Exactly… reminds me of an article I wrote a few years ago on why I use limit orders. Nothing wrong with dividend focused ETFs! I’ll buy SCHD when it’s on super sale as well. Just keep finding the best values you can and putting that money to work! Having some of the best businesses in the world pay you for doing nothing is a tough job… but somebody has to do it. Might as well be us 😉