A new decade of dividend income and net worth reports has finally begun and I’m happy to start it off with this one. With regards to dividend income, everything is great as we have set a new monthly record. On the other hand, net worth took it on the chin with the January pull back.

January Dividend Income

This month I received $1,083.70 in dividend income! On average, I was paid $29.29 from 37 different companies!! This month’s dividend income is a great 14.54% increase over January 2019.

That’s $137.54 more dividend income than last January!

Dividend Income - January 2020

Here is a chart of my passive dividend income progress over the last 5 years.

The dividend portfolio has been updated.

Here are the dividend stock purchases I’ve made between January 2019 and 2020 that have fueled this dividend income growth.

January’s dividend income covers my utilities, groceries, internet and mobile phones for the month!

January Dividend Growth (Dividend Increases)

Here are the realized dividend increases I received this January. Dividend growth is an extremely important part of my early retirement and is my favorite metric to report!

This January I received 9 dividend increases and 3 of those dividend increases were over 10%!

Dividend Increases - January 2020

January’s dividend increase adds $59.11 in annual dividend income! January’s dividend increases are the equivalent of investing an extra $1,688.65 of new money at 3.5% yield! While this might not seem like a huge amount of money, it is still free money that will continue to compound into the future!

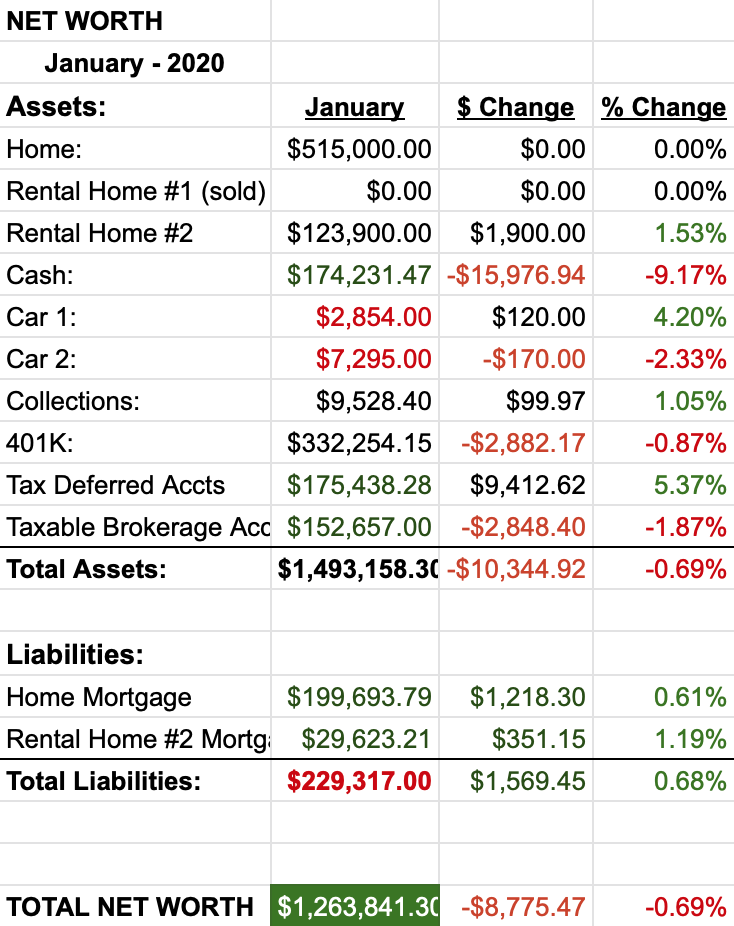

Net Worth

Well, they can’t all go up every month. January net worth takes a decent dip.

Let’s do the numbers…

Cash

You may have noticed, I cracked open the cash piggy bank this month!

Cash really was decimated this month for a good purpose. Mainly this was because I fully funded both of our Roth’s and also padded the after tax brokerage account.

I took full advantage of the new cash this month and invested pretty heavily this January.

The remaining cash pile is still pretty large. I’m keeping that dry powder ready in case we find a fantastic new house deal we just can’t pass up. We still need to find a new home in order for early retirement to happen, but we aren’t actively trying to sell our home now or scouring the market for a new home to buy.

Real Estate

As I mentioned above, we would still like to downsize our home… even after our almost “new construction purchase” debacle last year. That cash reserve will come in handy allowing us to put down a substantial amount of money on the new house while we wait to sell our primary home.

After last year’s experience, we will now plan to buy a new house, move in and then sell our house. Living in a house you’re trying to sell SUCKS!

Our rental is doing well. Our tenant re-upped for another 2 years with a $50 a month increase. However, we did just hear some sour news that our HOA has decided to put new roofs on every home in the neighborhood. This will cost us roughly 3k 🙁 Oh well, maintenance is a thing we budget for… but this is too pricey for the size of this roof. But, other than that… no maintenance issues again this month!

Wrap-up

We have another exciting month in the books. Dividend income is growing at a much slower pace now that the numbers have gotten a bit larger. All in all, that is fine and expected!

With regards to the stock market – we will have to wait and see how the Coronavirus effects the markets or if China can use their incredible social control systems to keep the virus from spreading. Nobody wants this new “flu” – and if the Coronavirus does spread into other provinces as it has in Wuhan, then it will be impossible to contain! Personally, I think they will keep it locked down, and I will continue to invest as this will be a small hiccup and nothing more. Let’s just hope the rest of the world can keep it contained as well!

How did you do this month? Are you worried about the Coronavirus slowing the worlds largest economies?

10 Comments

DP –

So awesome. The # of companies paying you and dividend increases are insane. Further, I am sure your net worth is blossoming so far this month.

-Lanny

Thanks Lanny! The raises were very nice this month but March is really the exciting month when dividend raises hit! I haven’t checked my net worth yet this month… but based on account balances I suspect you’re right 😉

DP, That is awesome. I started doing stock dividend investment and learning some tips from your site. I am kind of surprised that u found a rental around 124K and seems like you are making 1900$ rental income ( If i understood above numbers correctly).

I was looking for some advice. How do you figure out which neighbourhoods to buy rental property and asses how much rent we can get for a given property etc..

Please advise.

Thank you

Hi John! Thanks for the comment!

I wish I was making 1,900 a month on the rental! At the moment, all the rental income is reinvested into paying down the mortgage on the property. If we weren’t doing that, we would net roughly $400 and some change a month. In about 2 years (after the mortgage is gone), the rental should net us a bit over $700 a month.

With regards to new rental locations… I have no idea where you find values right now. I’ve been looking (in the greater Atlanta area) for years and haven’t found anything I’m comfortable with buying. Inexpensive houses are available outside the city… but require 60k – 100k to get them up to snuff but the areas aren’t great. Biggerpockets.com is a great resource for rental information if you aren’t already familiar. But hey, if you figure out where the good rental values are… come back and let me know!

Sorry to have so many questions in different comments.

I know u livin’ in the States so you dealing with USD, but I’m in Europe and all my ETFs are in EUR.

Is there a way to change the excel to handle both currencies?

Strange, but the GOOGLEFINANCE function takes the stock price correctly for the ETFs ( check: SXR8, QDVE ) but showing in USD instead of EUR.

ps:

I can’t delete my previous comments, sorry not taking only 1 for all of my questions.

Hi Dani! No problem. I’ll try to answer them all here.

The total and initial shares are similar columns but the total shares allows me to account for DRIP purchases (shares purchased automatically when dividends are paid out). So, if I DRIP a share, I will add the number to total shares and not initial shares – since the purchase is not made with “new” money. You don’t have to do it that way, but I like to account for it that way.

The cash row is there as a way to account for cash sitting in the investment accounts. Again, you don’t have to use it (delete it if not necessary for you), but you can.

For getting the values in EUR you can use “=GOOGLEFINANCE(“currency:USDEUR”)” to get the current exchange rate.

Let me know if you have any other questions!

Hi Blake,

thanks for your help, it worked and understood what was your intention.

Great excel and of course great portfolio!

Wish u the best!

Daniel

Thanks Daniel!

Awesome DivPig! This is going to snowball like you never imagined! Keep up the good work!

Thanks CW! I don’t know if “like you never imagined” is possible… I imagine a lot! 🙂