What a lucky March… dividend income soared, dividend growth exploded and net worth skyrocketed. Let’s get to it!

March Dividend Income

This month I received $3,338.03 in dividend income! On average, I was paid $39.74 from 84 different companies! This month’s dividend income is an incredible 22.33% increase over March 2020.

That’s $609.24 more dividend income than last March! Dang, I wish all months were like this!

Dividend Income - March 2021

Here is a chart of my passive dividend income progress over the last 5 years.

The dividend portfolio has been updated.

Here are the dividend stock purchases I’ve made between March 2020 and 2021 that have added to this dividend income growth.

March’s dividend income pretty much covers all my expenses for the month!

March Dividend Growth (Dividend Increases)

Here are the realized dividend increases I earned this March. Dividend growth is one of my favorite metrics to report… especially on a month like this one! The big month for dividend raises is here!

This March I received 16 dividend increases! Six of the dividend increases were over 10%!

Dividend Increases - March 2021

March’s dividend increase adds a massive $196.21 in annual dividend income. These 16 dividend increases are the equivalent of investing an extra $5,606.00 of new money at 3.5% yield!

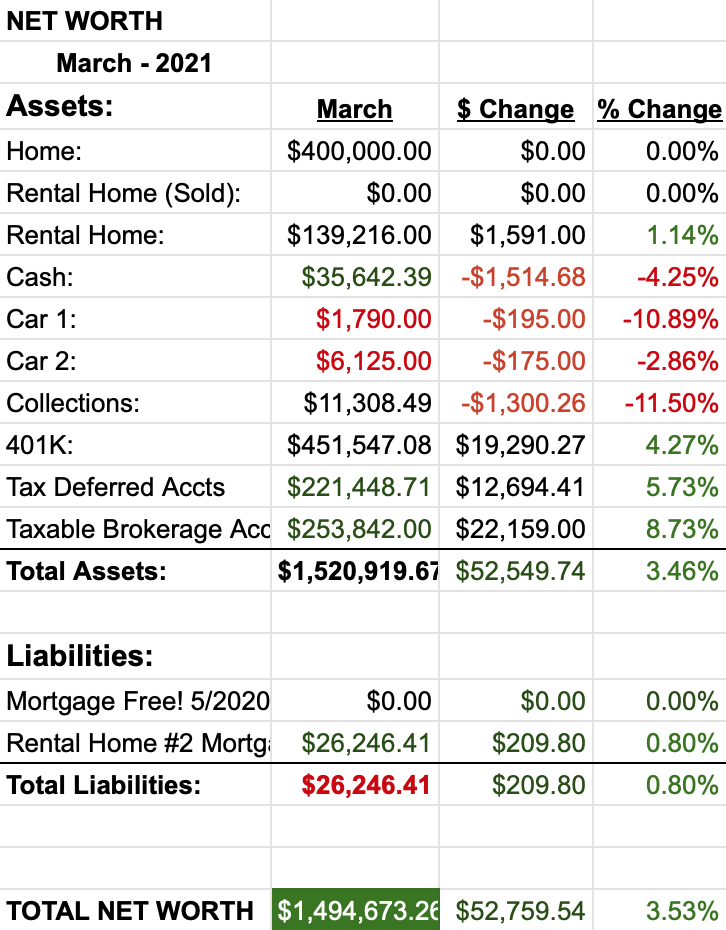

Net Worth

The market continues to push-up net worth!

Let’s do the numbers…

Cash

We spent a little extra again this month. A new ceiling fan and some awesome outdoor lights set us back a little over 1k. The outdoor string lights are super cool and look fantastic. However, the process of running the metal cable and the support poles to attach them and keep the lights from sagging took some serious doing 😉 Anyway, our outdoor ambiance is top notch now.

Real Estate

We are continuing to enjoy our new home and the cost savings it provides. For March, our electricity bill was $135 and our gas bill was $59. A total of roughly $195 – a little over $35 less than February. This is kinda where I expect our utility bills should be. However, March was mild here so it will be interesting to see once things heat up here in Georgia.

Our rental is doing great and still receiving rent checks on time!

Wrap-up

March’s dividend income was fantastic… a new March high! Dividend income is growing nicely again this year. However, we are still quite a bit off from last March where 18 different raises for about $30 more than this year. I feel comfortable that we are finally getting back to normal and should see more substantial dividend growth later this year (fingers-crossed).

Breaching a 1M dividend portfolio feels close and will be a nice milestone to reach. It’s important for me to remember, my goal is not an arbitrary portfolio balance, but dividend income that will grow and cash flow my retirement. I’m on track to arrive at my goal within the next 3 years, but I need to keep saving and putting that money to work.

7 Comments

Solid dividend income! Great year-on-year growth, let’s hope 2021 brings more of these months 🙂

Thanks DD! It does look like 2021 is going to be a good year!

Thank you for being so transparent. I think showing net worth amongst other assets outside of just dividends really shows the power of diversifying your passive investments to maximize your profits and try to stave off fluctuations within one form. This is impressive and and inspiration to me to reach out further than just dividends to further optimize my potential income streams.

Thanks for the comment Preston! Early-on, I was fortunate and recognized my risk tolerance was fairly low – which brought me to dividend growth investing. I made a very conscious effort to diversify as much as possible… maybe even too much. Broadly, I’ve done a decent job with roughly 500k in real estate and 1000k in the market. I consider my paid off home to be the equivalent of a bond and the rental is icing 😉

That is the smart play. I think I am in the same boat being low risk, especially because I started my journey a bit later than some. I have been solely focused on my DGI journey that I think I have really neglected at least taking the time to learn more about other avenues for diversity. Feeling very inspired here and you have prompted some new avenues of research I think I need to take up to better balance my attention.

Nice report, Blake! Incredible haul of dividend income and impressive YoY growth. You have plenty of high-quality businesses in your portfolio. It’s motivating to see dividend income investing in action.

Thanks RTC!