I’ll keep this short again as I’m rolling up this month’s report a couple weeks late! Dividend income was on FIRE this March, while portfolio values were also on FIRE (in the bad way) and burning to the wick. Net worth dipped to levels not seen in quite some time and I bought a new house during a pandemic!

March Dividend Income

This month I received $2,728.79 in dividend income! On average, I was paid $36.38 from 75 different companies!! This month’s dividend income is a great 29.07% increase over March 2019.

That’s $614.64 more dividend income than last March! Not bad at all!

Dividend Income - March 2020

Here is a chart of my passive dividend income progress over the last 5 years.

The dividend portfolio has been updated.

Here are the dividend stock purchases I’ve made between March 2019 and 2020 that have added to this dividend income growth.

March’s dividend income covers all my monthly expenses minus mortgage!

March Dividend Growth (Dividend Increases)

Here are the realized dividend increases I received this March. Dividend growth is always an exciting metric on which to report.

This March I received 18 dividend increases and 5 of those dividend increases were over 10%!

Dividend Increases - March 2020

March’s dividend increase adds $225.45 in annual dividend income! These dividend increases are the equivalent of investing an extra $7,298.57 of new money at 3.5% yield! I love the month of March!

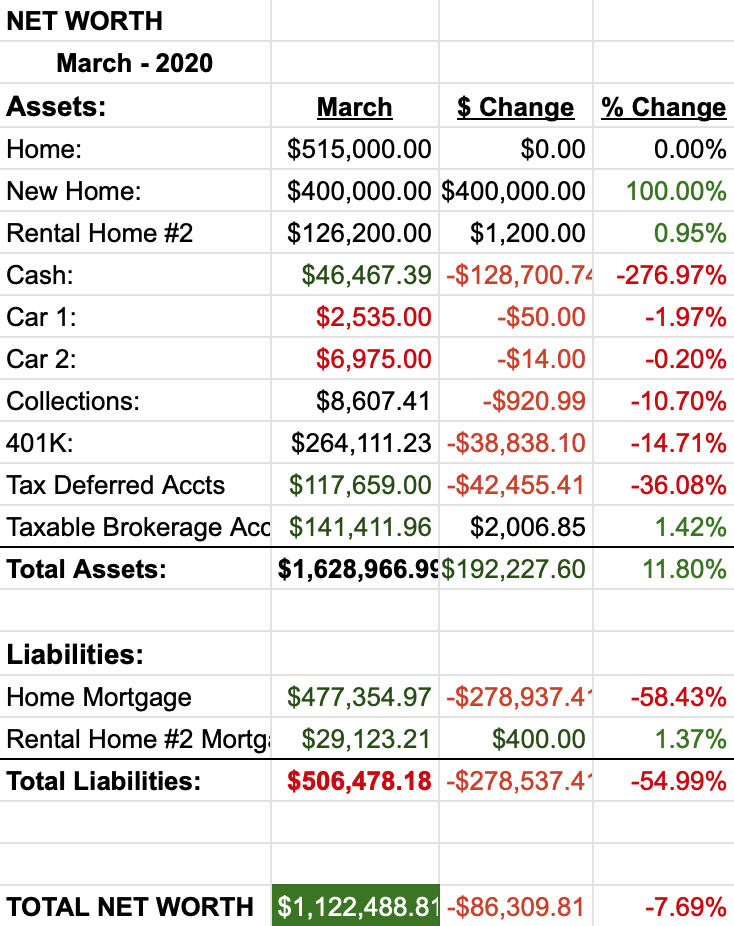

Net Worth

Ugh, net worth hit a pretty nasty crater this month 🙁

Let’s do the numbers…

Cash

I’ve mentioned somberly over the last couple posts that I’m cash poor at the moment. Well, this is what I was talking about. While I still have dollars in the bank, the reality is that I have roughly 130k less than I did.

Fortunately, I didn’t do anything too stupid, I just turned that cash into a down payment for a new house – which has been its purpose. Though, considering the timing, maybe it was stupid (time will tell).

Anyway, that cash became a down payment instead of dump truck of funds to invest in the market. I’ll talk about this below… but obviously, the timing wasn’t ideal considering the corona virus situation in the USA.

Real Estate

So, as I’ve mentioned in just about every report over the last few months in the real estate section (like here, what we tried to do here and what I talked about in length here) – we must downsize our house in order to make our early retirement dreams come true. So, we did it… we bought a new house!!

The new home is perfect, the size, location, build quality and neighborhood are exactly what we were looking for. For our family, I couldn’t have designed a better floor plan then what we found!

However, not everything was exactly perfect… the big downside is that we spent roughly 50k more than we wanted to spend on a new home. Fortunately this was a self imposed budget rather than an actual funding restriction so after some consideration we splurged and forked over the extra cash to get exactly what we wanted.

Buying a home during the beginning of the covid-19 restrictions was surprisingly easy. This all went down about a week before the infection numbers really began to jump up and before federal and state mandated shelter in place orders took hold. This was actually a benefit for us as we were able move and get our old home ready for sale while everyone else was at home.

We are now moved in to our new home and our existing home is on the market. All in all, I couldn’t be more pleased with where we are now.

Now, the goal wasn’t to move just to move. There is some serious math here that will enable to us to live the early retirement life we want if this all works out. The final goal is to sell our home and use the proceeds from that house to pay of the mortgage on the new home. Hopefully that time is right around the corner.

As far as our rental, we got a payment this month! Haven’t heard anything about having issues paying so we’ll keep our fingers crossed those rent payments keep flowing in during this time.

Wrap-up

Without a doubt, a huge month for us! A shelter in place order, global pandemic, a massive downturn in the market, we bought a new house and we recorded a new monthly dividend income record! I’ll keep on investing as much as I can during this time – I hope you do as well!

2 Comments

Hey Blake,

Great work on the dividend growth. Bumping ~30% YOY when you’re already starting from a really solid base is impressive.

You must be the first person I’ve seen talking about buying real estate since this pandemic started. Seems like everyone has their home buying/selling on hold for the time be. Glad to hear the rental income is still flowing as well.

Take care,

Ryan

Thanks Ryan!

The timing of the home purchase had much more to do with the house being available then that there was a global pandemic looming. I’m very happy it worked out… but had I known how bad things were going to get, I suspect I would have waited on the buy. Here in Atlanta, home prices haven’t declined much and everyone seems poised for a big rebound once we get through this. I hope that happens!

Thanks for dropping in!