Another (rocky) month has come and gone. And while there aren’t many positives to mention with regards to net worth… dividend income is a completely different story! Both dividend income and dividend growth have been phenomenal. Let’s go!

February Dividend Income

This month I received $2,175.71 in dividend income! On average, I was paid $44.40 from 49 different companies! This month’s dividend income is a fantastic 27.46% increase over February 2021.

That’s $468.72 more dividend income than last February, which is a a great increase.

Dividend Income - February 2022

Here is a chart of my passive dividend income progress over the last 5 years.

The dividend portfolio has been updated.

Here are the dividend stock purchases I’ve made between February 2021 and 2022 that has fueled this month’s dividend income growth.

February’s dividend income covers my utilities, groceries, internet and mobile phones for the month!

February Dividend Growth (Dividend Increases)

Below are the realized dividend increases I received this February. Dividend growth is one of my favorite metrics to report and an integral part of my early retirement plan!

This February I received 7 dividend increases and 3 of those dividend increases were over 10%!

Dividend Increases - February 2022

February’s dividend increase adds $76.73 in annual dividend income! February’s dividend increases are the equivalent of investing an extra $2,192.29 of new money at 3.5% yield! This is a nice sum of investment money!

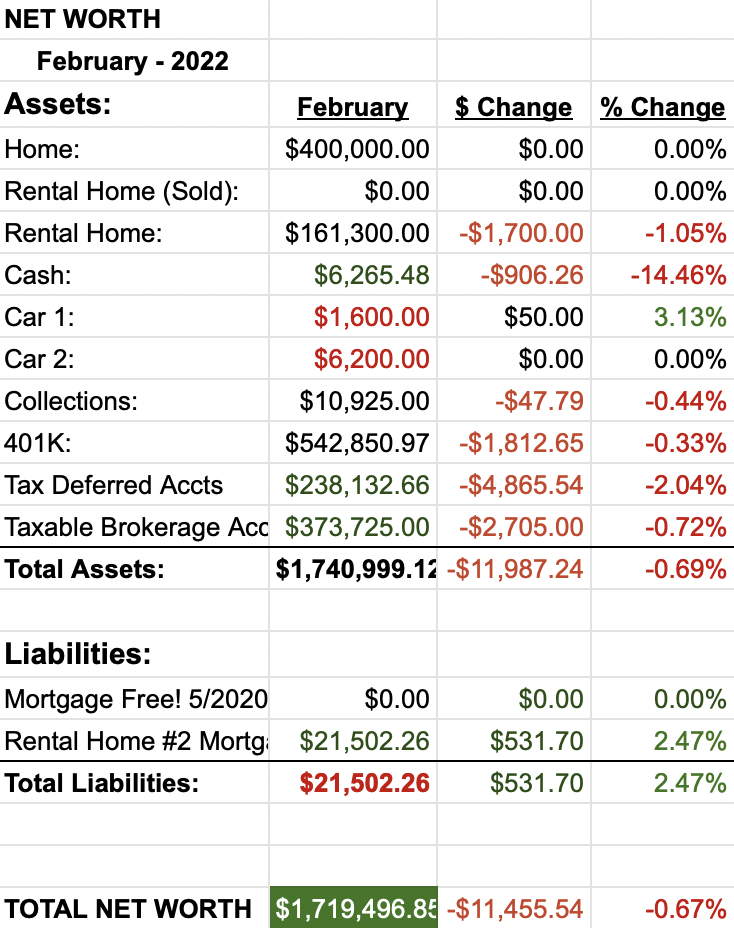

Net Worth

Net worth continued it’s decline.

Let’s do the numbers…

Cash

I will continue to eat away at my cash balance (though, I’m almost there). I have a few big expenses coming up that should help greatly.

Real Estate

For February, our electricity bill dropped to $175 for the month and our gas bill went to $67! That totals to $242. February was pretty cold this year. Admittedly, we’ve been running the heat more than usual.

Also, our neighbors (who purchased the same week we did) sold their home. We both purchased 2 years ago and their selling price was over 50% more than what they paid… again, just 2 years ago!! Crazy times! I’m thinking of adding 100k to our primary home value as that seems to be a pretty safe number.

Big news on the rental. We received our rent check on time and had zero service calls. We also negotiated a new 2 year lease agreement. The new lease is 15% more than the last 2 years. While locking in for 2 years kinda stinks for us right now, it’s a great deal for our tenant. At least somebody is getting a good deal 😉

Wrap-up

February’s dividend income was phenomenal. Dividend growth was roughly 50% more than last February! Our dividend totals are growing very well!

While net worth has been declining for the last 2 months, it’s still interesting to look back and see how far we’ve come. I’m currently up a little over 275k compared to last year! It’s encouraging to look back at past progress during rough times!

I will continue to save as much as possible and putting as much money to work as I can. I hope you do too!

4 Comments

We share quite a few names for the month paying us both. What are your plans for T? I will hold mine for now despite the cut and will probably sell the spin off when it hits my account. Thanks for sharing.

Hi DivHut! I sold off most of my DRIP purchases of $T (maybe 40 shares) when the announcement was made. Like you, I plan on holding. I suspect things will get pretty rocky in the next few weeks when they declare. However, I anticipate that will be short lived and AT&T will find new life (eventually). Only time will tell, but $T certainly isn’t going to zero and will be backstopped by its dividend. Not an ideal situation for us long-term holders… but that’s why we diversify!

Another great YoY post and dividend raise month. I do have to complement your images for the blog, part of me is always visiting just to see what new & creative pics you have lined up for us.

LOL, thank you!