Company Overview

Exxon Mobil Corporation (XOM) is an energy company, and their business involves exploration for, and production of, crude oil and natural gas, manufacture of petroleum products and transportation and sale of crude oil, natural gas and petroleum products.

Exxon Mobil Corporation (XOM) is an energy company, and their business involves exploration for, and production of, crude oil and natural gas, manufacture of petroleum products and transportation and sale of crude oil, natural gas and petroleum products.

Sales, Earnings, Free Cash Flow

Over the past decade, XOM has managed to grow revenue by an average of 6.8% a year. This number, (and pay attention to this, as it holds true for all of their financials) is to be taken with a grain of salt. The business of energy, at least in the way it pertains to XOM, is

Fundamentally a commodity business. This means XOM’s operations and earnings may be significantly affected by changes in oil, gas, and petrochemical prices, and by changes in margins on refined products…these in turn depend on local, regional, and global events or conditions that reflect supply and demand for the relevant commodity. (Exxon Mobil 10-K, 2011)

So this business is cyclical, and highly unpredictable. Events ranging from rebellions in Libya to spills in the gulf can affect oil prices, and hence profits. So while I look at growth rates over 1, 5, and 10 year periods, realize that these may be lower or higher than normal operational potential due to price and demand fluctuations.

| Years | Revenue (in millions) |

|---|---|

| 2006 | $377,635 |

| 2007 | $404,552 |

| 2008 | $477,359 |

| 2009 | $310,586 |

| 2010 | $383,221 |

Sales increased in the past year by 23.4%, a healthy jump, but still lower than the strong revenues of 2007 and 2008. Still, sales were up across the board, from all three divisions: Upstream, Downstream, and Chemical.

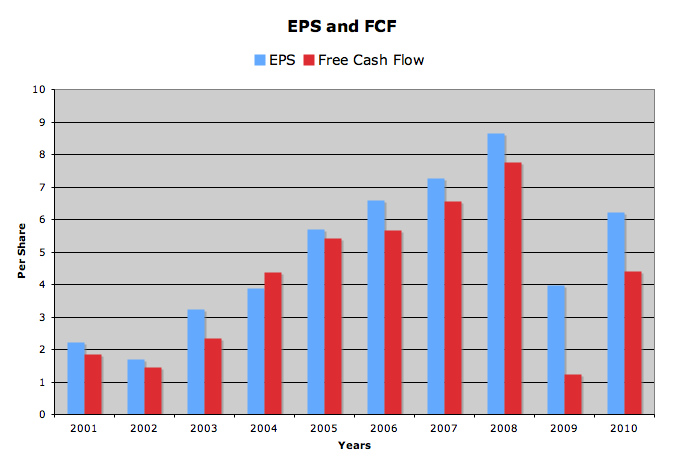

The cyclical nature of this business is evident in the graph. After peaking in the mid 2000’s (specifically 2008’s $8.66 a share) earnings took a huge hit in 2009, dropping down to $3.98. In 2010 they rebounded, and full year earnings came in at $6.22 a share. Analysts expect XOM to make $8.32 in 2011 and $8.89 in 2012, for increases of 34% and 6.9%, respectively.

Cash flow follows closely with earnings, and though at times XOM threw off huge amounts of cash, when earnings dive, so does fcf. Still, we know this business can generate cash, which is always a good sign for a dividend investor.

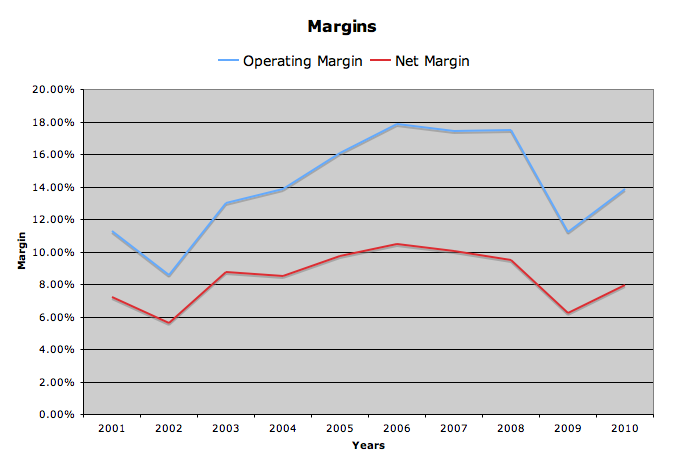

Like earnings, margins grew in the mid 2000’s, and have leveled off a bit since then, with operating margin at 13.8% and net margin at 7.9% in 2010. Though off of their highs, these are close in line with their 10 year averages, of 14% operating and 8% net.

In addition, XOM has a huge stock buyback program, initiated in 2000 and still going strong. They have averaged an 8.4% buyback rate per year for the past decade, and plan on continuing at this pace of roughly $5 billion a quarter, at least for Q1 of 2010. Based off of dividend growth rates, I would sacrifice some spending here in order to raise the growth rate.

Dividends

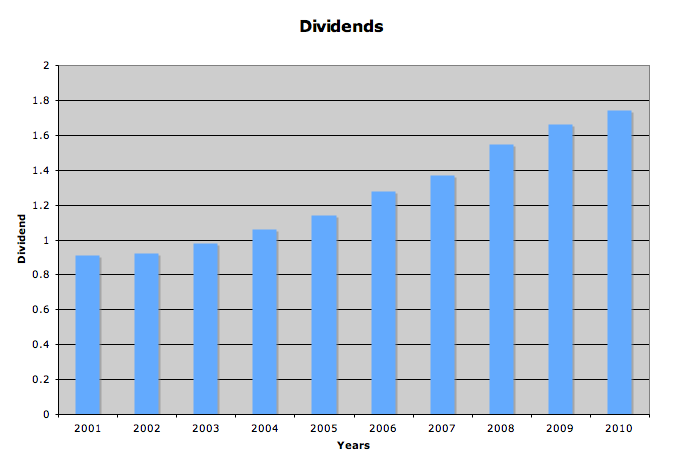

Exxon Mobil has paid an increasing dividend for the past 27 years, and according to their website, averaged 5.7% over that time period. The most recent increase came on April 27 of his year, when they raised the quarterly payout 6.8% from $0.44 to $0.47 a share. This is an annual raise from $1.74 to $1.88, or 8%.

The dividend CAGR of 7.4%% for the past decade is not great, especially with the low yield XOM carries. Looking at the 5 year rolling growth, I see that growth was accelerating in the mid-2000’s, reaching a high 5 year average growth of 9.9%. This declined to 8% using 2010’s dividend, which was a measly 4.8% increase from 2009.

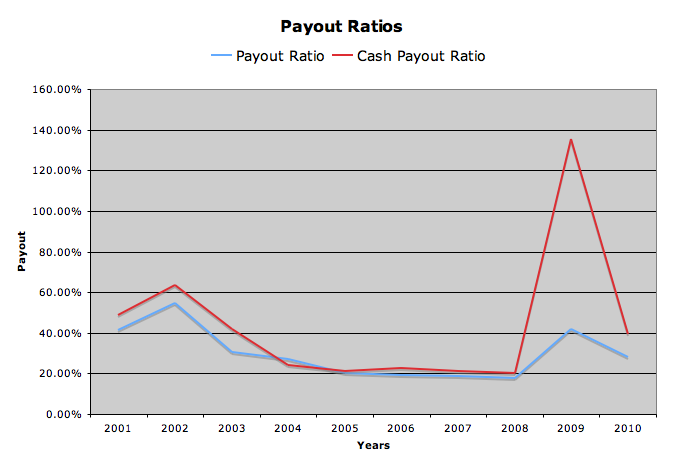

Both payout ratios, earnings and cash based, are pretty conservative, averaging just 30% of earnings and 43% of fcf. With such variable earnings, I see why XOM tries to keep it’s payout ratio rather low – this allows for those large fluctuations without causing a dividend cut. Only once in the past 10 years did the payout ratio reach over 100%, and that was in 2009 (a very poor year) and was the cash based ratio – I’m ok with this, since a company like XOM can easily borrow for one year to cover any dividend payments.

XOM’s cash position sunk a little in 2010, from 10.6 billion in 2009 to 7.8 in 2010. They pay out roughly 8 billion in dividends a year, so that cash seems ample.

Balance Sheet

The balance sheet of XOM is pristine. Debt comprises only 9% of total capital, and in a business that is very capital intensive, that’s a great sign.

The current ratio is low at 0.94, slightly lower than the generally accepted “safe” level of 1. $30 billion in earnings in 2010 is more than enough to repay the roughly $15 billion in total debt the company has in only a few years.

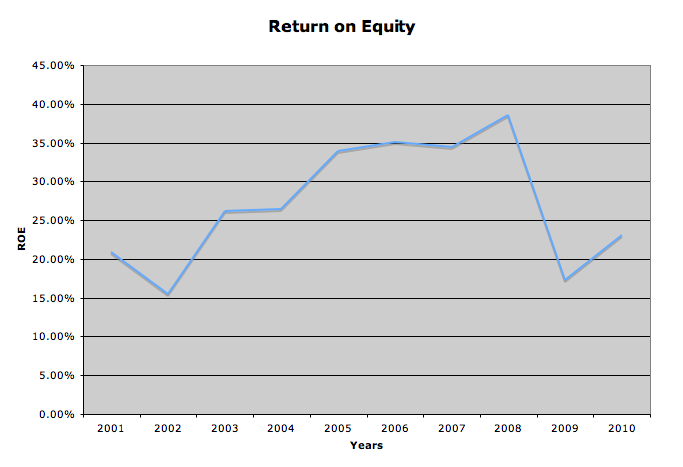

Return on Equity has bounced around a bit, which is to be expected. Still, it never dropped below 15%, and has averaged a healthy 27.2% over the past decade.

Stock Price Valuations

current price – 84.81

5 year low p/e – 9.8

p/e (ttm) – 13.6

p/e (forward) – 10.2

peg – 2.8

5 year high dividend yield – 2.6%

dividend yield – 2.2%

Conclusion

Exxon Mobil is not the type of stock to get excited over, for 2 reasons. 1) It is definitely a defensive play. I doubt you will see major price shifts in either direction, so it’s good for a solid, stable, dividend payer to backbone your portfolio. 2) Investors have already priced in the rising oil prices. Looking at the historical high p/e, for the past decade the high p/e has been in the mid teens. The current p/e of 13 is pretty normal – I would not expect it to go much higher than this. XOM was a great buy in the 50’s and and 60’s, when it was trading at 7-10 times earnings. With a low 5 year expected growth rate of 4.9%, moderate dividend increases, and a low yield, I would not purchase at these prices.

I still think XOM is a great company. And with their expectations of huge energy demand increases over the next 30 years (population increases to 8 billion, 35% increase in energy demand, 40% increase in energy for transportation, and liquefied natural gas demand expected to triple) there is definitely room for growth. But for such a large company, that growth will have to come slowly.

To get all my updates, please subscribe to my rss feed

Full Disclosure: I am long XOM. My Current Portfolio Holdings can be seen here

15 Comments

XOM is a great company, and a real cash machine. I’d definitely consider holding it, and buying more of it through every recession. I kills me how people will sell great businesses so cheap during temporary cycles. Any burst in oil’s rise is a time to pick up great names like Exxon!

Great analysis Pig!

I agree with you that it’s important to buy at the right price and clearly that time is not now with XOM. I bought my energy holdings when the rig went down in the Gulf, and that was a great time to get into energy. I’m anxious to see your analysis on the other energy companies and I think you would agree that CVX has a much more favorable valuation right now.

Nice post man!

I love this stock but can’t afford it right now. Hopefully a dip will happen (someday) and I can get into the game. I don’t see XOM cash flow, growth, earnings, other slowing down anytime soon…so for a “long” investor like yourself, you are laughing all the way to the bank. Kudos to that.

Cheers,

Mark

I like XOM, although its yield is pretty low in comparison to CVX for example. The company seems to be spending more funds on stock buybacks than dividends as of recently. I do like the fact that XOM has paid dividends for 100 years..

Solid analysis.

I’m long Exxon and Chevron, and while I think both are great, I’d be a bit wary of buying right now too.

Certainly glad I added to my XOM position last year when it was right around $60. It gives me a warm feeling when I open up my investment account and see a new dividend payment, too.

Long XOM!