This year started out with more of a bump and less of a bang. While net worth is climbing to new highs, dividend income is looking like it’s plateaued (at least for January). I’m also wrestling with the idea that my single largest holding doesn’t pay a dividend anymore… which is certainly counter to my plan as a dividend growth investor.

January Dividend Income

This month I received $1,127.06 in dividend income! On average, I was paid $29.66 from 38 different companies! This month’s dividend income is an abysmal 4% increase over January 2020.

That’s only $43.36 more dividend income than last January! However, we do have a small silver lining. JPM and CWCO dividends didn’t post to my account until February this year, so this January’s results would have been slightly better if they had posted in January… as they did last year.

Dividend Income - January 2021

Here is a chart of my passive dividend income progress over the last 5 years.

The dividend portfolio has been updated.

Here are the dividend stock purchases I’ve made between January 2020 and 2021 that hasn’t done much to fuel this month’s dividend income growth.

January’s dividend income covers my utilities, groceries, internet and mobile phones for the month!

January Dividend Growth (Dividend Increases)

Here are the realized dividend increases I received this January. Dividend growth is a great metric to report and a very important part of my early retirement plan!

This January I received 10 dividend increases and 5 of those dividend increases were over 10%!

Dividend Increases - January 2021

January’s dividend increase adds $107.10 in annual dividend income! January’s dividend increases are the equivalent of investing an extra $3,060.00 of new money at 3.5% yield! This is a respectable sum of FREE money!

January Dividend Cuts (Dividend Decreases)

Another month of dividend decreases.

Below are the realized dividend decreases I had this January.

Dividend Cuts - January 2021

This month I received 2 dividend decreases! This sums up to $69.15 of lost dividend income this period! That’s the equivalent of flushing $1975.71 instead of investing it at a 3.5% yield.

The total net dividend INCREASE for January was ($37.95 [increase – decrease]). I believe this is just the second month of positive dividend growth since June 2020.

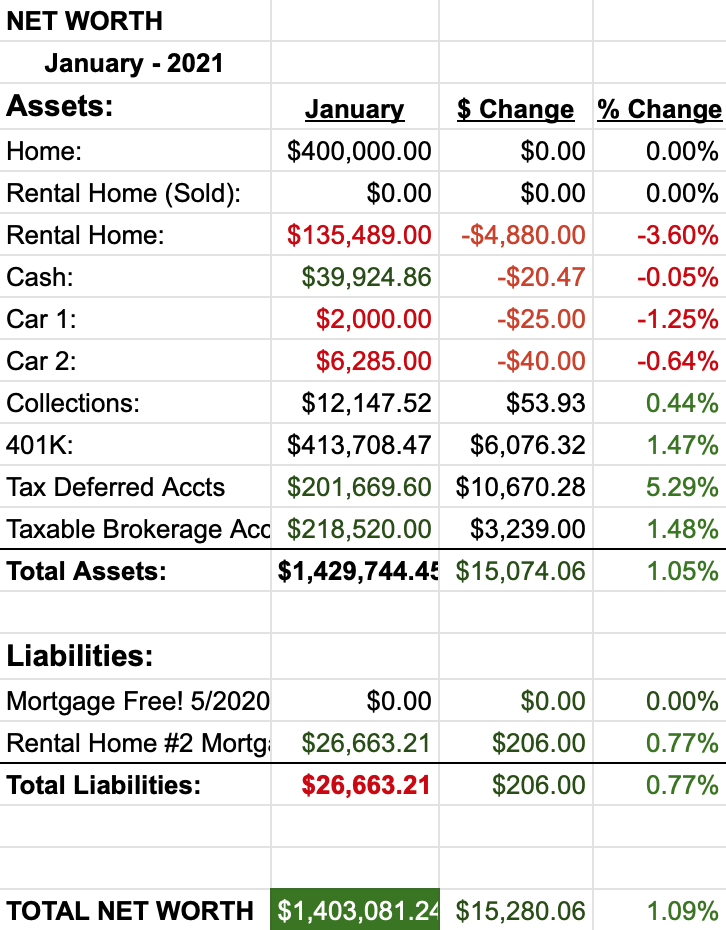

Net Worth

A new net worth record has been hit.

Let’s do the numbers…

Cash

We did a good job of keeping extra spending low this month. Our cash is a pretty good pile and I plan on keeping that money in cash for a little while. After running out of cash last year during the March correction, I’m more comfortable keeping some power dry. However, I do plan to up my monthly deposits to my trading account to gradually put it to work.

Real Estate

Since downsizing our home last March, we’ve been living the dream. A little over 2k a month we don’t have to pay to a mortgage has been incredible boost to our early retirement journey. The easier home maintenance tasks (small size + new construction + livable floor plan) has made home chores a breeze.

Our rental, besides Zillow saying the value dropped, is still doing great! Our renter is continuing to pay on time and we have had zero maintenance calls!

Wrap-up

January dividend income is always a little disappointing… perhaps because we are coming off a super strong December where we received three times the dividend income.

With some positive monthly dividend growth and a semblance of normality returning, I’m feeling good with everything except DIS.

I can’t seem to shake that my largest position (DIS) is no longer a dividend stock. While I appreciate the stock price appreciation, I am less than thrilled about the ZERO dividend income. 40k could easily produce $1,400+ in dividends, which is income I will need! But, with my love for all things Disney, I’ll continue to hold or HODL cause I’ve got those diamond hands (or whatever it is kids say these days) 😉 However, I hope there is a formal position regarding a continuing of the dividend policy made after all parks are reopened.

I’ll keep putting money to work in the best dividend values I can find… I hope you do as well!

2 Comments

Great stuff Blake. That is a solid income and love all those raises.

Interesting delimma regarding disney. I have alot smaller position then you, but I’ll gladly keep holding. The stock appreciation easily makes up for the minuscule dividend.

I do wonder if they will reissue the dividend after the parks reopen since disney plus is doing better than expected and ppl will be dieing to go on cruises/walt disney world. Maybe they will start with special dividends.

cheers!

Thanks! Yeah, with the recent price appreciation, its a good problem to have. On the flip side, what kind of dividend portfolio has a non dividend stock as its largest position? COVID certainly threw a wrench into Disney’s business… but I really would like to read a formal statement regarding an updated dividend policy. I’ll hold for now, but not years.