There’s no sugar coating this month… June will go down as huge kick in the pants for me.

It truly has been a doozy of a month with a lot of good and bad news to report this June with regards to dividend income. I kinda feel like this month we have taken two steps forward and two steps back after suffering from the dividend suspensions and cuts this month. Sadly, I’ve had to make a new section for this report – dividend decreases.

June Dividend Income

This month I received $2,544.82 in dividend income! On average, I was paid $36.35 from 70 different companies! This month’s dividend income is a massive 23.13% increase over June 2019.

That’s $478.05 more dividend income than last June! Great news!

Dividend Income - June 2020

Here is a chart of my passive dividend income progress over the last 5 years.

The dividend portfolio has been updated.

Here are the dividend stock purchases I’ve made between June 2019 and 2020 that have added to this dividend income growth.

June’s dividend income covers all my core expenses for the month!

June Dividend Growth (Dividend Increases)

Here are the realized dividend increases I earned this June. Dividend growth is always an exciting metric to report and I wish there was more good news to share here.

This June I received 6 dividend increases (once again, just like last month)! Fortunately, one of the dividend increases was over 10%! Hurrah!

Dividend Increases - June 2020

June’s dividend increase adds $64.06 in annual dividend income! These dividend increases are the equivalent of investing an extra $1,830.29 of new money at 3.5% yield! A decent month of free money… if it weren’t for the other part of the story.

June Dividend Cuts (Dividend Decreases)

Sadly, this is a real life blog of my dividend journey and often in life, things don’t always go as planned. That is exactly what we’ve got this month.

Here are the realized dividend decreases I had this June.

This June I received 10 dividend decreases! This sums up to $272.31 of lost dividend income this period! That’s the equivalent of burning $7,780.29 instead of investing it at a 3.5% yield. Ugh!

Dividend Cuts - June 2020

The total net dividend decrease for this June was ($208.25 [increase – decrease]).

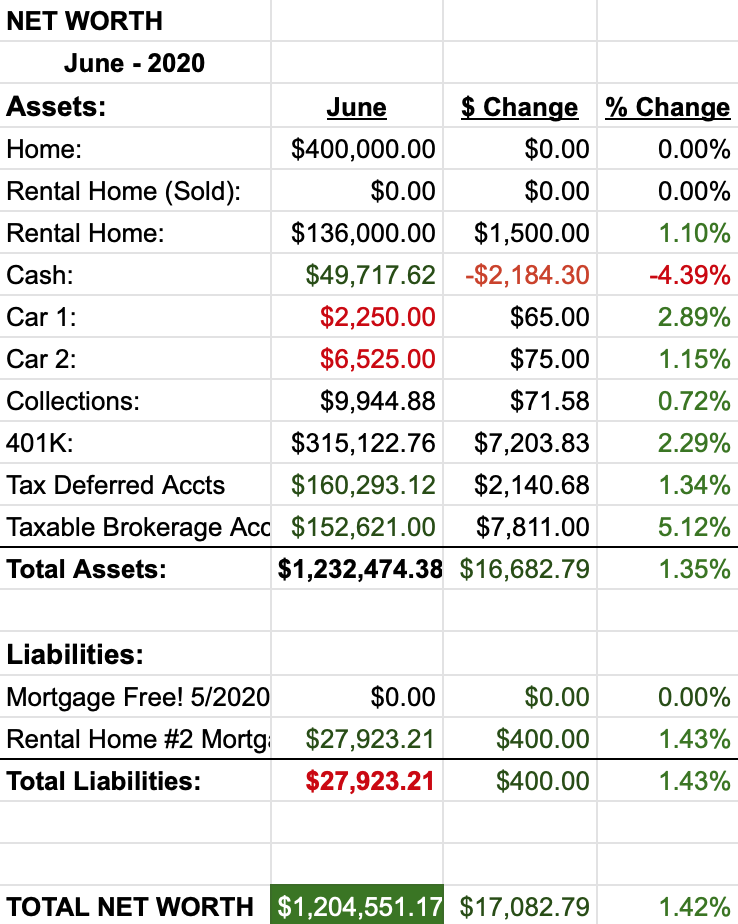

Net Worth

Net worth is continuing to climb with the market slightly moving up. Eliminating our mortgage has been a huge win psychologically and in terms of cash flow.

Let’s do the numbers…

Cash

Once again, I added a little extra to my Interactive Brokers account this month which padded that account, but depleted cash. I also have a few other larger expenses coming up that will sum to a couple thousand dollars – however, that should be realized next month. I’m investing all the extra cash I can right now!

Real Estate

With our smaller home and no mortgage, our bills have been reduced nicely. For example, our electricity bill was a little over $100 less this month than it was at this time last year! Thank you new house!

Our tenant is still paying their rent just fine. The new 2 year lease starts next month with a $50 a month rent increase! That will help in paying off what’s left of that mortgage.

Wrap-up

These dividend cuts and suspensions are tough. While I’m still making great progress (hard to complain about a 23% increase over last year) the dividend decreases / cuts certainly took a chunk out. While I’m not distraught or giving up, I am concerned that 2020 is turning out to be a phantom year with little to no progress made and lots of time lost.

I’m trying to shorten my TTR (time to retirement) and positive dividend growth is an important factor to that equation. Dividend suspensions and cuts are clearly moving in the wrong direction. I do understand the predicament many of these companies are in, but I will keep a keen eye on them with regards to rejuvenating their earnings and dividends.

6 Comments

So what are you planning to do with those stocks that cut their dividends? I’d love to hear how you analyze what action to take. I’d guess it might start with “Would I buy those stocks now?” with a few other pieces thrown in (what are the capital looses or gains, do I think they will bounce back, how long do I wait, does it throw off my sector allocation plan, etc).

BTW, I have a few of those stocks in my portfolio, so I feel your pain. But my other dividend stocks do make me happy each month!

Hi Ernest,

Thanks for the comment! I’ve gone through quite a few different options on what to do with those holding that cut or eliminated their dividend. For the majority of them, I’ve given them a pass. I’ve only sold the worst offenders (ex. WRK) who, in my opinion, cut huge under the guise of COVID.

Fortunately, many of the decreases came from my non core holdings (just to be clear, that doesn’t mean they don’t matter). BA, F & DAL were the most significant reducers this period for me.

Out of those DAL is the only company I’m really concerned about. DAL needs a cure/treatment quickly. The world has become too small to risk ones life on unnecessary travel. I may be trimming DAL by roughly half (and taking the 50% capital loss) to put that money to work else where.

Also, I’m not actively buying any company that moved their dividend any direction but up!

DP –

Definitely a phantom month, no doubt. You had great news and are still suffering the blows from the cuts. I have the cuts, and they are deep as well.

DP, keep the head-up and continue to invest, watch expenses and let’s see if time heals this.

-Lanny

Hi Lanny!

Yeah, these cuts definitely suck and are painful. I’m keeping my head down and am buying strictly on the side of caution. Hopefully we’ll get some good news soon with regards to vaccines to reduce peoples trepidation about being in public!

Just ran across your blog, this is fantastic progress! Appreciate the detailed update and excited to follow your journey.

– Navi

Thanks Navi!