Happy new year! It’s time to wrap up 2020 with the final dividend income and net worth report. It’s been a heck of a month and year. We had a wonderful Christmas, even though some family members weren’t able to join.

December Dividend Income

This month I received $3,503.30 in dividend income! On average, I was paid $42.72 from 84 different companies and ETF/Funds! This month’s dividend income is a remarkable 39.29% increase over December 2019.

That’s $988.10 more dividend income than last December!

Dividend Income - December 2020

Here is a chart of my passive dividend income progress over the last 5 years.

The dividend portfolio has been updated.

Here are the dividend stock purchases I’ve made between December 2019 and 2020 that have fueled this dividend income growth.

December’s dividend income covers everything this month. If I earned $3,500 in dividend income every month, I wouldn’t need to work.

December Dividend Growth (Dividend Increases)

Here are the realized dividend increases I earned this December. Dividend growth was once my favorite metric to report… then COVID hit. Anyway, this month I have a big smile on my face!

This December I received 14 dividend increases and 4 of those dividend increases were over 10%!

Dividend Increases - December 2020

December’s dividend increase adds $101.16 in annual dividend income! December’s dividend increases are the equivalent of investing an extra $2,890.29 of new money at 3.5% yield!

December Dividend Cuts (Dividend Decreases)

Below are the realized dividend decreases I had this December, this is one of those super rough months.

Dividend Cuts - December 2020

This month I received 11 dividend decreases! This sums up to $443.47 of lost dividend income this period! That’s the devastating equivalent of loosing $12,670.29 instead of investing it at a 3.5% yield. Yeah, that isn’t pretty.

The total net dividend decrease (UGH) for December was ($342.30 [increase – decrease]).

2020 Dividend Income Wrap-up

First, lets give credit where credit is due – this December turned into a fantastic record breaking month thanks to special dividends from $COST, $FAST and $EV.

As you know, 2020 was a tough month for dividend cuts/suspensions. I was on the wrong end of quite a few this year. For my dividend portfolio $BA, $DIS, $F, $DAL, $SPG, $D were the most damaging dividend delinquents, though there were several other smaller cutters as well (and they all add up!).

In spite of all the cuts, this year still topped last year by several thousand dollars! In fact, I’ll say 2020 was a pretty good year for dividend income thanks to a combination of a very diversified dividend portfolio, reinvested dividends and new money invested.

This year I received a total of $22,015.23 in dividend income! This is a huge overall increase of 21.23% over 2019 total income of $18,160.63. I added a little over $3,800 of new dividend income this year!

Here is a chart of my dividend income by the year and month. I’m encouraged by the trajectory!

As far as my yearly dividend growth is concerned, all I can say there really isn’t much good news here. This year, my dividend decline was a little over $1,600. Sadly, this caused me to miss my yearly goal. And my average dividend monthly dividend growth has declined to about $17.50 – from $72 a month (Sept 2018 to January 2020).

Net Worth

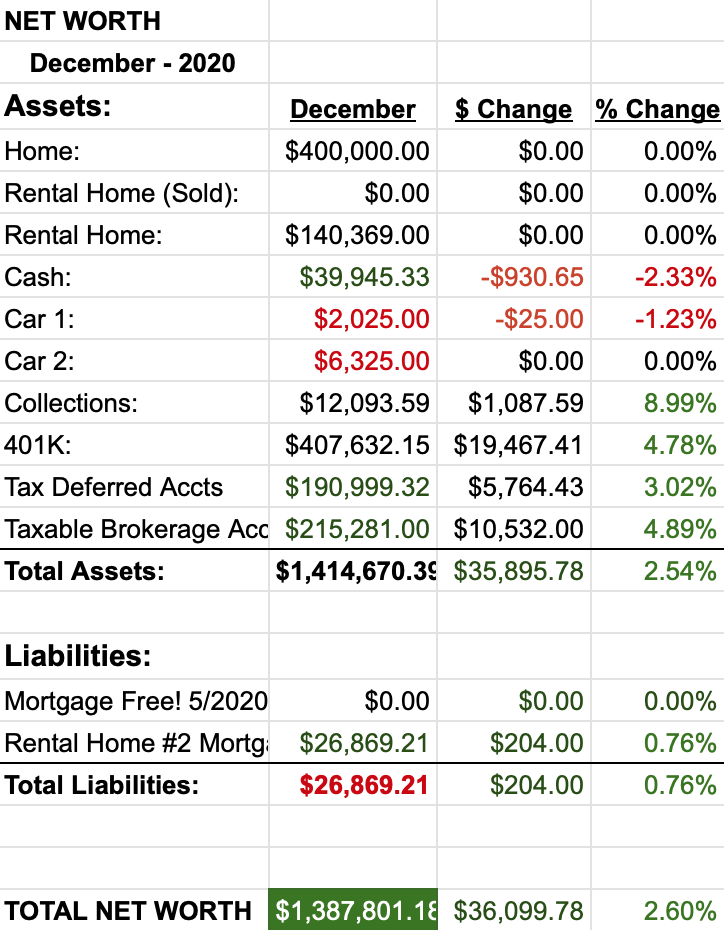

Net worth turned out well this month.

Let’s do the numbers…

Cash

Cash

Cash declined a bit this month due to Christmas spending and some random bills. Nothing crazy, but it sure did add up fast. We have also been putting money aside every month to fill our ROTHs when January rolls around.

Real Estate

The most work we had to do with our rental this month was walk to the mailbox to get the check. This kind of land-lording is great. Unfortunately, the property HOA decided to install a new roof and paint this year. This has put us back a few thousand dollars that we decided to pay monthly as it was basically interest free.

2020 Net Worth Wrap-up

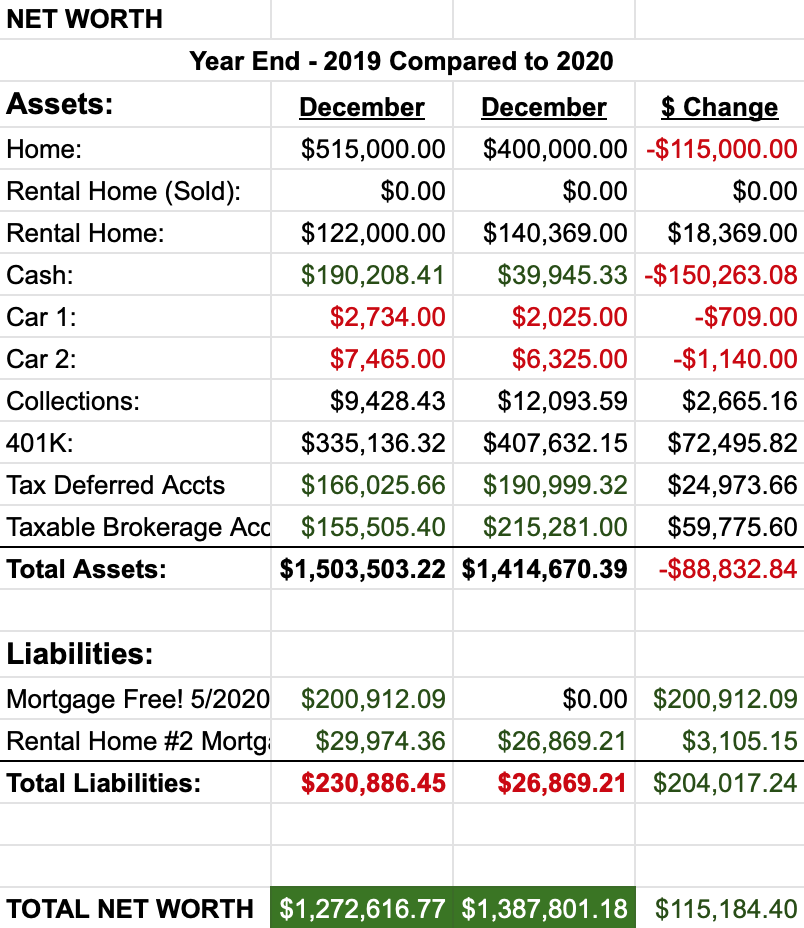

I’ve gone through this exercise for the last few years and have always enjoyed the results! 2020 did not disappoint!

March of this year we made a pivotal step towards our early retirement dream and downsized our home. We happened upon a home that we knew would be perfect and made it happen. We found the home in February and ended up moving in March… just as COVID was kicking off.

We were able to get our home ready, listed and sold in a little less than a month – thank God! The best part, we were able to use the proceeds from our house sale to completely pay off our new home… and now we live in a home without a mortgage!

The downsizing process wasn’t easy. We went from 5k+ sqft to 2.5k and had to get rid of A LOT of stuff. It was hard, but now that we have lived in the house for almost a year, I can easily say, it was worth the effort and I don’t miss any of the stuff. You can read more about the downsizing here.

As you can see in the spreadsheet below, my net worth has grown by a bit over $115,000 in 2020!

So, lets break the numbers down a bit.

We ended up netting a little over 300k from our home sale and had enough cash on hand to cover the rest of the new home cost. A bit over 150k of growth came from the investment accounts thanks to the year end market recovery. As an aside, I remember looking at the total value of my dividend portfolio and coughing when it was down -14%. As I mentioned above, our primary mortgage has been eliminated and we have 26k to go on the rental mortgage. We took some time off paying that down aggressively and we’ll probably start adding a little bit more to pay it down quicker this year.

Wrap-up

Even with the world collapsing from covid, the end of the year market rally really turned everything around. On a personal note, I am thrilled with this year. In 2020, we were able to stay well, both physically and mentally. After reading this post from 2018 regarding my wife’s last surgery and the emotions of that experience, I’m ecstatic with the outcome of a healthy year. Nothing, not even early retirement, is more important than health!

So, Merry Christmas, Happy New Year and here’s to a healthy 2021!

6 Comments

What can you say to 39.29% YoY growth other than WOW! Realize you did not meet your personal goals but from my perspective that snowball is packing some serious momentum. That Costco payout is sweet and SCHD is not too shabby either.

Thanks SD! You’re exactly right, the snowball is picking up some mass. If it weren’t for just 1 or 2 of the cuts, I would have far surpassed the goal this year. Oh well… onward and upward! 😉

Thanks for dropping by!

These are huge dividends! Any chance I could get your transaction list, so I could import them to digrin.com to see how a portfolio of this size would render there?

Hi Lucas. I don’t have a master list, but if you want to do some quick compiling, all of my buys can be found in my monthly dividend stock purchases.

Congrats! How much do you make from the website?

Thanks Bruce! Ha, not much. I keep this site for motivation and accountability for me to follow through with the plan, not for making money. Thanks for stopping by!