I’m back on the ball this month and pumped to share this month’s record breaking dividend income and net worth report. It’s these kind of months that keep me motivated to continue this FIRE marathon. Also, a bad news update about our downsizing plan.

September Dividend Income

This month I received $2,425.32 in dividend income! On average, I was paid $32.34 from 75 different companies! This month’s dividend income is an impressive 40.05% increase over September 2108.

To put things in dollar figures, that’s $693.60 more dividend income than last September!

Dividend Income - September 2019

Here is a chart of my passive dividend income progress over the last 5 years.

Here are the dividend stock purchases I’ve made between September 2018 and 2019 that have fueled this dividend income growth.

The dividend portfolio has been updated.

September’s dividend income covers my mortgage – which is no small feat!

September Dividend Growth (Dividend Increases)

Below are the realized dividend increases I received this month.

This month I received 13 increases. Five of my holdings increased their dividends by over 10%! It was $TAP with an almost 40% increase that really shined this month for the portfolio’s dividend growth.

Dividend Increases - September 2019

September’s dividend increase adds $93.09 in annual dividend income. This dividend growth is $20.56 more than I received September 2018! September’s dividend increases are the equivalent of investing an extra $2,659.71 of new money at 3.5% yield!

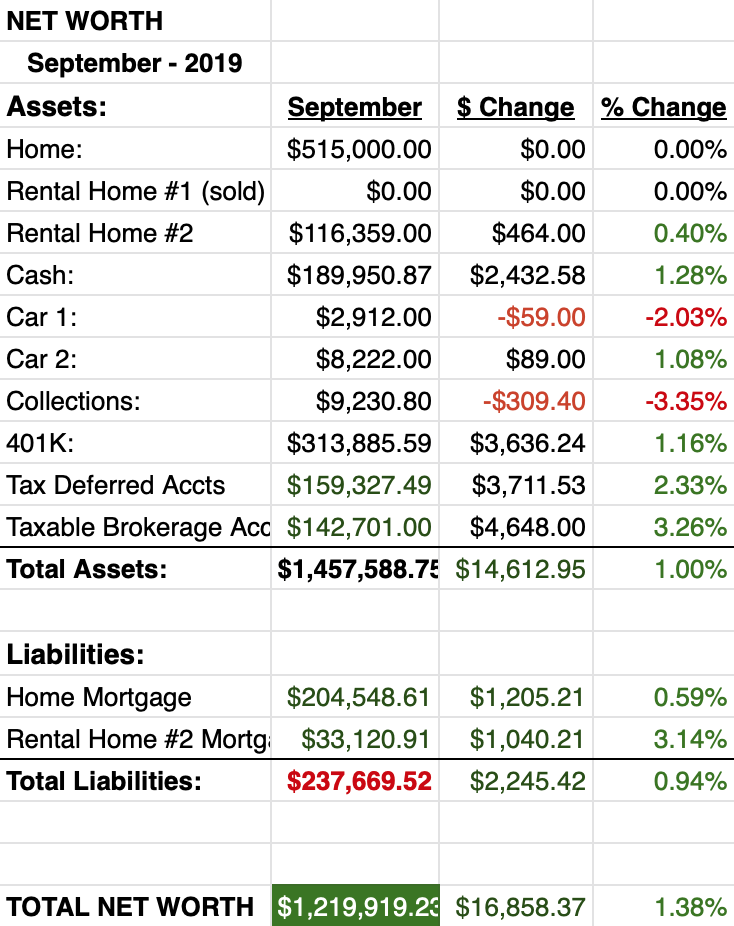

Net Worth

Net worth crushed the new high set last month. Things are definitely moving in the right direction.

Let’s do the numbers…

Cash

We were cash positive this month as we were saving to purchase a new home. I didn’t deposit into the taxable trading account as I normally do and saved that money to bolster cash reserves. We also saved a little extra money this month and sold some stuff around the house to net us a little over 400 bucks!

Real Estate

I hate to have to write this, but here is our sad and bad news update on our house. It doesn’t look like we are going to purchase the new house. After almost 5 months of planning, visiting, watching, helping and stressing about our new home purchase – we’ve decided to throw in the towel.

We’ve run into several problems with the home construction and are concerned with the quality of the craftsmanship. For example, our front porch was poured nearly 2 feet too small, the siding and soffits were replaced with lesser materials (and installed incorrectly), the craftsman columns on the front of the house look emaciated, the covered back porch has a column that is 3/4 hanging off the footing, the cabinets look as if the installer used their teeth to make cuts… and I could go on and on.

The builder at one point told us that many of the sub contractors used to build our house were fired (concrete, framing and siding) after the work they did on our house. First, how the heck does that help me… and second, the builder didn’t plan to get any of the work redone!?! Ugh.

Anyway, we just don’t feel comfortable spending 300k+ on a house that we know is going to have some extra problems a few years down the road. So, back to the drawing board on our downsizing goal.

Also, after some minor interest in our home this last month, we have decided to take it off the market until prime time next year.

Our rental property is still ticking along well and we’ve finally started receiving checks without us having to pay for water. YAY!

Wrap-up

This report is a bit good and bad news this month. We were very excited to cut our living expenses in half and live in a mortgage free home, however, I do feel as if we are making the right decision to not buy a poorly constructed home. But, on the good news side, dividend income is chugging along and dividend increase have been incredible this year! I’m certain a better downsizing plan will present itself in due time 😉

4 Comments

Pig –

Damn. Insane. Those totals are HUGE. Those dividend increases are STACKED. What type of steroid are you on?! Kidding, kidding, but you are knocking it out of the park!

Also – where do you maintain your cash reserves? Are you earning interest income on that big stack? Hope so!

-Lanny

HA Lanny – I’ve been taking the DGI roids for the last few years and the gains have been great. 😉 This was a very special month! The cash is sitting in a high-ish yielding savings account… 1.9% isn’t much, but it isn’t nothing either.

Fan-freaking-tastic! Nearly a $700 increase and over $2.4k in dividends. That sucks to hear about your home and pretty damn crazy that the builder isn’t going to fix any of the stuff that’s wrong. I’m glad you were able to get out of the purchase.

Thanks JC! Yeah, the whole experience has been a heck of a learning experience. We aren’t getting out of the deal completely unscathed, but its much better than plunking down several hundred thousand dollars on shoddy work.