Half of 2019 is in the history books. Dividend investing has again shown it’s worth! June’s dividend income and net worth have respectfully set records in both monthly and lifetime performance! It’s been a great month and I’m excited to share the progress!

June Dividend Income

This month I received $2,066.77 in dividend income (my second time cracking through the 2k ceiling)! On average, I was paid $31.31 from 66 different companies! This month’s dividend income is a healthy 30.79% increase over June 2108.

To put things in dollar figures, that’s $486.57 more dividend income than last June!

Dividend Income - June 2019

Here is a chart of my passive dividend income progress over the last 4 years.

Here are the dividend stock purchase I’ve made between June 2018 and 2019 to fuel that have fueled this dividend income growth.

The dividend portfolio has been updated.

June’s dividend income covers everything except my mortgage. I’m making some really solid strides with dividend income.

June Dividend Growth (Dividend Increases)

Below are the realized dividend increases I received this month.

This month I was presented with 14 dividend increases. 4 of the dividend increases were greater than 10%. $UNH had the highest percent increase at 20%.

Dividend Increases - June 2019

June’s dividend increase adds $123.65 in annual dividend income. This dividend growth is about triple last month’s increase! June’s dividend increase are the equivalent of investing $3,532.86 of new money at 3.5%. These are the kind of month’s that keep me PUMPED about dividend growth investing!

2019 Half Year Dividend Income Results

2019 has been an wild ride of volatility. Earlier this year we were affected by a potential China trade war, then it started, then we didn’t care, then we did and then we didn’t as it may cause the Fed to lower rates.

However, through all that up and down the markets has given us some nice opportunities to pickup some good dividend growth stocks at decent values. Here are the purchases that I’ve made this year.

- January Buys

- February Buys

- March Buys

- April Buys

- May Buys

- June Buys

- Total dividend stock purchases for the first half of 2019 equal $31,512.04!

Dividend Income Received in 2019

- January Dividend Income

- February Dividend Income

- March Dividend Income

- April Dividend Income

- May Dividend Income

- June Dividend Income

- Total Dividend Income: $8,488.28!

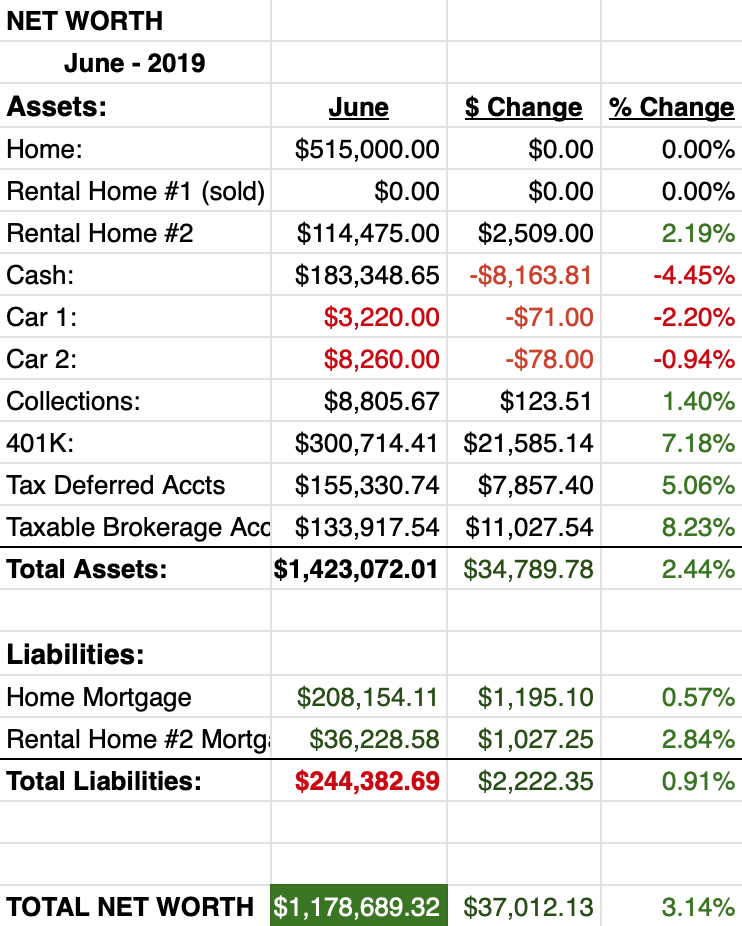

Net Worth

Net worth rebounded nicely with the market!

Let’s do the numbers…

Cash

Honestly, I’m not exactly sure how this large decline worked out. This month was a like death by a thousand paper cuts… except is was just smaller expenses. We had few home related expenses that snowballed into some real money!

Fortunately, the money is there, but I need to be much more careful with expenses I give my wife the go ahead on. Oh, I also bought some new gear for an upcoming race that added up to a few hundred dollars… so my wife isn’t all to blame 😉

We also purchased airline tickets for a family vacation – which set us back nearly $1,000! Ugh.

Real Estate

So selling a house in June isn’t ideal. We came out hard in late May but haven’t yet received an offer. Our eyes were larger than buyers bank accounts for the first month and we’ve had to lower the price.

However, now that the price is quite a bit cheaper, we’ve been getting a few showings every week. Sadly, June sales in Atlanta are down roughly 7% from June 2018. We are working with a softer market that seems to be much more price sensitive… which makes complete sense to me. I have no idea how people afford houses in this price range (and above is even more crazy)! Oh well… I know it’s all relative – it will get sold, eventually.

Our new home, that we are “building”, is coming along super fast! The land has been graded, foundation poured and the frame constructed. It’s really neat to see how quickly a home can be built (which isn’t necessarily good). But, it is fast!

Wrap-up

I am very excited about the results so far this year! The dividend investing strategy has again proven itself and I have earned almost $2,500 more dividend income than this time last year! Organic dividend growth has helped increase income nicely but the majority of the growth has come from new money. I’ll keep at it and I hope you do the same!

How have you done first half of the year? Are you easily finding new dividend growth stocks to invest your money?

6 Comments

Pig –

SERIOUS income – 3 pages worth of tickers? Goodness.. that growth rate is incredible. Excited for you to keep stacking next year’s June.

-Lanny

HA! Thanks Lanny, June was a great month! I’d love to maintain this growth, but I suspect it will continue a gradual decline as the numbers grow. A great problem to have 🙂

Why don’t you just pay off the two mortgages since you have the cash available? I’m curious if you have a good reason for not doing so?

Hi Brad – good question! My primary house is on the market now and will hopefully sell soon! I’m going to use that cash from the sale to purchase (without a mortgage) the new house we are currently building. However, if the timing of those two transactions isn’t perfect, I’ll need that cash to get approved for a mortgage on the new house. Anyway, the goal is to have 2 (at least) paid off houses in the next year or so. After all the houses are purchased, I still plan to keep a larger cash position though.

Wow Blake!

That is absolutely fantastic. Love that 3m dividend.

Crazy that it took 3 pages to look through all your holding as well.

Congrats on the dividend raises and best of luck with the house sale.

cheers!

Thank you! I love assembling all the dividend payments received every month. It takes some time to gather everything, but that is a good problem to have 😉